Stockholm (HedgeNordic) – Nordic hedge funds edged down in May to end their six-month run of positive returns, as equity and fixed-income hedge funds dragged down the performance. The Nordic Hedge Index inched down by 0.1 percent last month (95 percent reported) to trim its year-to-date advance to 3.9 percent.

Three of the five strategy categories within the Nordic Hedge Index enjoyed gains last month, with equity and fixed-income hedge funds ending the month in the red on aggregate. Equity hedge funds, this year’s strongest-performing strategy group in the Nordic Hedge Index, were down 0.5 percent last month to cut their 2021 advance to 6.1 percent.

Fixed-income funds, meanwhile, fell by 0.6 percent on average last month to take their performance for the year down to 1.0 percent. The first five months of 2021 and the month of May, in particular, were more challenging for Nordic fixed-income hedge funds than their international counterparts, partly because of the struggle of Danish callable mortgage bonds. Nordic CTAs, meanwhile, advanced 1.7 percent in May, extending the group’s advance for the year to 3.8 percent. Multi-strategy and funds of hedge funds were up a similar 0.2 percent last month.

At a country level, the Norwegian hedge fund industry gained the most in April, with its 18 members advancing 0.4 percent on average. Norwegian funds within the Nordic Hedge Index are up 6.6 percent in the first five months of 2021. Swedish hedge funds, which account for the largest portion of the Nordic hedge fund industry, edged up 0.1 percent in May to reach 3.0 percent for the year. The Danish hedge fund industry, dominated by fixed-income vehicles, was down 0.5 percent in May to trim its year-to-date advance to 3.0 percent. Finnish hedge funds, meanwhile, fell by 0.3 percent on average last month to cut the industry’s year-to-date advance to 6.0 percent.

The dispersion between last month’s best- and worst-performing members of the Nordic Hedge Index remained somewhat unchanged month-over-month despite last month’s top performers gaining less than the prior month’s best performers. In May, the top 20 percent of Nordic hedge funds gained 2.4 percent on average, while the bottom 20 percent lost 2.9 percent. In April, the top 20 percent were up 4.2 percent on average, and the bottom 20 percent were down 1.3 percent. More than half of all members of the Nordic Hedge Index with reported May figures posted gains last month.

Top Performers in May

Precious metals-focused Atlant Precious was last month’s best-performing member of the Nordic Hedge Index. Ahead of its shift in focus from precious metals to “green” metals, the fund managed by Mattias Gromark advanced 10.7 percent last month to bring its 2021 performance into positive territory at 5.5 percent. RPM Galaxy, one of the two vehicles under the umbrella of RPM, gained 5.0 percent last month, taking its performance for the first five months of 2021 to 17.2 percent.

Formue Nord Fokus, a niche hedge fund focused on offering financing solutions to small- and mid-cap companies, advanced 4.2 percent last month to take its 2021 performance to 10.2 percent. Oslo-based energy-focused long/short equity fund AAM Absolute Return under the umbrella of Oslo Asset Management was up 3.9 percent in May and advanced 25.5 percent in the first five months of 2021. The fund managed by Harald James Otterhaug is among the best performing members of the Nordic Hedge Index this year. Artificial intelligence-assisted systematic Mandatum Managed Futures Fund followed suit with a monthly advance of 3.6 percent, bringing the fund’s 2021 performance to 8.9 percent.

Biggest Performance Surprises

Hedge funds exhibit different risk-return profiles and hence experience different levels of volatility in their returns. With a return of 10.7 percent in May, precious metals-focused Atlant Precious enjoyed the highest above-own-average return relative to its historical volatility in returns. The 10.7 percent advance was 2.1 standard deviations above the fund’s average monthly return. Danske Invest Europe Long-Short Equity Factors advanced 2.4 percent last month, which was 1.7 standard deviations above its average monthly return.

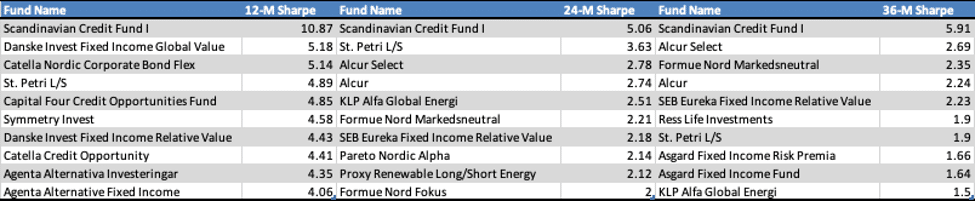

Highest Sharpe Ratios

Given the heterogeneous nature of hedge fund strategies, absolute performance numbers do not always reflect how successful hedge funds are. Risk-adjusted measures such as the Sharpe ratio are a good starting point in the process of identifying the best-performing hedge funds. The three tables below display the Nordic hedge funds with the highest Sharpe ratios over the past 12 months, past 24 months, and 36 months.

The Month in Review for May 2021 can be downloaded below:

Photo by Rahul Pandit on Unsplash