By Dan Rizzuto and Linus Nilsson: In our September 2021 article (HedgeNordic Systematic Strategies, 2021) we sought to evaluate CTAs, Risk Premia, and Hedge Funds in a manner that demonstrated some potentially less understood or under-appreciated attributes for these investment sectors. We compared these alternative sectors to public and private equity, and to cryptocurrency in the context of absolute and relative performance, and correlation. We hoped to reinforce the importance and benefits of actively managed alternative investment strategies.

One year hence, markets and geopolitical circumstances have changed dramatically. And importantly, uncertainty across most markets has increased along with a seemingly universal diminution of confidence in future investment outcomes and securities valuations.

Herein we update some of our key analyses to reflect more recent circumstances and provide additional context to these alternative investment strategies.

CHANGES ABOVE… AND BENEATH THE SURFACE

This article is extracted from a larger report we’ve produced recently. In that larger piece, we revisit the now well-documented drawdowns across equity sectors and cryptocurrency markets and the concurrent outperformance of macro and CTA strategies in 2022. Here, we concentrate our note on certain critical observations that continue to be underemphasized in current alternative investment discussions.

In our original report we observed CTAs demonstrating important attributes (absolute return, low correlation, and positive skew) vis a vis equity-dominated portfolios. Noting that the positive return attribution from CTAs can be episodic, the first half of 2022 was one of those episodes. Risk Premia saw a smaller pick up in returns and Hedge Funds were in the red, consistent with the sector’s dependency on equity market risk factors.

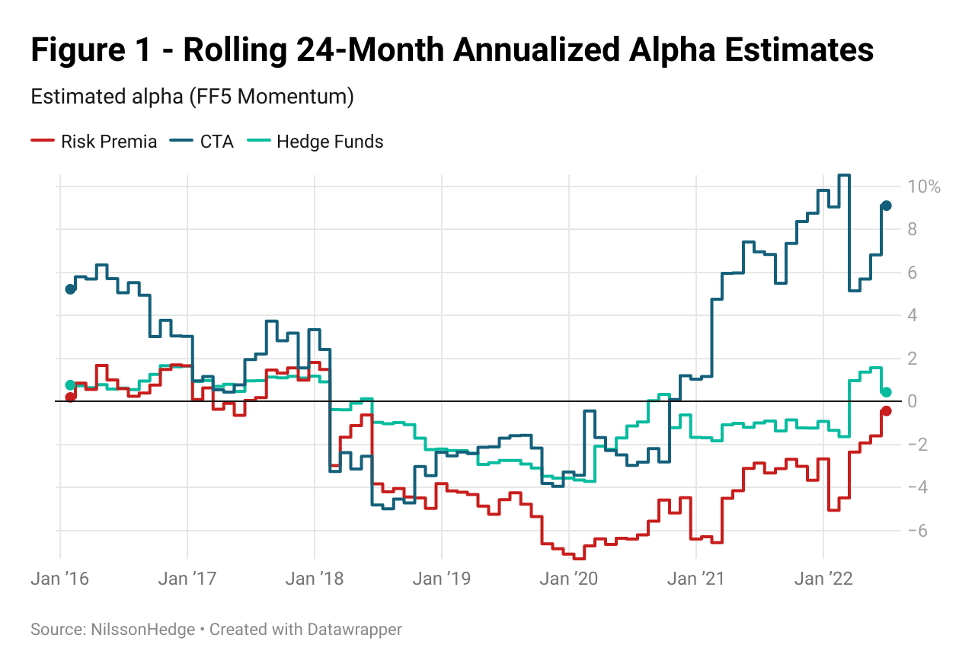

In Figure 1 below we observe alpha (in the context of Fama French plus momentum factor framework) for CTAs, Risk Premia, and Hedge Funds. Alpha from CTAs has continued to expand from the time of our original report. Hedge Funds and Risk Premia have also improved, though their pace of expansion and absolute level are a fraction of CTAs. A significant part of the alpha for CTAs is likely due to the sector’s successful navigation of the fits and starts in global risk appetite throughout this period.

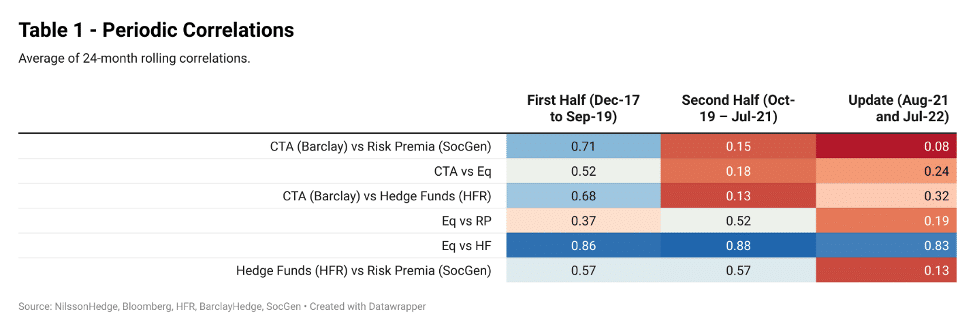

In Table 1 we note that the average 24-month rolling correlation of CTAs to equity showed some variability but remained mostly low, consistent with long run expectations.

Noteworthy (Table 1) is also the change in correlation of Risk Premia to the equity market. Though a few explanations may be offered, we point to the continued variability of profile of Risk Premia, a theme we studied in the original paper.

AND… THE MORE THINGS CHANGE, THE MORE THEY STAY THE SAME

To demonstrate how a systematic, long volatility strategy like trend following has generated profits and losses during more recent equity downturns, we created a basic trend following proxy (please see our full report, available on request, for details on the proxy structure.)

