Stockholm (HedgeNordic) – Tough market conditions likely present more challenges for managers to launch new hedge funds. According to HFR, new hedge fund launches in the third quarter of 2022 edged lower compared to the prior quarter, reaching the lowest level since the final quarter of 2008. The level of fund liquidations also remained historically low.

An estimated 71 hedge funds were launched in the third quarter of 2022, down from the estimated 80 launches in the second quarter. The third quarter’s number of new launches represents the lowest launch rate since the depths of the Global Financial Crisis in the final quarter of 2008, which saw only 56 new fund launches. The environment was challenging for new and recently launched funds amid a decline in overall risk tolerance, according to Kenneth J. Heinz, President of HFR.

A decline in risk tolerance led to “institutions focusing allocations on well-established funds which have successfully navigated much of the 2022 volatility,” says Heinz. “Similar risk-off sentiment has also contributed to steady but historically low levels of fund liquidations, with institutions maintaining exposures through the current economic turmoil and tension between inflation and economic weakness heading into 2023,” emphasizes Heinz.

“Similar risk-off sentiment has also contributed to steady but historically low levels of fund liquidations…”

The number of hedge fund liquidations declined quarter-over-quarter with an estimated 145 funds closing their doors in the third quarter compared to 156 fund liquidations in the second quarter. An estimated 544 funds were liquidated during the trailing 12-month period ending September 2022, with the number of new launches reaching an estimated 449 hedge funds. “With significant uncertainty and wide disparity in economic outlooks into early 2023, it is likely that both launches and liquidations remain near historic levels, as institutions carefully evaluate opportunities and deliberatively position portfolios for volatility in 2023,” concludes Heinz of HFR.

The Nordic Angle

Some managers may see difficult market conditions as an opportunity to launch a fund to take advantage of market dislocations. Copenhagen-based fixed-income specialist CABA Capital has launched a new fund to capitalize on elevated and attractive spreads between Scandinavian mortgage and government bonds (read more).

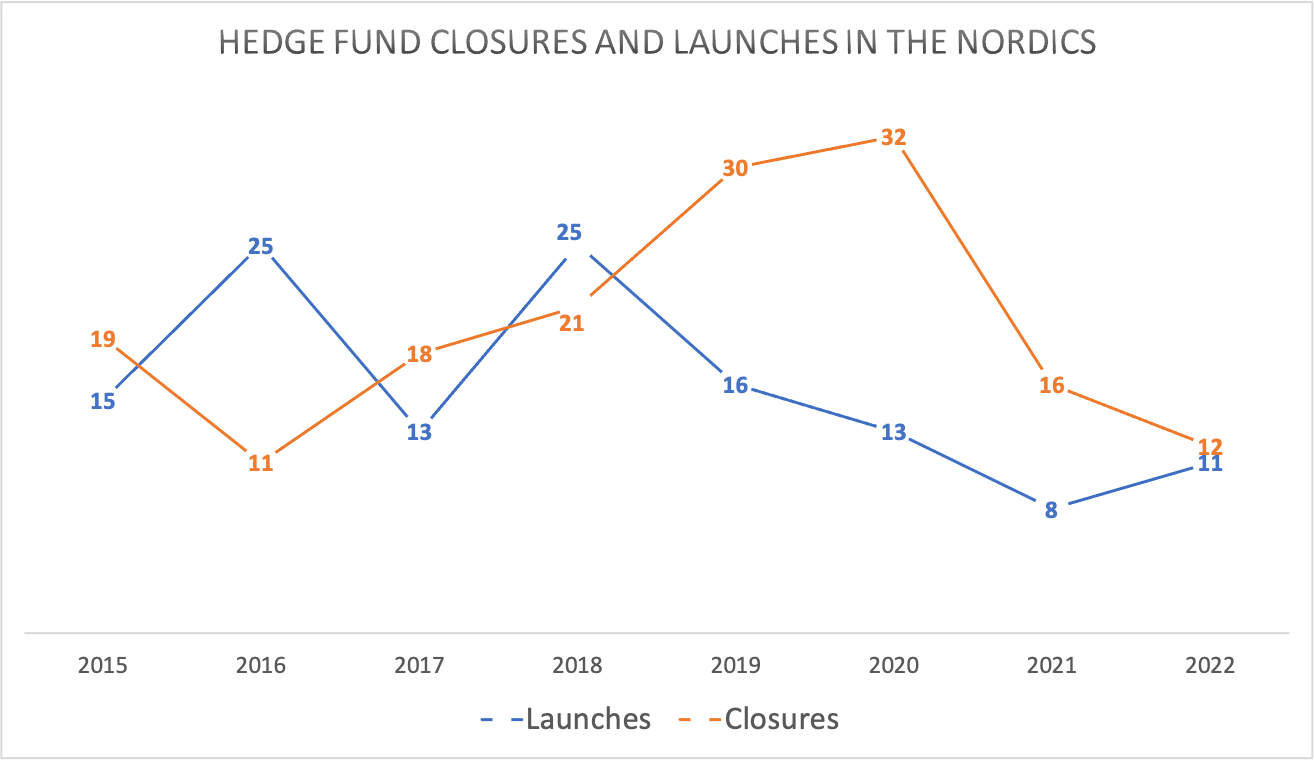

The Nordic hedge fund industry saw a similar number of launches and liquidations in 2022, as liquidations slowed down noticeably in the past two years. An estimated 11 new hedge funds were launched in the Nordic region during 2022, compared to eight in 2021 and 13 in 2020. The number of hedge fund liquidations declined in the past two years, with an estimated 12 funds shutting down during 2022, down from 16 in 2021, 32 in 2020, and 30 in 2019.

Photo by Piret Ilver on Unsplash