Copenhagen – (Jesper Rangvid): During 2022, mortgage rates have risen and stock prices have fallen, both negatively influencing households’ consumption possibilities. But how much should we expect households to cut consumption? If not answering this specific question, coauthors and I shed light on it in new research (link) where we find that households cut consumption considerably more—in fact twice as much—when hit by rising mortgage rates and falling stock prices, compared to situations where households are hit “only” by rising mortgage rates or falling stock markets. This indicates rough times ahead.

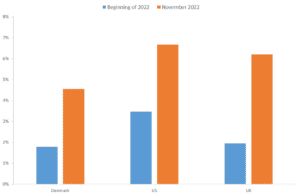

Mortgage rates have risen during 2022, as a consequence of higher monetary policy rates. For different countries, Figure 1 compares mortgage rates at the time of writing (November 2022) to rates at the beginning of the year. In the US, 30-year mortgage rates are currently close to 7%, compared to 3.5% in January. Similar increases are seen in other countries.

Higher mortgage rates mean it is more expensive to borrow to buy a home, leaving less for consumption. It also becomes more expensive to service an existing adjustable-rate mortgage, after rates have been reset. In total, higher mortgage rates reduce people’s consumption possibilities, all else equal. Academic studies verify that people cut consumption when mortgage rates rise (link, link).

Stock markets are also down this year. Depending on where you look, markets are down some 20%. Lower stock prices reduce the value of people’s savings, for people saving in stocks. When people see their wealth diminished, they tend to cut consumption, academic literature also finds (link, link).

So, here we are. Mortgage rates are up this year, stock markets are down, and we are all speculating whether we will enter a recession and, if so, how bad it will be.

From the academic literature cited above, we know that people reduce consumption when mortgage rates rise. We also know that people cut consumption when stock markets fall. We do not know, though, how households respond when both mortgage rates rise and stock markets fall. In fact, when researchers conduct studies such as those mentioned above, they typically conduct them under a ceteris paribus assumption. This means that the researcher wants to identify what happens to consumption if, e.g., mortgage rates rise, keeping everything constant. Or, what happens to consumption if stock markets fall, keeping everything else constant. Hence, existing studies deliberately exclude an answer to the question of what happens to consumption if both the stock market falls and mortgage rates rise. This is fine and good if you want to identify each effect separately, but in situations such as the one we are facing now, this leaves us without precise answers.

It seems reasonable to hypothesize that people cut consumption more if both stock markets fall and mortgage rates rise, compared to a situation where households are affected “only” by rising mortgage rates or falling stock prices. But how much more? Is the total effect on consumption the sum of the effect from the stock market on its own and the effect of an interest-rate change on its own (as identified in the existing academic literature), is there a diversification effect that softens the total impact, or is the total effect even magnified when households are hit by shocks to both markets? In new research (link), Rikke S. Nielsen, Linda S. Larsen, Ulf Nielsson, and I provide first answers to these questions.

WHAT WE STUDY

To measure whether and how much people cut consumption when affected by both falling stock markets and rising mortgage rates, we exploit cross-sectional variation across households’ risk attitudes towards mortgage and stock markets. We compare the consumption responses of people who are affected by both mortgage rates and stock prices to the consumption responses of people who are either exposed to the stock market only or the mortgage market only.

To conduct such as study, you need detailed data on households’ stock market investments and their mortgage financing decisions. We have access to such data. We study individual-investor panel data during 2007 to 2011 from Denmark. We naturally look at households participating in both the stock market and the mortgage market, i.e. homeowners with a mortgage and stock holdings. In total, we examine 83,083 such households.

