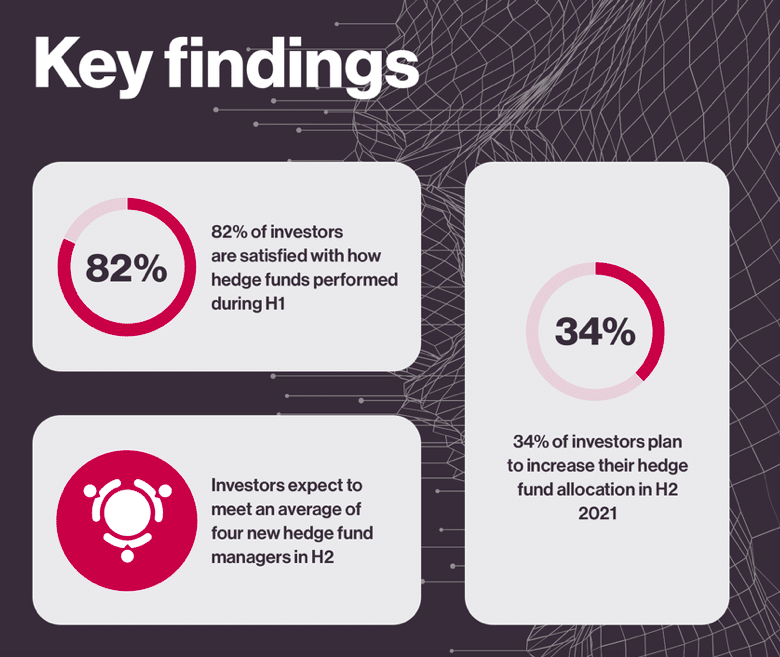

Stockholm (HedgeNordic) – With half the year already behind us, both Nordic and global hedge funds enjoyed their best first-half return since 2009. According to the latest bi-annual “Investor Intentions” report by the Alternative Investment Management Association (AIMA), more than 80 percent of investors were satisfied with the performance from their hedge fund investments in the first six months of 2021. Over a third of allocators plan to increase their hedge fund allocation in the second half of this year.

Based on surveys and interviews conducted with 108 investors in alternatives and 128 senior hedge fund IR and marketing professionals during the second quarter of 2021, the “Investor Intentions H2 2021” report by HFM and AIMA shows that investors’ outlooks on hedge funds remain encouraging. More than one-third of all respondents plan to increase their allocation to hedge funds in the second half of 2021. The percentage of investors planning to increase their allocation to the space decreased from the 45 percent figure highlighted in the previous report six months ago, partly attributable to some investors finding themselves over-allocated to hedge funds.

“Hedge fund managers posted the strongest first-half returns since 2009 during H1 and are on track to achieve the best Sharpe ratio since 2017,” says Elias Latsis, HFM’s Chief Data Officer. “While investor satisfaction with performance remains high, the slight pullback witnessed since our last survey shows the bar for success has been set higher by managers’ outperformance during Q2 2020.”

“While investor satisfaction with performance remains high, the slight pullback witnessed since our last survey shows the bar for success has been set higher by managers’ outperformance during Q2 2020.”

With hedge funds reporting their strongest first half to the year since 2009, capital inflows to the hedge fund industry up to May reached $57.8 billion, eclipsing the outflows of $23.4 billion experienced during 2020. AIMA also recently published its Global Hedge Fund Confidence Indicator for the second quarter, which showed that more than 90 percent of fund managers reported a positive confidence score for their economic prospects for the next 12 months. On a scale ranging from -50 to +50, hedge funds rated their economic confidence at +19.5, up from an average of +18.4 the previous quarter. Confidence is also up significantly from +13.8 in the fourth quarter of last year, according to the index.

“The findings of this report underscore the experience of AIMA’s members and our research, including the quarterly Hedge Fund Confidence Index, which emphasises that investors value hedge funds’ ability to protect against downside risk and provide steady performance in a variety of market conditions,” says Tom Kehoe, Managing Director and Global Head of Research and Communications at AIMA. “The vast majority of investors unsurprisingly remain satisfied with their hedge funds performance and are considering their future allocation plans accordingly,” he adds. “If the industry’s performance in H1 can be sustained for the rest of the year, it will have generated its highest returns for investors in over a decade.”

“The vast majority of investors unsurprisingly remain satisfied with their hedge funds performance and are considering their future allocation plans accordingly.”

Global macro strategies are expected to see the strongest inflows in the second half of 2021, as 32 percent of investors are planning an increase in exposure to global macro managers, with investors particularly interested in the strategy’s ability to hedge against rising inflation. Long/short equity and multi-strategy funds can also expect significant investor interest, with 31 percent of respondents planning increasing allocations to these sub-strategies.

Photo by Clark Young on Unsplash