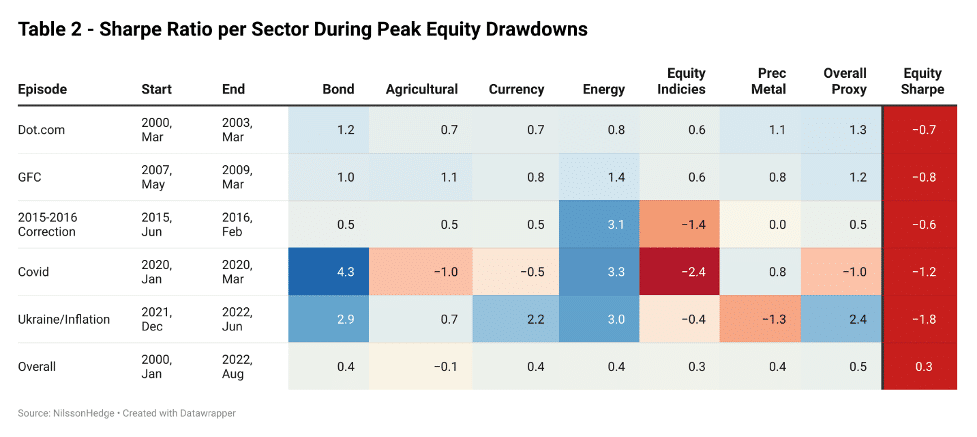

Using this proxy, Table 2 records the Sharpe ratio for each major market sector the proxy “traded” during negative equity markets since January 2000. Most noteworthy may be the prevalence of positive performance for the proxy during the three years following the unwinding of the Dot.com bubble. All market sectors have positive Sharpe ratios. The almost two years following the Great Financial Crisis demonstrates similar strong performance and breadth of diversification.

The three-month equity drawdown at the onset of the COVID Crisis is an exception. During this “V-shaped” equity market drawdown, the trend following proxy delivered risk-adjusted returns marginally better than equity market. But, both had negative returns.

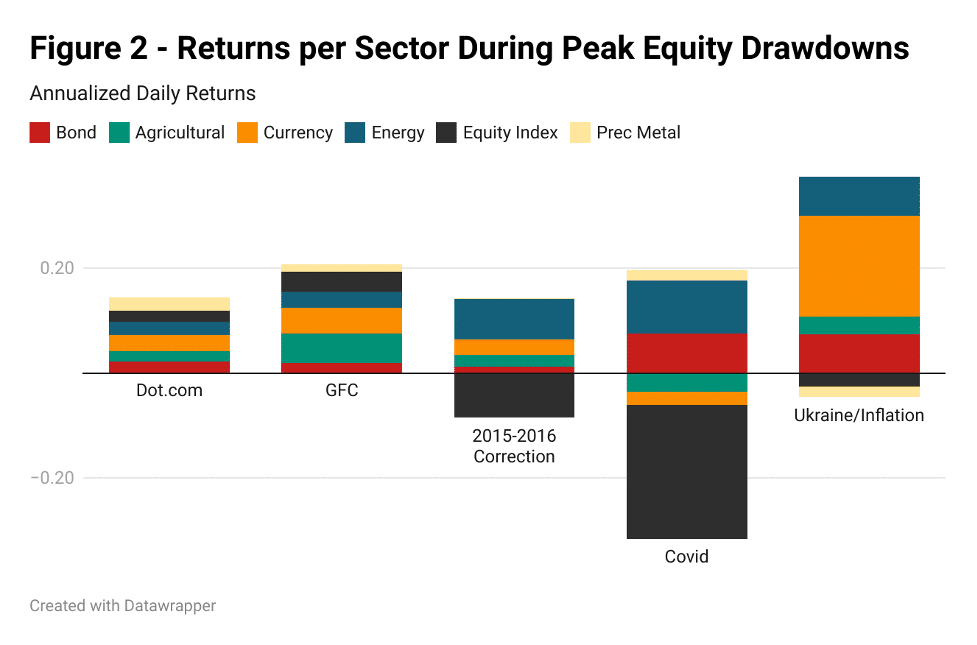

Figure 2 provides the annualized daily returns for our trend proxy during the various equity drawdowns. We note the benefits from CTA exposure can result from market sectors not anticipated to drive performance when viewed at the time through a conventional lens. Foreign exchange, the Energy complex, and fixed income each have provided meaningful positive attribution during the periods we evaluated.

THINGS TO CONSIDER

- CTAs and long volatility strategies have had a moment in H1 2022. In fact, at the time of publishing, rolling effectivity of CTAs is close to or at all-time highs. Risk Premia has recovered marginally but has outperformed Hedge Funds.

- Volatility (i.e. VIX) remains at elevated levels above 20%, well above the historic lows prior to 2020.

- Central banks have gone back to first principles and have re-focused on their primary mission; to fight inflation domestically rather than to provide a backstop for risky assets globally.

- From a longer historical context, the equity markets seem reasonably expected to have a sustained period of reversion to the long-term performance averages. If so, future equity returns (absolute and risk-adjusted) may be flat or below the unprecedented positive results that followed the Great Financial Crisis and that were supported by historic quantitative easing.

- Behavioral biases keep memories too short, outlooks too rosy, and risk taking a conundrum. More recent market entrants are by definition less familiar with recently observed equity market distress and ambivalence.

Here we again advocate for globally diversified, active alternative investment management strategies, including positive skew, managed futures and CTA portfolios, as an important response to the seeming contradiction of needed investment results during an increasingly uncertain investment outlook.

This article features in HedgeNordic’s “Systematic Strategies” publication.