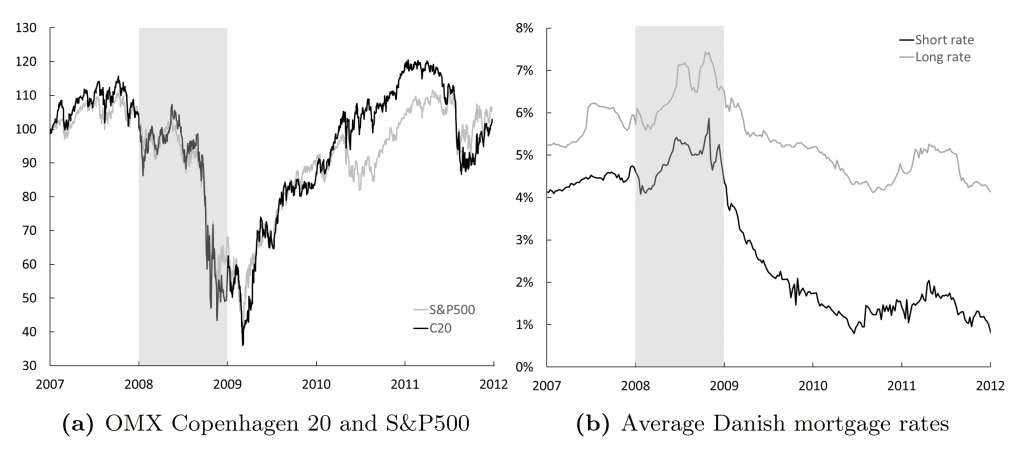

As our laboratory, we look at how people responded to the eruption of the financial crisis in late 2008, when mortgage rates rose and stock prices fell. To reflect pre-crisis conditions, our base is end-of-year values in 2007. We then follow households during 2008 and a three-year period after the negative shock (until 2011).

In Figure 2, I highlight in grey the mortgage rate and stock market developments between late 2007 and late 2008, i.e. the shocks that we study, as well as the period thereafter. Both the Danish and the global stock markets fell dramatically during 2008, by some 50%. At the same time, the short rate on Danish mortgages increased by approximately 50%, from around 4% to 6% at its peak.

To identify how increases in mortgage rates and falls in stock markets affect people’s consumption, we zoom in on people who are particularly affected by such events. We look at people with high mortgage payment-to-income ratios, high ratios of mortgage debt to assets, and mortgages where the rate is reset relatively often. These should be people particularly affected by rising mortgage rates. We compare those people to people who have low mortgage payment-to-income ratios, low ratios of debt to assets, and mortgages where the rate is reset relatively seldom, i.e. people who are less affected when mortgage rates rise. We expect the former group of households to react stronger to rising mortgage than the latter.

Similarly, we identify people who have a high fraction of their wealth allocated to stocks, as well as people who have a low fraction of their wealth invested in stocks. Again, we expect the former group of people to react stronger to falling stock markets than the latter.

Finally, we merge the groups, i.e. look at people who are highly exposed to both the stock and the mortgage markets, and people who have a low exposure to both the stock and mortgage markets.

In total, we look at four types of people:

- People highly affected by stock and mortgage markets.

- People highly affected by the stock market but only little affected by the mortgage market.

- People only little affected by the stock market but highly affected by the mortgage market.

- People only little affected by both stock and mortgage markets.

We compare how these different groups of households adjusted their consumption when exposed to the negative events in 2008. To do so, we use so-called “Triple-Difference estimations”. These estimations exactly allow us to identify how falling stock markets and rising mortgage rates affect people particularly exposed to such events, compared to people less affected by the events.

RESEARCH RESULTS

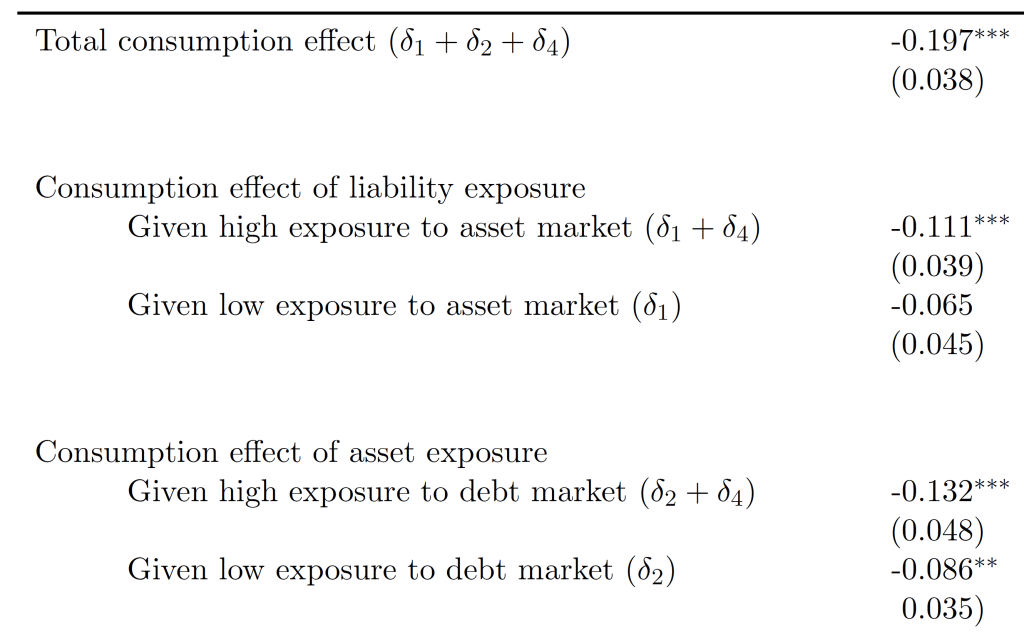

Table 1 includes the results from our “Triple-Difference estimations”.

