Stockholm (HedgeNordic) – Fund savers in Sweden channeled a net SEK 1.9 billion into hedge funds in October, according to Fondbolagens förening, the Swedish Investment Fund Association. The figure brings this year’s net inflows to hedge funds to an estimated SEK 9.2 billion, offsetting net outflows from equity, mixed and fixed-income funds.

Although Fondbolagens förening collects data from a small subset of the Swedish hedge fund industry, the fund flow statistics could be indicative of increasing investor interest towards hedge funds in the Nordic region. According to data collected by Fondbolagens förening, fund savers in Sweden allocated SEK 47 billion to hedge funds at the end of October. The fund statistics displayed by Fondbolagens förening do not include data from large hedge fund players such as Brummer & Partners, Lynx Asset Management and Rhenman & Partners Asset Management.

Based on data collected by HedgeNordic from 50 of the 61 Swedish hedge funds included in the Nordic Hedge Index, the Swedish hedge fund industry manages over SEK 203.7 billion as of the end of October. Lynx Asset Management alone oversees about SEK 94 billion in assets under management, with the asset manager’s Lynx trend-following strategy accounting for SEK 92 billion. Lynx Asset Management’s Swedish-domiciled Lynx Fund oversees about SEK 2 billion in assets under management.

“October was a positive month for many fund savers. The asset volume development was positive despite the fact that more people chose to sell than to buy.”

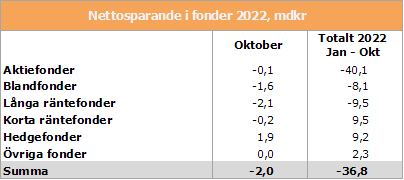

According to the Swedish Investment Fund Association, total fund assets in Sweden amounted to SEK 5,973 billion at the end of October, reflecting an increase of SEK 210 billion month-over-month despite net outflows of SEK 2 billion in October. While hedge funds received an estimated SEK 1.9 billion in net inflows during the month, long-term fixed-income funds and mixed funds experienced net withdrawals of SEK 2.1 billion and SEK 1.6 billion, respectively. Equity funds recorded a small net outflow of SEK 0.1 billion in October, taking the year-to-date net outflows to SEK 40.1 billion. Equity funds accounted for the majority of the SEK 36.8 billion redeemed by Swedish fund savers in 2022.

“October was a positive month for many fund savers. The asset volume development was positive despite the fact that more people chose to sell than to buy,” comments Philip Scholtzé, savings economist at the Swedish Investment Fund Association. “The last few weeks show that markets can also bounce back quickly. The Stockholm Stock Exchange’s rise in October corresponds to what many expect for a full year,” he continues. “We don’t know if we have finally turned the corner. But those who try to time the market run the risk of falling behind when the tide turns.”