By Anna Svahn, Antiloop Hedge – Investors entered the second half of the year a little less optimistic than the first. So far, it seems like disaster after disaster follows each other. The decade of 2020 began as well known with a pandemic that would catalyze enormous economic stimulus, forcing global central banks to raise rates into a recession to deal with inflation levels not seen in over 40 years. At the same time, the Russian invasion of Ukraine has left the world in global food and energy supply deficits, driving high prices even higher.

No strategy – and no level of brilliance – will make every quarter or every year a successful one. – Howard Marks

Almost as if it was a joke, the S&P 500 reached an all-time high on the second trading day of the year, only to fall deeper and deeper until we recently officially reached bear market territory. At the beginning of the year, investors were still hopeful. Historically, the stock market has increased during wars, as wars are usually followed by more economic stimulus. However, it is different this time. While investors initially sought to join the dip buying club, most have now capitulated as Jerome Powell disguises as a modern Paul Volcker.

The story of the great sell-off is broader than stocks. After reaching an eight-year high in June, the broad commodities index S&P GSCI has since fallen more than 15 percent in just a few weeks, making investors wonder if commodities, after all, might not work as well as an inflation hedge as they first believed. The only thing that has offered investors some protection has been the US dollar, utterly contradictory to what one might think would be a good hedge during high inflationary times.

In these markets, I seek comfort in a paper written by Bhardwaj, Gorton, and Rouwenhorst. The article, first published in 2005 and then updated one decade later, is called “Facts and Fantasies About Commodities Futures” and shows proof of how there is no such thing as a perfect hedge – not even in assets that generally have low or even negative correlation.

The Perfect Hedge Does Not Exist

Markets have been confusing lately. No one seems to know how to interpret any data or information anymore. When CPI rose more than expected in May, stocks initially climbed as investors hoped that rising rates into a recession would end the rate hiking cycle sooner and we would get back to the old “new” normal we’ve gotten accustomed to where rates stay close to zero, and the printing press never sleeps. When the Federal Reserve turned even more hawkish (who would have guessed?), assets tumbled again and continued downwards. The same pattern of behavior was seen when CPI for June surprised everyone with 9.1 % YoY inflation. Stocks initially fell but have since climbed again before awaiting what’s next from the Federal Reserve.

As a hedge fund manager, I constantly look for the perfect draw-down hedge. The best way to generate high risk-adjusted returns over long periods is to diversify in low- or non-correlated assets or strategies. However, while that’s great in theory, during major market events, correlations change dramatically (Bookstaber, 1997).