The main result of our analysis appears in the first row of Table 1. The negative number -0.197 means that households highly exposed to both the mortgage market and the stock market reduce consumption in 2008 by 20% more than households having only little exposure to stock and mortgage markets. Obviously, an additional 20% cut in consumption during the course of one year is an economically large effect.

Next, Table 1 shows that consumption in 2008 is reduced by 11%-points more for households highly exposed to changes in both markets, compared to households highly exposed to changes in the stock market but only little exposed to changes in the mortgage market.

Similarly, consumption in 2008 is reduced by 13%-points more for households highly exposed to changes in both stock and mortgage markets, compared to households highly exposed to changes in the mortgage market but only little exposed to changes in the stock market.

In total, and in easy-to-remember approximate terms, we thus find that people exposed to one market only (the stock or the mortgage market) cut consumption by app. 10% more than people having low exposure to both markets. But if people are hit by both falling stock markets and rising mortgage rates, they cut consumption 20% more than people having little exposure only. So, if people not exposed to any market reduce consumption by, e.g., 5%, then those exposed to one market will reduce consumption by 5.5% (10% more than 5%), and those exposed to both markets by 6% (20% more than 5%). The cut in consumption is thus twice as large when stock markets fall and mortgage rates rise, compared to situations where “only” mortgage rates rise or stock markets fall.

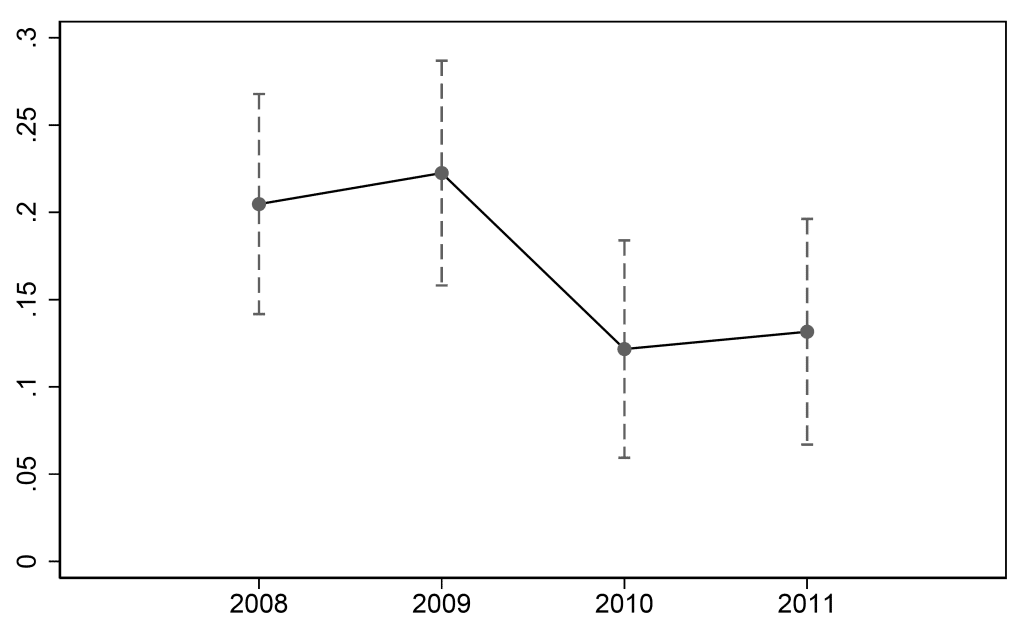

Finally, we study whether the effects persist. Figure 3 plots the consumption effects over the years 2008 to 2011. Relative to the 20% extra reduction in consumption during 2008 (Table 1) for people exposed to both the stock and the mortgage markets, the reduction in consumption is intensified further in 2009. The following two years, the total consumption effect diminishes. However, even in 2011, the economic shocks from 2008 still affect household consumption considerably, as it explains a 13.2% reduction in consumption relative to 2007. The conclusion is that shocks to stock and mortgage markets have long-lasting negative effects on people’s consumption decisions.

CONCLUSION

Using the financial crisis as a laboratory, we find that households cut consumption particularly much if they are hit by falling stock prices and rising mortgage rates. The negative effects last several years.

In 2022, mortgage rates have risen and stock markets have fallen. Mortgage rates have risen even more than in 2008, while stock markets have fallen less. On balance, given our research evidence, I judge there is a good chance that the 2022 shocks to financial markets will significantly reduce real economic activity going forward.

This post has originally been published here.