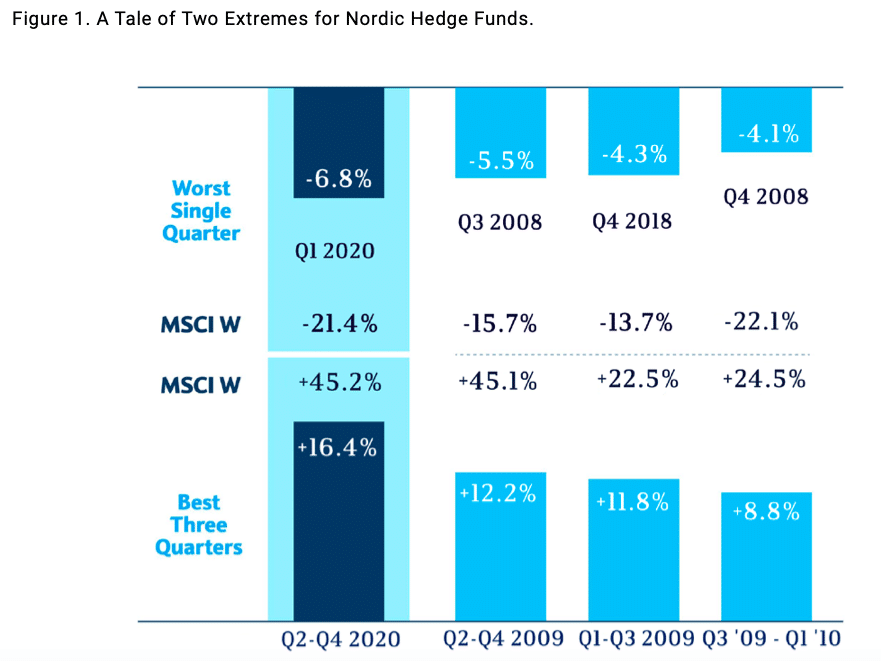

Stockholm (HedgeNordic) – 2020 was a year of extremes for markets, investors and hedge funds managers alike. For the Nordic hedge fund industry, 2020 could be summed up as a tale of two extremes. The first quarter of last year was exceptionally difficult for Nordic hedge funds, which recorded their worst quarterly decline since HedgeNordic started tracking the industry back in 2005. The industry’s sizeable drawdown was quickly offset by strong performance when markets bounced back starting in April. Following the worst quarterly decline on record in the first quarter, the Nordic hedge fund industry went on to enjoy its best three-quarter performance since 2005.

The Nordic hedge fund industry, as reflected by the Nordic Hedge Index, advanced 8.5 percent last year, its strongest annual performance since 2009. Viewed on a standalone basis, 2020 was an exceptionally strong year for Nordic hedge funds. When looking beneath the surface, last year was indeed a tale of two extremes for the industry. The Nordic hedge fund industry lost 6.8 percent in the first quarter of last year, its worst quarterly decline on record. The quarterly decline was mainly attributable to the 5.4 percent-loss in March, which was the industry’s worst month on record.

Starting with a loss of 1.8 percent in February and then enduring an additional decline of 5.4 percent in March, the Nordic hedge fund industry experienced its second-worst drawdown on record in the first quarter of last year. Drawdowns are peak to trough, what about climbing out from the trough back to a new peak? How long did it take for the Nordic hedge fund industry to recover from its second-worst drawdown? The recovery from the valley of the index to a new high lasted only four months. In the final three quarters of 2020, the Nordic hedge fund industry enjoyed a cumulative return of 16.4 percent, its best three-quarter performance on record.

