By Nina Jahanbin, Fredrik Langenskiöld & Zuhair Khan – Union Bancaire Privée (UBP): UBP is committed to responsible investing through the promotion of good governance principles and the integration of environmental and social considerations into our investment approach. As a financial intermediary and member of the economic and social fabric, we are determined to channel capital towards responsible investment solutions that offer real potential to generate financial returns, while adhering to sustainable business practices and working to quantify and improve our social and environmental footprint.

After initially focusing on the integration of ESG principles into our traditional asset franchises, we progressively broadened our scope to include alternative investments. As a pioneer in the field of alternatives, with investments dating all the way back to the 1970s, it felt natural to apply ESG principles to alternatives. We did so by implementing a dedicated ESG policy to our Alternative Investment Solutions (AIS) investment process, as well as by launching two long/short equity strategies. We believe that both risk management and alpha generation are enhanced by integrating ESG factors.

Integration Into our Due Diligence Process

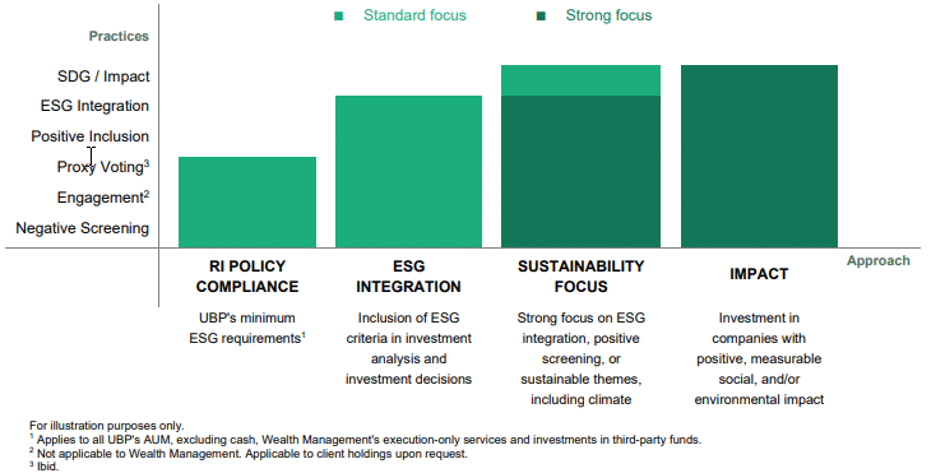

Our investment team is aware of the opportunities and risks that ESG factors pose and actively consider these throughout its investment process. As investors, we believe that we have a responsibility to use our influence and industry knowledge over how similar funds and firms are managed to offer constructive guidance to the managers. When selecting managers, ESG factors come into consideration at two levels: 1) the practices of the manager’s company and 2) the manager’s underlying funds’ investments.

At the manager’s company level, we look to discuss any measures the firm has in place to run their own firm according to ESG principles in terms of all three factors. As a minimum, the firm should have a) signed the UN PRI, or is planning to do so shortly; b) disclosed its environmental policies or provided a review of the environmental impact of the firm; c) disclosed social policies or provided a review of hiring and training practices which aim to improve the firm’s diversity and inclusion, and; d) displayed strong governance practices and disclosed their conflicts of interests policy.

When reviewing the investments for ESG characteristics, we first review what is possible within the strategy, as not all of them can be analysed from an ESG standpoint. If the strategy can be analysed for sustainability, we would look to see, amongst other things, what analyses are being carried out, who does these, how much these rely upon external providers and what their proxy voting and engagement policies are. This covers both ESG analyses of underlying securities and sub-strategies, but it is also to consider the risks posed by such factors, such as insured or uninsured loss from climate change.

We are not excluded from investing in funds which have no or limited ESG considerations at firm and/or fund level, especially for some strategies that would be materially impacted by their implementation. However, as a minimum, the fund should consider sustainability risks. AIS will document the findings and encourage the manager to improve their processes where possible.

UBP’s Exclusion List

The UBP Exclusion List comprises companies in sectors in which UBP-managed funds are excluded from purchasing; these are primarily focused on the weapons-, fossil fuel- and tobacco-related industries.

Where AIS is investing in a customised or single-investor vehicle, or creating a UBP fund, the investment scope will be subject to the UBP Exclusion List.

For third-party funds approved, the team will periodically monitor the fund’s exposure to UBP exclusion list.

All the factors outlined above are analysed and monitored by two independent teams, namely Investment Due Diligence (IDD) and Operational Due Diligence (ODD). The result of this process is the assignment of an overall ESG rating of positive, neutral or negative. The rating is a joint qualitative assessment made by the ODD and IDD teams.

Two Long/Short Strategies Integrating ESG Factors

In addition to the policy implemented during the fund-selection process, UBP has also launched two long/short equity strategies with a focus on ESG factors. As mentioned above, given the relative lack of clarity of the SFDR when it relates to alternatives, we feel that long/short equity is the strategy which is the most straightforward in terms of integrating ESG criteria, which is why we have started here.

