Stockholm (NordSIP) – Although sustainable investing is increasingly a part of mainstream investor’s tools, a low yield environment means continues to drive the appetite for sustainable investments in riskier markets. Although generally associated with higher returns, private markets remain a frontier sustainable investors find difficult to conquer due to the lower disclosure requirements for unlisted companies, their smaller scale and the limited resources at their disposal to respond to sustainable concerns.

As a result, NordSIP took some interest in two recently-published notes by impact asset manager BlueOrchard, part of Schroders group, discussing the roles of private equity and private debt in fostering the transition to a more sustainable economy.

Fostering Financial Inclusion in Emerging Markets via Private Equity

In a recent whitepaper, BlueOrchard argues that private equity investments in companies tackling financial inclusion in emerging markets (EMs) have been a relatively successful strategy for the impact investor.

“1.7 billion adults remain unbanked, women continue to suffer disproportionately from financial exclusion, and individuals and businesses alike require funding to reignite their economic activities in the aftermath of the Covid-19 crisis,” the report explains.

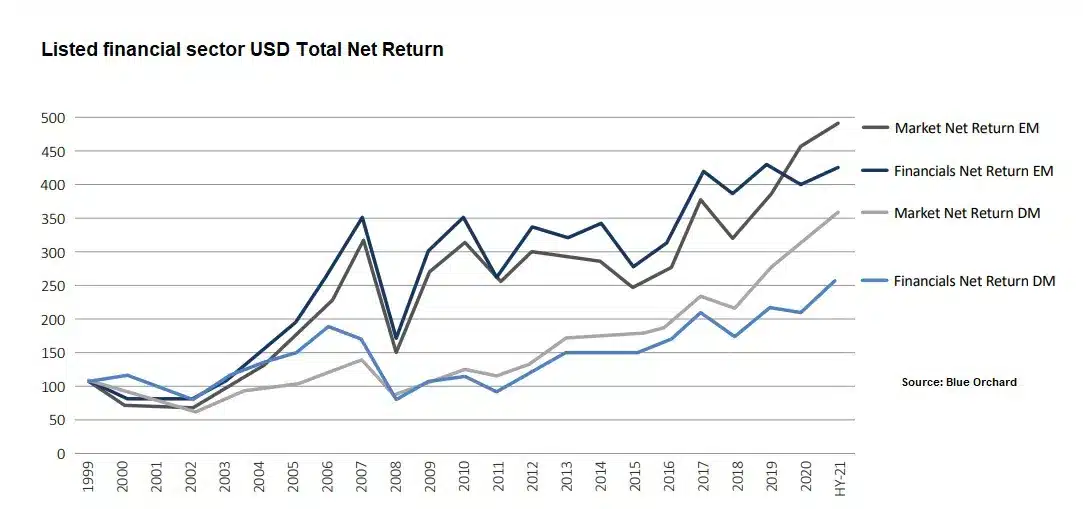

According to the report, the case for private equity in Ems is particularly interesting for investors looking to gain exposure to “businesses with regulatory capital requirements where equity provides the basis for debt funding.” Thus, the private equity investment works as the foundation upon which businesses may then leverage themselves to finance growth. Another appeal of private debt is that it provides access “to cash-generating businesses that typically cannot be accessed through debt markets, such as insurers or fast-growing technology companies, typically funded via equity.” According to the data provided by BlueOrchard, exposure to financial inclusion in EMs has traditionally outperformed the rest of the market.

The impact asset manager argues that its own experience has been even more successful. “The firms in BlueOrchard’s portfolio have fared even better than their emerging markets peers. By tending to the underserved segments of the population and economy, they have grown their assets more than fivefold on average over the last decade,” the whitepaper continues.

Blue orchard also argues that a focus on private markets is best. “The analysis of 180 banks and non-bank financial companies in the BlueOrchard client portfolio suggests that the largely non-listed universe of companies focusing on financial inclusion is growing even more strongly than their listed financial sector peers in emerging markets,” the report adds.

The report was authored by Felix Hermes, Head of Private Equity & Sustainable Assets at BlueOrchard, and Ernesto Costa, Head of BlueOrchard’s Private Equity Investment activities.

Private Debt: A Preferable Route to Renewable Infrastructure

In a market commentary article, Ashwin West, Head of Sustainable Infrastructure Investments at BlueOrchard, argues that private debt is the best channel for investments in renewable infrastructure at the moment.

“The falling cost of renewable energy is cause for celebration and much needed optimism in the fight against climate change. However, as project costs have fallen and governments have adjusted their approach to project procurement, competition has risen. This is putting returns under pressure for private equity investors in infrastructure projects. Indeed, the average return in emerging and frontier market renewable energy private equity investments has been falling steadily for about a decade. But the same is not true for the credit portion of infrastructure project finance,” West says.

The cost of installing the infrastructure and producing power declined over the last decade. In South Africa, for example, renewable energy represents 16 percent of the country’s energy capacity, up from 4.9 percent ten years ago. These improvements have found their way to the pocket of consumers, the unit cost per kilowatt-hour of renewable energy (“tariff”) has fallen by approximately 37 percent on average (and as much as 70 percent for solar PV).

According to West, market conditions appear to be better in debt markets “Emerging market infrastructure debt offers a material premium over the developed markets, but with a similar or marginally greater risk profile,” he says.

“The additional 200-400 basis point spread achievable in the emerging markets, whilst taking similar or marginally higher risk than similar investments in the developed markets, supports this strategy,” West concludes.

This article features in HedgeNordic’s “Private Markets” publication. The article was originally published on NordSIP.com.