The Nordic Hedge Index Overcomes the Survivorship Bias

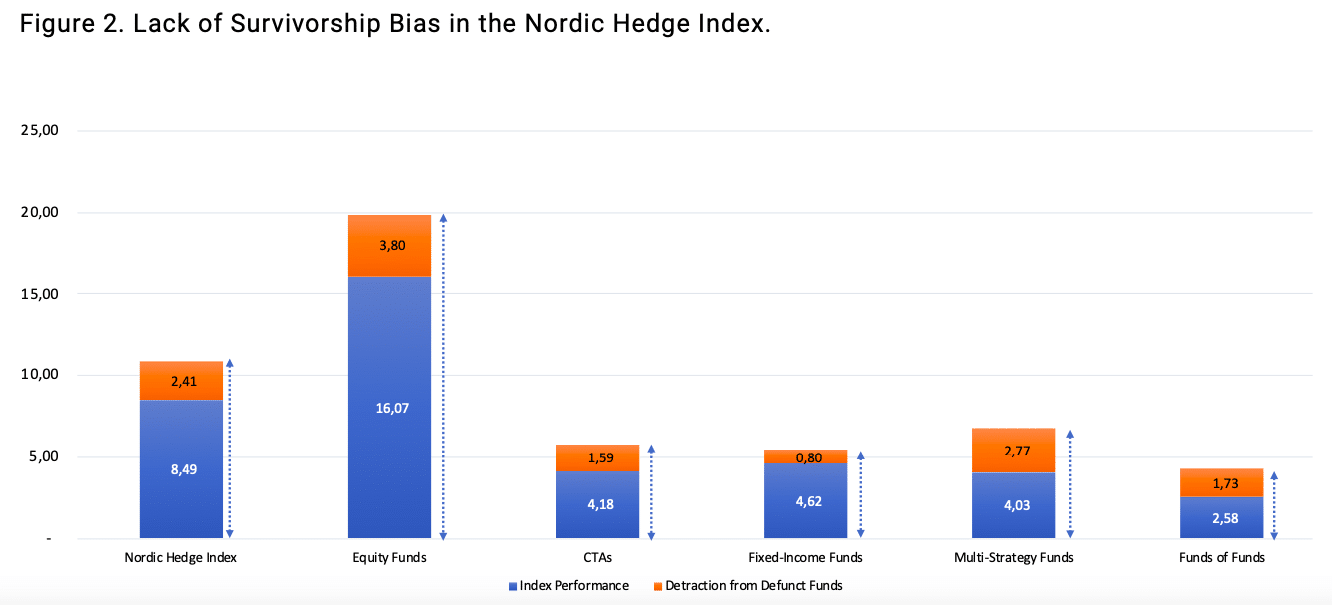

Hedge fund indices are often (perhaps wrongfully) associated with exhibiting “survivorship bias,” which reflects the tendency of certain data providers to solely reflect the returns only generated by existing funds – thereby, ignoring the performance of already-defunct funds. With no less than 30 Nordic hedge funds delisted from the Nordic Hedge Index last year – funds either closed down or merged into other funds, an inappropriate calculation methodology for the Nordic Hedge Index could have resulted in significant survivorship bias.

The Nordic Hedge Index tackles this bias by reflecting the aggregate performance of both defunct and up-and-running funds. The index was up 8.5 percent last year, but the 138 active Nordic hedge funds returned 10.9 percent on average last year. The 240 percentage points-difference reflects the performance detraction from the funds that closed during 2020 (which, unsurprisingly, performed worse than the up-and-running funds).

The most noticeable difference between the performance of a sub-index and the performance of active funds underlying that sub-index is observed in the NHX Equities. The 50 up-and-running equity hedge funds within the Nordic Hedge Index gained 19.9 percent on average in 2020, while the NHX Equities was up 16.1 percent as 13 members of this sub-index closed down last year.

Up-and-running Nordic multi-strategy hedge funds returned 6.8 percent on average last year, whereas the NHX Multi-Strategy was up 4.0 percent. This 280 percentage points-difference stems from the worse-than-average performance of the 13 multi-strategy hedge funds that closed down last year. Similarly, the existing funds of hedge funds in the Nordic Hedge Index were up 4.3 percent last year, while the NHX Funds of Funds, which reflects the performance of defunct funds too, gained only 2.6 percent.

