Copenhagen – (Jesper Rangvid): The Council for Return Expectations (that I chair) has published new expectations. We expect higher returns. This does not necessarily mean that next year will be great. Maybe, maybe not. There is risk, i.e. individual years can be bad, but our revised expectations imply that if you invest for the long run—say ten years—you should expect higher average returns, compared to a similar investment made half a year ago.

These are difficult times: Inflation is at a 40-year high, meaning people struggle to make ends meet, interest rates are on the rise, meaning people have to pay higher mortgages, house and stock markets fall, which erode people’s wealth, liquidity is low, leading to volatile swings in asset prices, there is geopolitical uncertainty, there is war. It is a challenge to remain an optimist.

So, let me share some good news: Going forward, you should expect higher returns on your investments.

I chair the Council for Return Expectations (link). We publish expected returns on different asset classes, correlations, volatilities, investment costs, etc. Here is a link to a post I wrote a couple of years ago (link), describing the council and how we work.

Our expectations are widely used. Danish banks and pension funds use them when advising customers about their wealth developments. They also affect what pension companies pay out to current retirees.

We update our expectations twice a year, in spring and in autumn. We recently published our autumn forecasts. As we notably hiked them, I thought it would be interesting to share them here.

We provide expected average annual returns over the next ten years on ten different asset classes. We also publish expected average returns over 1-5 years and 6-10 years, but let me concentration the 1-10 year horizon here.

We provide expectations to annual returns in Danish kroner. The Danish kroner is fixed to the euro, i.e. our assumptions are applicable to euro-based investors, too. Our assumptions are arithmetic averages, i.e. they are best guesses of the return in any random year over the next ten years.

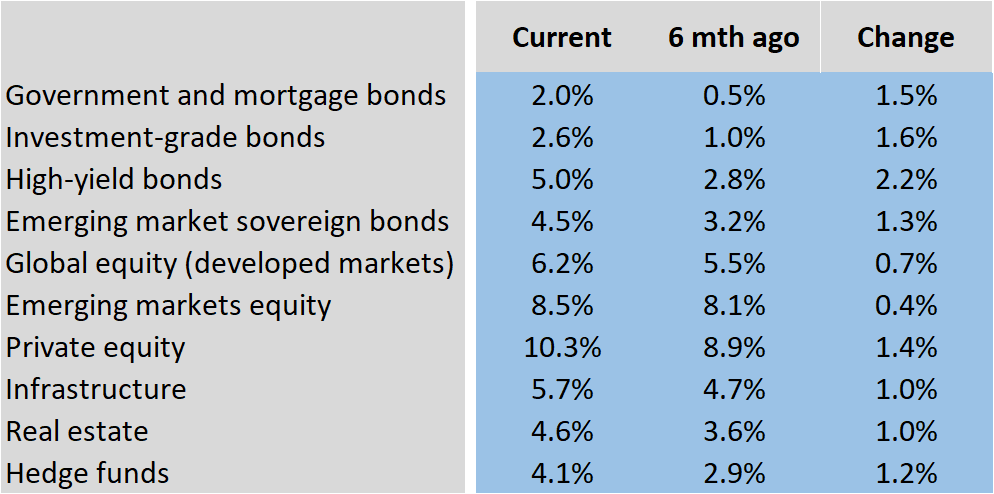

In Table 1, I show our current expectations, what we expected in spring (6 months ago), and the differences between our current and our previous expectations.

Source: Council for Return Expectations.

The main take away from Table 1 is that we have hiked our return expectations across all asset classes relative to our expectations six months ago. Expect somewhere between 0.4 percentage points (emerging market equity) and 2.2 percentage points (high-yield bonds) higher average annual return if you invest your money for ten years, compared to investing them in spring.

We have particularly hiked our expected return on fixed income investments. For instance, the expected returns on government and mortgage bonds have been hiked from 0.5% per annum to 2% per annum, i.e. four times higher returns.

The main reason we have hiked our expectations, of course, is that 2022 has been such a bad year on financial markets. Interest rates have risen, causing losses on fixed-income assets, and stocks have fallen. The flipside of such a development is that you get a higher interest rate if you invest your money today.

These are nominal returns. What about inflation? While not providing expectations to individual years, we mentioned in the press release that we expect inflation to be considerably higher than central banks’ 2% target next year and the year after (2024), after which we expect inflation to normalize. On average over the next ten years, we now expect 2% inflation, compared to the 1.8% we expected in spring.

RISK

The happy message of higher expected average returns does not necessarily mean that next year will be great. There is uncertainty. Things might go wrong in individual years, as we have seen during 2022.

