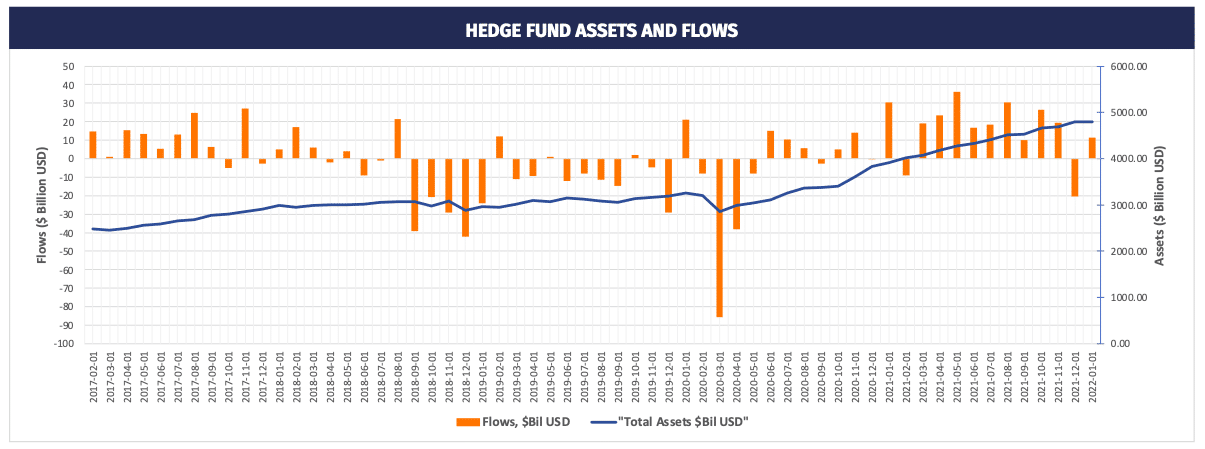

Stockholm (HedgeNordic) – After ending a nine-month run of net inflows in December due to investor profit-taking, tax-harvesting and rebalancing at year-end, the global hedge fund industry resumed attracting capital in January with net inflows of $11.3 billion, according to BarclayHedge. The industry’s assets under management continue to hover around $4.8 trillion as the industry experienced about $117.9 billion in trading losses during January.

“End of year profit-taking, tax-harvesting and rebalancing in December 2021 broke an impressive nine-month run of net inflows to the hedge fund industry. Happily, January marked a return to net inflows, albeit in a somewhat more circumspect manner,” says Ben Crawford, Head of Research at BarclayHedge. “Investors gave over an additional $11.29 billion to managers on the month,” he elaborates. “It is notable, however, that January 2022’s net inflows were less than 40% of the industry’s uptake a year ago and also well below the mean monthly inflow from 2021.”

“End of year profit-taking, tax-harvesting and rebalancing in December 2021 broke an impressive nine-month run of net inflows to the hedge fund industry. Happily, January marked a return to net inflows…”

Multi-strategy funds enjoyed the highest net inflows as a group in January this year, attracting an estimated $9.2 billion, according to the Barclay Fund Flow Indicator published by BarclayHedge. Emerging Markets – Asia funds and sector-specific funds attracted net inflows of $2.9 billion and $2.6 billion, respectively. Among the hedge fund sub-strategies recording net redemptions in January, balanced funds experienced the largest net redemptions with $2.4 billion in outflows. Emerging Markets – Global funds and fixed-income funds incurred net outflows of $1.8 billion and $914 million, respectively.

The managed futures industry posted its third consecutive month of redemptions in January with $1.4 billion in outflows. Although three of the four CTA sub-sectors picked up assets during the month, those gains were overshadowed by net outflows in the largest sub-sector comprised of systematic traders.

Most hedge fund sub-sectors tracked by BarclayHedge enjoyed net inflows over the 12-month period ending January. 13 of the 19 hedge fund sub-sectors tracked by BarclayHedge picked up assets over the 12 months ending January, with fixed-income funds leading the way in U.S. dollar terms by adding $60.7 billion. Multi-strategy and sector-specific funds followed suit, receiving net inflows of $44.7 billion and 38.4 billion, respectively, during the 12 months ending January.