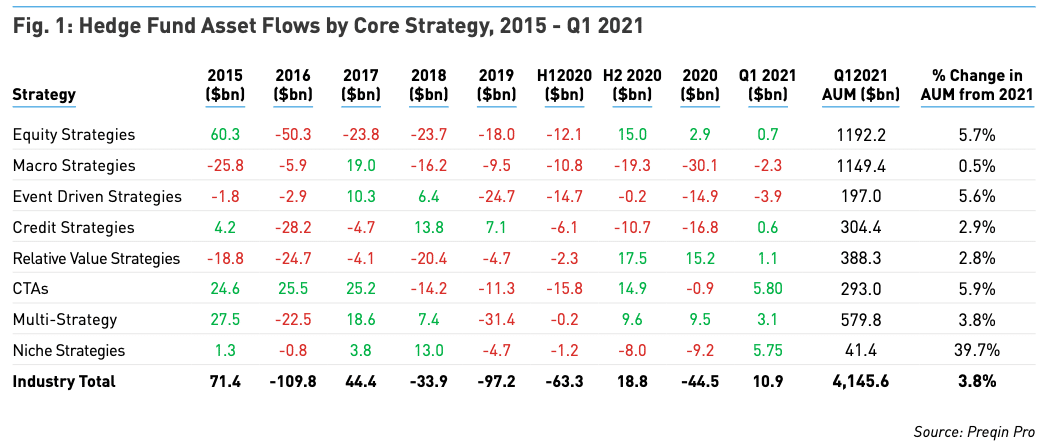

Stockholm (HedgeNordic) – Hedge fund assets surpassed the $4 trillion-mark to reach an all-time high of $4.15 trillion after three consecutive quarters of inflows and the best first-quarter performance since 2006, according to Preqin. Investors poured $10.9 billion into hedge funds in the first quarter, which, combined with the Preqin All-Strategies Hedge Fund benchmark’s return of 6.9 percent, resulted in a quarter-over-quarter increase in assets under management of $150 billion.

CTAs, which suffered the highest net redemptions in the first half of 2020 among the eight strategy categories tracked by Preqin, received the highest inflows in the first quarter of 2021. After losing $15.8 billion in assets under management due to outflows in the first half of last year and then recouping $14.9 billion in the second half of the year, CTAs received an additional $5.8 billion from investors in the first quarter of 2021. CTAs had $293 billion under management at the end of the first quarter. Niche strategies, which incurred net redemptions of $9.2 billion in 2020, enjoyed net inflows of $5.75 billion in the first quarter of this year.

“We see a bit of a shift towards the top level strategies that didn’t receive the attention in the pre-Covid-19 environment, because risk wasn’t a major factor.”

“We see a bit of a shift towards the top level strategies that didn’t receive the attention in the pre-Covid-19 environment, because risk wasn’t a major factor,” comments Sam Monfared from Preqin. “It seems like allocators are paying more attention to risk management and putting money into buckets that are there to protect capital.”

“It seems like allocators are paying more attention to risk management and putting money into buckets that are there to protect capital.”

Macro strategies, which experienced the highest redemptions last year with $30.1 billion in net outflows, saw investors redeem an additional $2.3 billion in the first quarter of 2021. Fifty-six percent of macro-focused funds experienced outflows in the first three months of 2021, the worst performance among all hedge fund strategy categories tracked by Preqin. Even so, macro managers continue to remain the second-largest strategy category within the Preqin universe with assets under management of $1.15 trillion as of the end of March. Equity strategies, which account for the highest portion of the hedge fund industry with a combined $1.19 trillion under management, received $0.7 billion in net inflows during the first quarter of 2021 after receiving a net $2.9 billion last year.

“This is obviously a good mark to hit for the hedge fund industry, especially because, over the past few years, the industry has struggled a bit.”

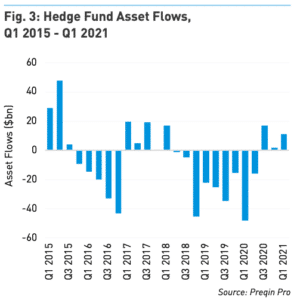

The new all-time high in assets under management comes during a period of “much-need optimism” in the hedge fund industry, said Monfared, according to Institutional Investor. The hedge fund industry experienced nine consecutive quarters of net outflows starting with the first quarter of 2018 through the second quarter of last year. “This is obviously a good mark to hit for the hedge fund industry, especially because, over the past few years, the industry has struggled a bit,” said Monfared.

Photo by Benjamin Davies on Unsplash