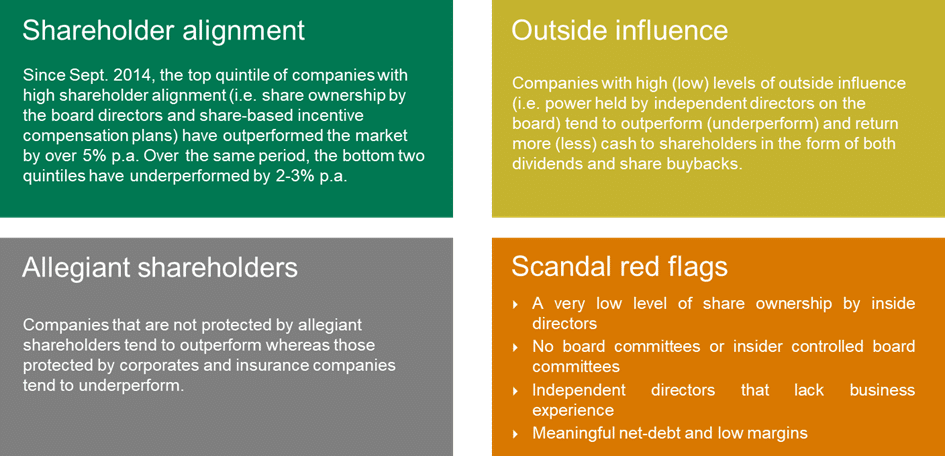

The first strategy was launched in 2020 and focuses on Japanese corporate governance with a market- neutral approach. The premise is simple: since the implementation of the Corporate Governance Code in 2015, local and international investors have increasingly been focusing on the more proactive companies who have implemented changes, while shying away from obstructive companies, which are slow to implement these changes. The criteria that are considered include board structure, shareholder composition and corporate scandals. Based on years of data collection, the investment team will select long positions that showcase high governance scores, solid fundamentals, and attractive valuations while shorting companies with low governance scores, weak fundamentals and unattractive valuations.

There are currently strong relationships between the governance metrics outlined in the chart above and share price performance. Although these relationships are intuitively expected, what is surprising is their strength, systematic nature and persistence.

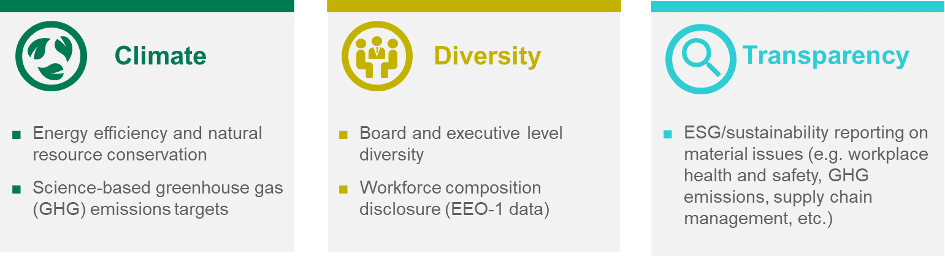

The second strategy was launched at the end of 2021, in partnership with Bain Capital Public Equity and is a global long/short strategy with a responsible investment approach. The strategy engages in three main areas of focus, which apply to the long book: the first relates to sustainable growth and reducing climate impact, where the companies’ energy efficiency and natural resource conservation, as well as greenhouse gas (GHG) emissions targets are monitored; the second relates to diversity, equity and inclusion, where the investment team promotes diverse leadership and board representation, advocating at least two female directors in particular; the third is based on the company’s ESG transparency and disclosure, engaging with companies that provide insufficient disclosure on material ESG factors. On the short side, the team focuses on investment opportunities where ESG considerations may negatively impact the forward earnings power of the company’s operations.

One of the biggest challenges in integrating ESG into a fundamental equity strategy is sourcing consistent, high-quality emissions and ESG-specific data. The investment team uses a multi-pronged approach, evaluating all long equity positions based on company disclosures, third party ESG reports, and news publications for ESG performance and severe controversies. Information is cross-referenced with MSCI ESG manager and RepRisk to ensure data quality. The investment team may also engage with an individual company, advocating for improved transparency and data disclosure to assist with the investment decision making process.

The Future

The process of integrating ESG factors into alternative investments is still in its infancy, with very few actors and investment strategies available in the space. The lack of a clear regulatory framework from the SFDR and the fact that several strategies can hardly roll out ESG criteria without materially impacting their implementation, along with the concerns about greenwashing, could be some of the reasons why. However, investor demand, especially in Europe, will continue to encourage alternative managers to enhance their ESG frameworks. As a pioneer and one of the largest allocators in alternative investments in Europe, we are willing to use our ESG expertise that we have developed in-house over the last ten years within the long-only world and to increasingly apply it to alternatives, offering clients innovative investment solutions which transparently integrate concrete and measurable ESG factors.

This article features in HedgeNordic’s “ESG & Alternative Investments” publication.