Stockholm (HedgeNordic) – March is always an exciting period for us at HedgeNordic, as it means we are going into April, which in turn means: it is time for the Nordic Hedge Award. We will get to meet friends, partners and business relations. We shake hands, hug, exchange war stories and business cards, enjoy the traditional hot dogs and pop-corn ahead of the winner announcement and have a good evening overlooking Stockholm harbor over some beers. Expect, this year we won´t.

As so many other things dear to us have fallen victim to the global Covid-19 pandemic, the Nordic Hedge Award will look different this year.

What did not change, is the basic set up and process to determine the winners. The Nordic Hedge Award is set to distinguish outstanding hedge fund managers from, or active in the Nordic region. All funds with a minimum track record of 36 months are that are listed in the Nordic Hedge Index (NHX) for the Nordic Hedge Award.

The winners in the regular categories are determined in a three step process:

Initially, a quantative model compounds various parameters of all funds in the respective subcategories to determine a shortlist. These parameters are taken into consideration both on an absolute basis, as well as relative to the other funds in the same sub-category. The highest scoring FIVE funds per category become the nominees. The model and parameters chosen were co-developed by HedgeNordic in cooperation with Stockholm School of Economics´ House of Finance.

In a second step, a jury typically consisting of institutional investors and asset owners reviews the shortlisted funds for a qualitative screening. Each jury member then awards his or her score for each respective fund. We are delighted to again have a most distinguished jury board Kari Vatanen, CIO at Veritas Pension Insurance, Gilles Lafleuriel Head of Real Assets and Alternatives at Nordea, Gustav Karner CEO/CIO at Apoteket’s Pension Fund, Helen Idenstedt Head of External Partnerships and Innovation at AP1, Claudia Stanghellini, the head of external management of AP3 and Christer Franzén, CIO at Ericsson Pensionsstiftelse (pictured below, left to right).

And finally, the quantative and qualtitavie scores are aggregated in an equal weighting to determine the final rankings, and thus the winners and runners up to the Nordic Hedge Award.

There are two extraordinary categories where a different approach is taken to determine the winners:

The Performance award solely compares pure net performance as the one and only factor to determine the ranking. Performance awards are awarded for the highest compound performance over 12, 36 and 60 months.

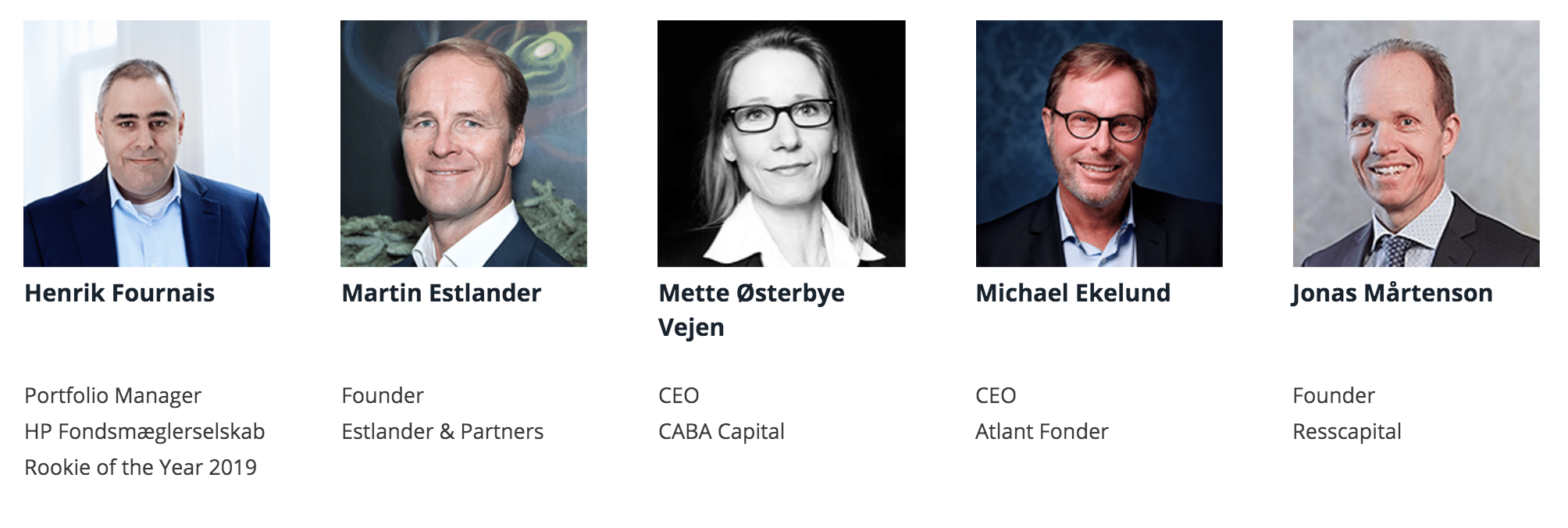

And finally, the best new Nordic hedge fund is determined by other Nordic hedge fund managers, making the Rookie-of-the-Year Award a peer group distinction.

Jury Board for the 2020 Rookie of the Year

The winners of the 2020 Nordic Hedge Award will be revealed during the week of April 19-23 2021 and announced in a series of videos.

The winners of the 2020 Nordic Hedge Award will be revealed during the week of April 19-23 2021 and announced in a series of videos.

- Best Nordic Fund of Hedge Funds 2020 presented by RBC

- Best Nordic Fixed Income Hedge Fund 2020 presented by SS&C EZE

- Best Nordic Multi-Strategy Hedge Fund 2020 presented by AMX

- Best Nordic Equity Hedge Fund 2020 presented by Northern Trust

- Best Nordic CTA 2020 presented by Efficient Capital

- Performance Awards presented by SHoF

- Rookie of the Year – Presented by Harvest Law

- Best Nordic Hedge Fund 2020 – OVERALL presented by CME Group

You can sign up to the premiere broadcast of the 2020 Nordic Hedge fund winner reveal by registering on https://hedgenordic.com/2020reveal/

The 2020 Nordic Hedge Award is supported by: