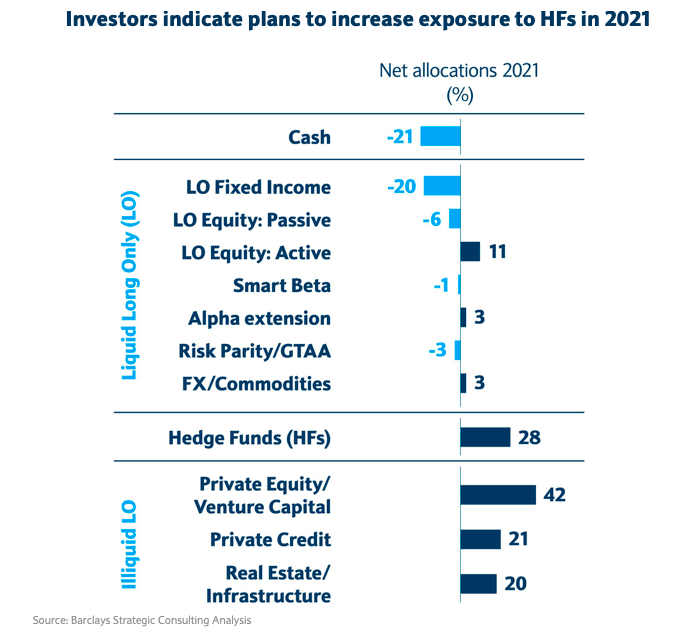

Stockholm (HedgeNordic) – Investors pulled an estimated $30 billion from hedge funds in 2020, marking the third consecutive year of net outflows for the hedge fund industry. But “2021 could be a breakout year,” says Barclays. “Investor interest in hedge funds is the strongest in years,” with the industry expected to attract $10 billion to $30 billion of net inflows in 2021. The estimates stem from Barclays’ most recent Strategic consulting survey of 240 investors, who collectively account for about 22 percent of the hedge fund industry’s capital.

“2021 could be a breakout year, with a projected $10 billion to $30 billion of net inflows.”

According to Barclays’ 2021 Global Hedge Fund Industry Outlook and Trends report, all investor types indicated plans to increase their exposure to hedge funds in 2021, with family offices and private banks indicating the most bullish plans. The survey results show that 41 percent of investors plan to increase their hedge fund exposure. “The large, established hedge funds are still going to get the bulk of the money, but compared to 2020, there will be more allocations to managers outside of existing relationships,” Roark Stahler, U.S. head of strategic consulting at Barclays, tells Bloomberg.

The hedge fund industry experienced net outflows of $30 billion last year, with investors redeeming more than initially planned in 2020 as the coronavirus pandemic “made cash a premium for a number of investor types,” writes Barclays. The coronavirus pandemic also disrupted investors’ allocation process due to the restrictions imposed in response to Covid-19. “Because of the difficulty conducting operational due diligence under quarantine and social distancing, many investors opted to stick with existing hedge fund relationships last year rather than establish new ones,” writes Barclays.

“Because of the difficulty conducting operational due diligence under quarantine and social distancing, many investors opted to stick with existing hedge fund relationships last year rather than establish new ones.”

The challenges for fund investors to undertake their due diligence, in particular face-to-face meetings, forced 97 percent of the surveyed investors to adjust their operational due diligence processes. More than half of these investors expect to continue those changes in a post-pandemic environment. Respondents also indicated that about 60 percent of their staff are expected to be back at the office by the end of June, but they are unlikely to take in-person meetings with fund managers until the second half of next year at the earliest.

“After generally not expanding their hedge fund rosters in 2020, investors appear likely to begin forging new hedge fund relationships again as they allocate an estimated gross of $450 billion throughout 2021.”

“After generally not expanding their hedge fund rosters in 2020, investors appear likely to begin forging new hedge fund relationships again as they allocate an estimated gross of $450 billion throughout 2021,” writes Barclays. The key drivers of allocations to hedge funds differ across investor types, with the main objectives including diversification, risk mitigation, and potential to earn equity-like returns with bond-like risk. According to Barclays, the most popular hedge fund strategies in 2021 are sector-specific equity managers, market-neutral stock-pickers, and discretionary macro managers. Generalist equity funds, on the other hand, are least in favor.

Photo by Possessed Photography on Unsplash