Stockholm (HedgeNordic) – After logging their best annual performance since 2009, Nordic hedge funds started 2021 on a positive note with an average gain of 0.6 percent in January (97 percent reported). Equity hedge funds, the largest strategy group within the Nordic Hedge Index, led the gains last month, continuing their momentum into 2021 after enjoying their second-best year on record with an advance of 16.1 percent in 2020.

Month in Review – January 2021

Four of the five strategies in the Nordic Hedge Index posted gains last month, with CTAs losing 1.4 percent on average. Nordic equity hedge funds, on the other hand, advanced 1.4 percent on average in January. Fixed-income and multi-strategy hedge funds were up 0.9 percent and 0.2 percent, respectively. Funds of hedge funds gained an estimated 0.3 percent in January.

At a country level, Swedish hedge funds, which account for the largest portion of the Nordic hedge fund industry with 68 listed funds, advanced 0.6 percent on average. Norwegian and Danish hedge funds closely followed suit with an average gain of 0.5 percent in January. The 14 Finnish hedge funds listed in the Nordic Hedge Index were up 0.4 percent on average last month.

The dispersion between last month’s best- and worst-performing members of the Nordic Hedge Index decreased month-over-month. In December, the top 20 percent of Nordic hedge funds advanced 4.2 percent on average, while the bottom 20 percent lost 2.4 percent on average. In December, the top 20 percent were up 7.8 percent on average and the bottom 20 percent were down 0.4 percent on average. About three in every five members of the Nordic Hedge Index with reported January figures posted gains last month.

Top Performers in January

Proxy Renewable Long/Short Energy, a directional long/short equity fund focused on the energy transition, was last month’s best-performing member of the Nordic Hedge Index with a return of 11.6 percent. According to the team running the energy transition-focused fund, “Energy Transition related sectors had a more favourable development than global markets in general over the month.” Adrigo Small & Midcap L/S, a stock-picking hedge fund looking for long and short opportunities in the Nordic small- and mid-cap segment, followed suit with a monthly advance of 10.4 percent.

Symmetry Invest, a Danish long/short equity fund founded and co-managed by Andreas Aaen, was up about 9.0 percent in January, while energy-focused market-neutral equity fund KLP Alfa Global Energi gained 7.1 percent in the first month of 2021. The Lucerne Nordic Fund, a Cayman Islands-domiciled hedge fund run by Jonathan Copplestone out of New York with a strictly Nordic investment theme, was up 6.5 percent in January.

Biggest Performance Surprises

Hedge funds exhibit different risk-return profiles and hence experience different levels of volatility in their returns. With a gain of 7.1 percent for January, market-neutral equity fund KLP Alfa Global Energi enjoyed the highest above-average return last month relative to its historical level of volatility. Its last month’s gain was 2.9 standard deviations above its average monthly return. Global macro fixed-income fund Nordkinn Fixed Income Macro Fund advanced 1.5 percent last month, which was 1.8 standard deviations above its average monthly return of 0.28 percent. Adrigo Small & Midcap L/S’s return of 10.4 percent was 1.5 standard deviations above its average monthly return since inception.

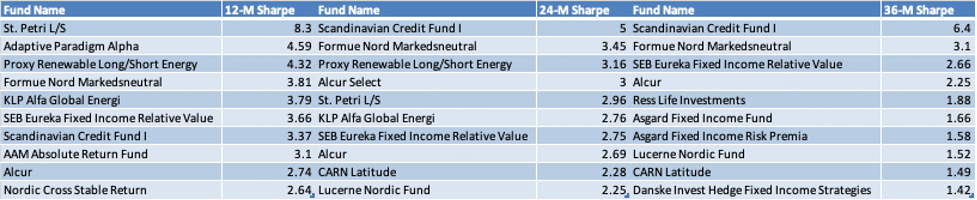

Highest Sharpe Ratios

Given the heterogeneous nature of hedge fund strategies, absolute performance numbers do not always reflect how successful hedge funds are. Risk-adjusted measures such as the Sharpe ratio are a good starting point in the process of identifying the best-performing hedge funds. The three tables below display the Nordic hedge funds with the highest Sharpe ratios over the past 12 months, past 24 months and 36 months.

The Month in Review for January 2021 can be downloaded below:

Photo by Glen Carrie on Unsplash