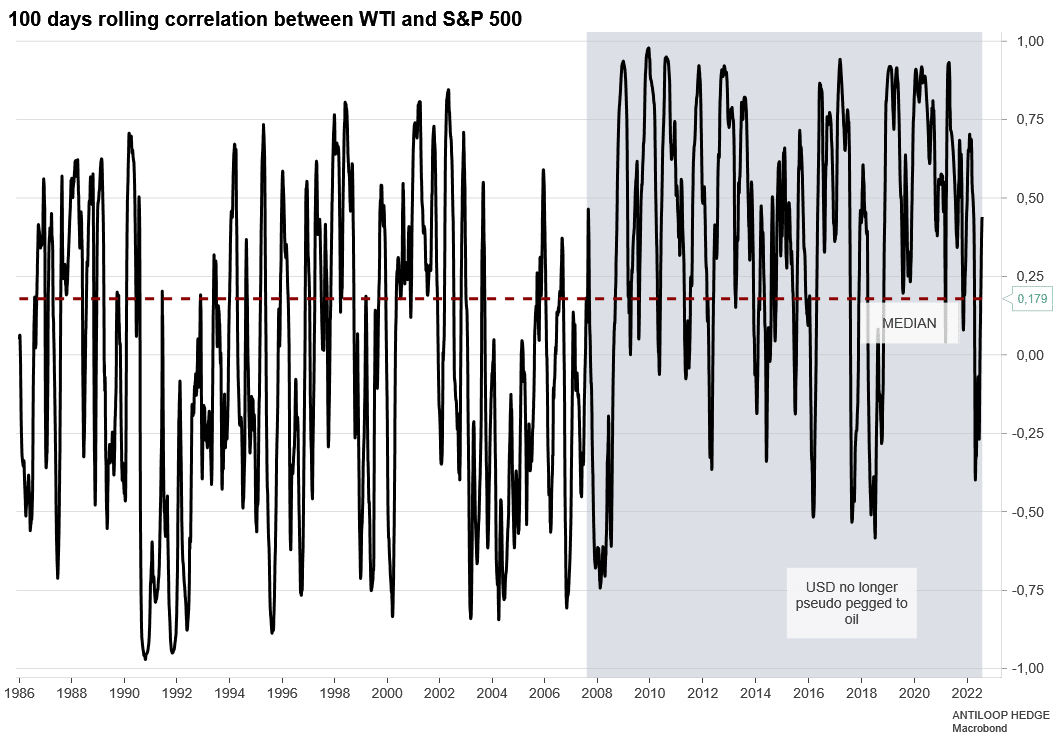

In my most recent memo, I mentioned that after the United States left the gold standard in 1971, the US dollar was pseudo-pegged to oil. For 30 years, oil prices traded between 15 USD and 30 USD. If the price rose, the Federal Reserve would raise rates, and if prices fell, the Fed would ease its monetary policy. It worked brilliantly until demand from China grew so much and so fast that there was no way for producers to match their demand quickly enough, resulting in prices going from around 30 USD in 2004 to almost 150 USD per barrel in 2008. After 2008, instead of continuing the rate hiking cycle, the then Fed chair Ben Bernanke lowered the Federal Funds target rate from 5 percent to almost 0, and the peg to oil was forever lost. Since 2008, the oil price has been trading between 150 USD and -30 USD.

More interesting, however, is that since the Federal Reserve let go of its pseudo-oil-peg and began to expand its balance sheet by forcing liquidity into financial markets, the correlation between the S&P 500 and oil increased substantially.

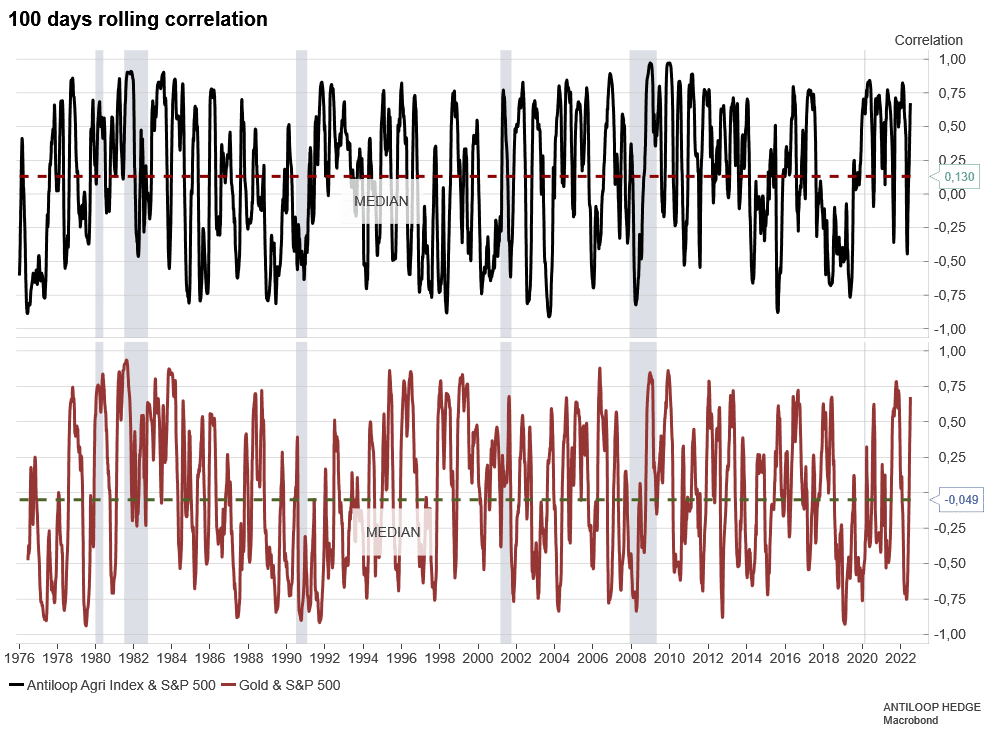

Before the United States lost its USD-to-oil-peg, the median 100-day rolling correlation between WTI and S&P 500 was -0.08. But from 2008 onwards, the median 100-day rolling correlation increased to 0.5. A similar change is to be found in the relationship between agricultural commodities, the S&P 500, and gold.

While looking at the long-term median correlation between different assets might be interesting, it does not tell us anything about the future and only very little about the past. The median is nothing else than just a single expression of a much more complicated relationship, meaning it is an almost useless factor to base short-term investment decisions on.

Market uncertainty brings market volatility and short-term disruption in correlation. As the Federal Reserve has poured liquidity into financial markets, investors have gotten used to seeing average yearly returns in one month or less, causing investors to gain a more short-term mindset. In Howard Mark’s latest memo, “I Beg to Differ”, Marks claims that focusing on just one quarter’s or one year’s performance is “meaningless at best and harmful at worst”, and I agree.

With correlations at a historical high, the biggest mistake an investor could make today would be to withdraw from their long-term strategy to find a “better” hedge elsewhere or, as Marks put it:

“If you wait at a bus stop long enough, you’re guaranteed to catch a bus, but if you run from bus stop to bus stop, you may never catch a bus”.

Exceptional returns are not created by jumping from one asset or strategy to another while looking for short-term gains but through patience and rigorous risk management.

This article was originally published here.