Stockholm (HedgeNordic) – The hedge fund industry’s assets under management passed the $4 trillion mark in the first quarter in 2021, growing substantially to $4.32 trillion as of the end of September last year thanks to strong performance and positive inflows for a fifth consecutive quarter, according to Preqin. The alternative assets data specialist’s H1 Investor Outlook for 2022, based on investor surveys at the end of 2021 before the escalation of the Russia-Ukraine conflict, indicates that institutional investor interest in hedge funds may be waning.

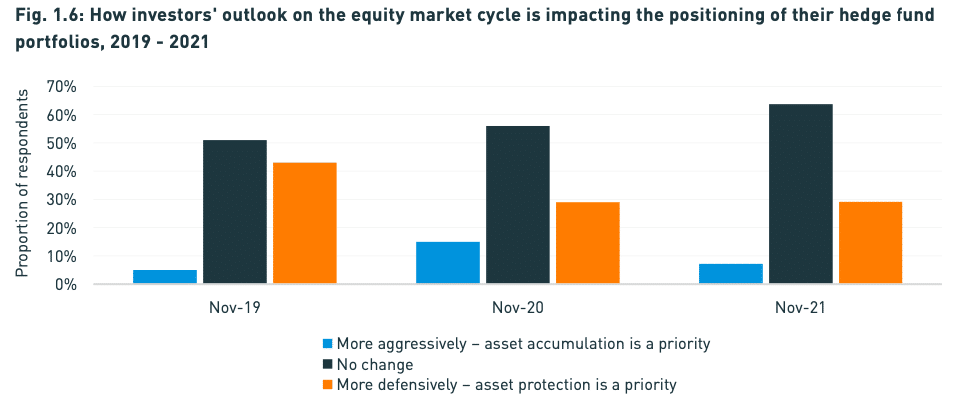

According to Preqin’s Investor Outlook, a little less than ten percent of surveyed allocators indicated they were “more aggressively” allocating to hedge funds and accumulating assets in this asset class due to their outlook on the equity market cycle. In November of 2020, double the proportion of investors, somewhere between 15 and 20 percent, indicated they were “more aggressively” investing in hedge funds, up from about five percent in November of 2019.

The waning investor interest in hedge funds may stem from the industry’s strong performance in the past three years. The Eurekahedge Hedge Fund Index, which reflects the equally weighted performance of about 2,200 hedge funds, enjoyed its best year in 2020 since 2009 with an annual advance of 13.3 percent. The Eurekahedge index delivered an annualized return of 10.6 percent over the three years through the end of last year. Hedge funds gained 9.4 percent on average last year. According to Preqin’s latest Investor Outlook, 72 percent of surveyed investors stated that their hedge funds had met or exceeded expectations in 2021, while 28 percent said returns fell short of their expectations.

“Markets have generally calmed and the dislocations are slowly disappearing, making it hard for managers to find high-return opportunities.”

A little more than 20 percent of surveyed allocators also expected their capital commitments to hedge funds over the next 12 months to increase compared with the previous 12 months. About 30 percent of investors expected allocations to decrease. The current stage of the overall market cycle is one of the reasons behind investors’ waning interest in hedge funds, according to Preqin. Close to 45 percent of surveyed investors believed the equity market was approaching its peak, and about 22 percent indicated that the market had already passed the high. “Markets have generally calmed and the dislocations are slowly disappearing, making it hard for managers to find high-return opportunities,” the report writes. “Investors are fully aware of this.”

Preqin’s Investor Outlook “Alternative Asset H1 2022 is based on a survey of more than 350 limited partners investing across alternative assets, including private equity, private debt, real estate, hedge funds, infrastructure, and natural resources. Preqin surveyed investors at the end of 2021, before the escalation of the Russia-Ukraine conflict.

Photo by LOGAN WEAVER on Unsplash