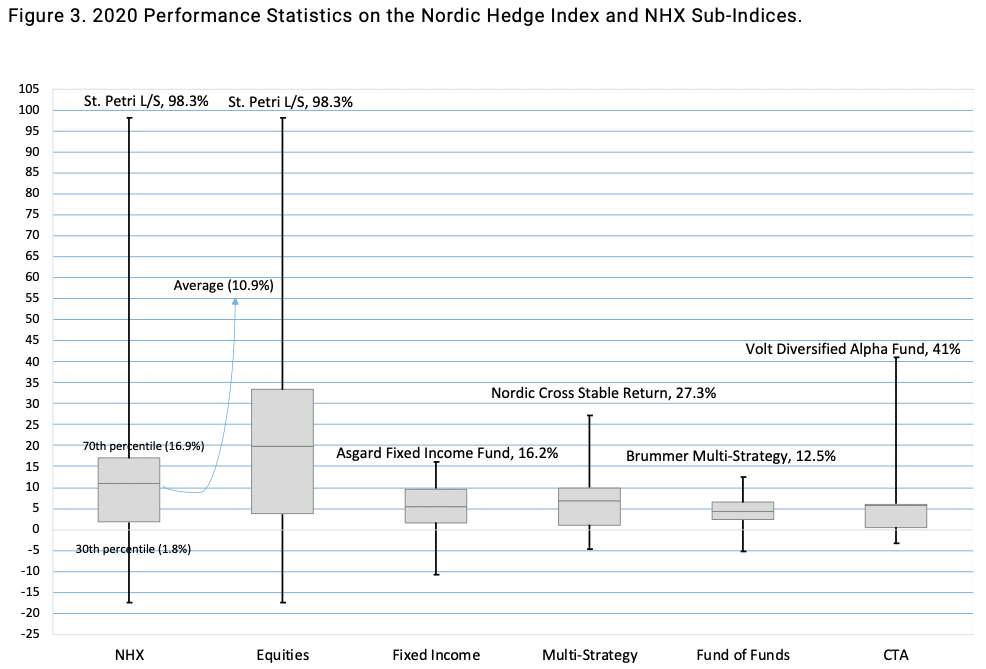

Averages Hide Disparities

The Nordic hedge fund industry gained 8.5 percent net-of-fees last year and active Nordic hedge funds were up 10.9 percent on average. While these average figures are useful for comparison, averages do hide disparities. With a return of 98.3 percent, thematic-focused long/short equity fund St. Petri L/S was last year’s best-performing member of the Nordic Hedge Index. The worst performing fund that is still part of the index, meanwhile, was down 17.4 percent. The dispersion between last year’s best- and worst-performing hedge fund was wide, very wide in fact.

The top 30 percent of all members of the Nordic Hedge Index gained 30.2 percent on average, whereas the bottom 30 percent was down slightly over two percent. The top 20 percent, meanwhile, gained 37.9 percent last year and the bottom 20 percent lost 3.9 percent on average.

In the graph below, the grey boxes show that the Nordic hedge funds that were not in the top and bottom 30 percent in terms of performance returned between 1.8 percent and 16.9 percent last year. About one in every five members of the Nordic Hedge Index achieved a return higher than 16.9 percent in 2020, while eight percent returned above 30 percent. A little more than seven percent of all members returned above 40 percent last year.

About 47 percent of Nordic equity hedge funds outperformed the MSCI World’s 16.5 percent-return last year, but one should not forget that most Nordic equity hedge fund maintain a net market exposure below 100 percent. Some members of the NHX Equities employ a market-neutral approach to investing, and some even maintain negative net exposure to the market. The average equity hedge fund in the Nordic Hedge Index was up 16.1 percent last year, but, again, the average hides wide disparities.

The top 20 percent of performers in the NHX Equites returned 63.1 percent on average last year, while the bottom 20 percent were down 6.5 percent on average. The equity hedge funds that were neither in the top 30 percent nor in the bottom 30 percent returned between 3.6 percent and 33.4 percent. In a similar fashion, the great majority of fixed-income hedge funds returned between 1.6 percent and 9.7 percent last year. The top 20 percent, meanwhile, were up 13.8 percent on average, whereas the bottom 20 percent lost 3.0 percent on average. The majority of multi-strategy hedge funds returned between 1.1 percent and 10.0 percent.

This article featured in HedgeNordic’s 2021 “Nordic Hedge Fund Industry Report.”