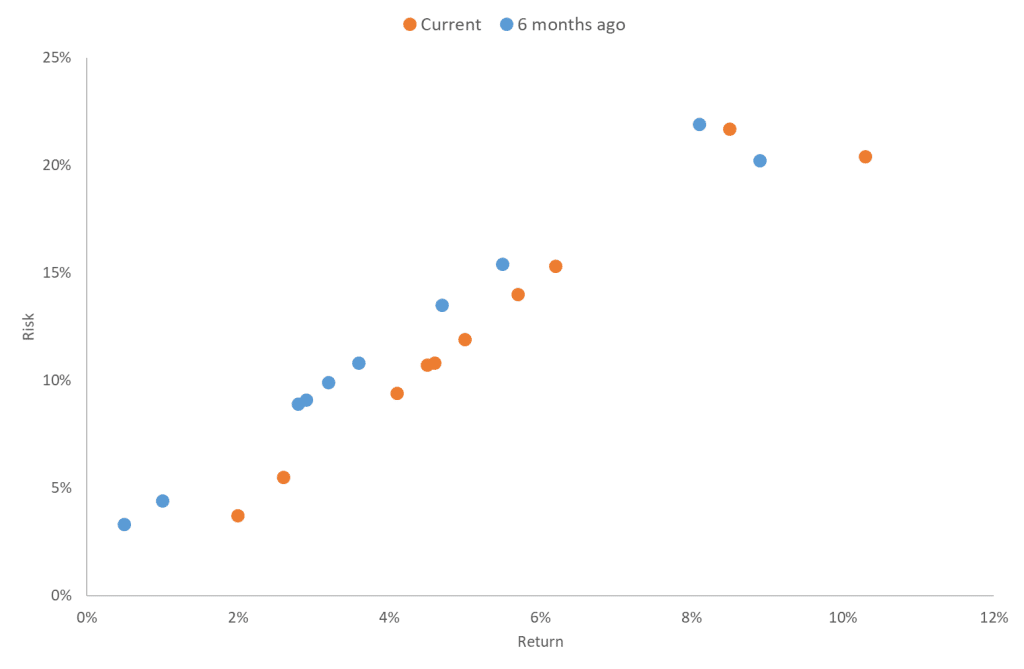

To capture the possibility that things might go wrong (or better), or, rather, to capture the uncertainty surrounding our expectations, we publish standard deviations of returns. In Figure 1, I show the relation between expected risks and returns. Generally, we expect that assets that deliver higher expected returns also deliver higher volatility.

Data source: Council for Return Expectations.

As an example, consider global equity. We expect an average annual return of 6.2% over the next ten years (Table 1) and a standard deviation of 15.3%. If returns are normally distributed, there is a two-third chance that global equity will return between app. –9% and 21% in any random year. Another way of saying this is that on average:

- Returns on global equity will be lower than –9% in one out of six years.

- Conversely, returns will exceed 21% in one out of six years.

- Returns on global equity will be lower than –25% in one out of forty years.

- Conversely, returns will exceed 36% in one out of forty years.

So, on average, we expect positive returns, but sometimes things go wrong (or better). Our expectations include this possibility.

We have hiked our expected returns, but risks are also higher. I illustrate this in Figure 2. The figure shows combinations of risks and returns for our current expectations and those we published six months ago.

The main message of Figure 2 is that the dots have moved to the right and most of them up. Returns have gone up, but so have risks.

Data source: Council for Return Expectations.

LONG-RUN RETURNS

What if you invest for the very long run, that is, if your investment horizon exceeds 10 years?

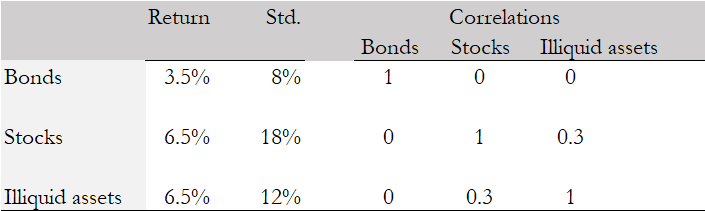

Historically, we have worked with two asset classes for investment horizons exceeding 10 years; stocks and bonds. We expected bonds to return 3.5% per annum on average and stocks 6.5%.

We have evaluated these expectations in light of recent academic literature. We published a thorough paper on this (link). Caveat: The paper is in Danish.

In the paper, we review the recent academic literature on “Low for long”, i.e. whether interest rates will revert to their pre-pandemic lows, and how demographics, productivity growth, global indebtedness, high inflation, etc. influence expected long-run interest rates and the equity risk premium. Overall, our conclusion is that “the academic literature does not provide sufficient justification for changing the long-run expected returns on stocks and bonds, nor for changing long-run inflation expectations.” Thus, we continue to expect bonds to return 3.5% per year on average (for investment horizons exceeding ten years), stocks 6.5%, and inflation to be 2% per annum.

Source: Council for Return Expectations.

However, we introduce a new asset class. Heretofore, we have, as mentioned, provided expectations for stocks and bonds. Given that illiquid assets have other return characteristics—are illiquid—we have introduced a new asset class, labelled “Illiquid assets”. We expect illiquid assets to return 6.5% on average on the long run (horizons > 10 years), the same as stocks, but with a lower volatility. The reason we expect illiquid assets to yield the same return as stocks, but with a lower variance, is exactly that they are illiquid. This expectation is in alignment with recent literature on the topic (link). Investors require an illiquidity premium if they should hold illiquid instead of liquid assets. Under certain assumptions, these expectations imply that the implicit illiquidity premium is 2.4% per annum. Table 2 collects our long-run expectations.

CONCLUSION

Compared to six months ago, the Council of Return Expectations (of which I am a member) now expects higher returns over the next ten years. This is some positive news in these otherwise uncertain and challenging times.

Remember, though, that higher expected average returns do not necessarily imply that next year will be great. Maybe, maybe not. There are always risks. But on average, over a number of years, expect higher returns.

This post has originally been published here.