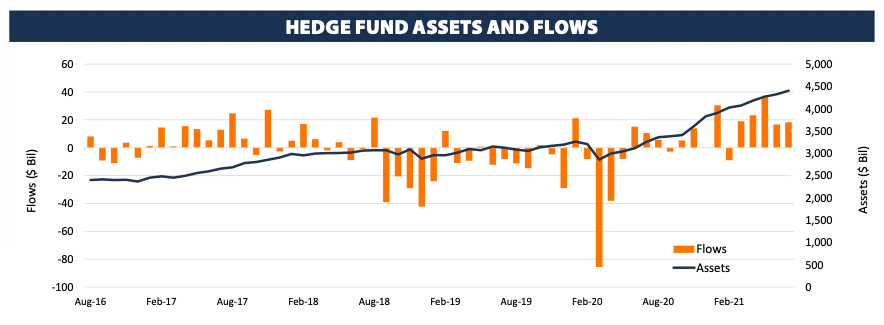

Stockholm (HedgeNordic) – Investors continued to pour money into hedge funds in July for a fifth consecutive month, according to data published by BarclayHedge. Investors injected a combined $18.3 billion into the hedge fund industry in July and plowed more than $116 billion into hedge funds in the first seven months of 2021 on top of the performance gains of almost $174 billion. With $18.3 billion in net inflows and an additional $7.3 billion in performance gains for July, total hedge fund assets reached $4.4 trillion as July ended, according to BarclayHedge.

“We have observed a marked shift in the risk appetite of hedge fund investors over the past twelve months, during which investors have in effect “doubled down” on their bets.”

“We have observed a marked shift in the risk appetite of hedge fund investors over the past twelve months, during which investors have in effect “doubled down” on their bets — letting their winnings ride while gradually increasing their exposure with additional targeted bets,” says Ben Crawford, Head of Research at Backstop BarclayHedge. “The result has been a roughly 45% increase in global AUM for the industry in the last twelve months,” he continues. “This figure is notable not only because it has pushed industry AUM to an all-time high, but because it has occurred in the wake of a roughly 18-month stagnation in which investors extracted profits from hedge funds practically as soon as they were generated.”

Most hedge fund sub-sectors, as defined by BarclayHedge, enjoyed inflows in July, with sector-specific funds leading the way by adding $4.7 billion in new assets. Balanced funds brought in $3.3 billion, fixed-income funds attracted $2.4 billion in inflows and equity long-only and multi-strategy funds each netted $2.3 billion in new investments. Sub-sectors shedding assets in July included equity long bias funds with $1.0 billion in net redemptions, equity market-neutral funds with $581 million in outflows, and event-driven funds with $246 million in redemptions.

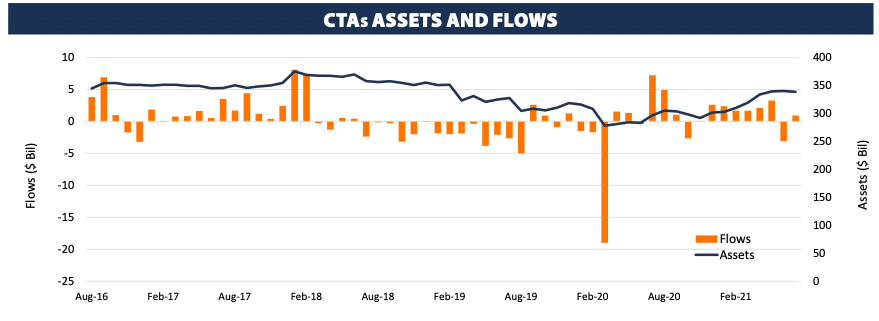

The managed future industry returned to inflows in July after June’s net redemptions broke a seven-month inflow streak. CTAs attracted $920.9 million in new assets in July, with the industry’s performance gains of $1.7 billion during the month bringing total managed futures industry assets to approximately $338.6 billion. The CTA industry posted $14.8 billion in inflows over the 12 months through the end of July. The $19.8 billion in performance gains over the period brought total industry assets to the $338.6 billion figure, up from $296.7 billion a year earlier.