Stockholm (HedgeNordic) – Nordic hedge funds notched their best month on record in November, narrowly beating its previous record of 3.6 percent reached in April this year. Nordic hedge funds, as measured by the Nordic Hedge Index, advanced 3.7 percent last month (91 percent reported) to take the year-to-date performance to 5.7 percent. The industry is on pace to register its strongest yearly performance since 2013.

Month in Review – November 2020

All five strategy categories in the Nordic Hedge Index were in the green for November, with equity funds leading the gains. Nordic equity hedge funds gained 5.0 percent on average last month, enjoying their second-best month on record. The group is up 10.7 percent year-to-date through the end of November. Last month, multi-strategy hedge funds and CTAs advanced 3.7 percent and 3.5 percent, respectively. Fixed-income hedge funds, the second-best performing strategy category this year, were up 1.9 percent on average in November to extend the year-to-date gains to 4.3 percent. Funds of hedge funds, meanwhile, advanced 2.5 percent in November.

At a country level, Norwegian hedge funds gained the most last month, with the group advancing 5.0 percent on average in November to bring the 2020 advance to 8.7 percent. Finnish hedge funds followed suit with an average gain of 4.2 percent last month, which brought the year-to-date performance to 6.6 percent. Danish hedge funds are also up 6.6 percent over the first 11 months of 2020 after returning 3.8 percent on average in November. Swedish hedge funds, which account for the largest portion of the Nordic hedge fund industry with 73 listed funds, were up 3.2 percent on average last month. The Swedish hedge fund industry gained 4.5 percent this year through the end of November.

The dispersion between last month’s best- and worst-performing members of the Nordic Hedge Index increased sharply month-over-month, as the magnitude of gains for top performers significantly surpassed the magnitude of losses for bottom performers. In November, the top 20 percent of Nordic hedge funds advanced 10.8 percent on average, while the bottom 20 percent lost 1.2 percent on average. In October, the top 20 percent were up 1.9 percent on average and the bottom 20 percent lost 3.7 percent on average. About 85 percent of all members of the Nordic Hedge Index with reported November figures posted gains last month.

Top Performers

Sissener Canopus, a Norwegian bottom-up stock-picking fund founded by Jan Petter Sissener, was last month’s best-performing member of the Nordic Hedge Index with a gain of 17.3 percent. Sissener Canopus registered its best month on record to bring the year-to-date performance to 8.1 percent. Danish long/short equity fund Symmetry Invest closely followed suit with an advance of 17.1 percent, which brought the fund’s 2020 performance further into positive territory at 24.4 percent. Managed by founder Andreas Aaen and Henrik Abrahamson, Symmetry Invest has joined the list of top ten best-performing hedge funds in the Nordics in 2020.

Incentive Active Value Fund, a long/short equity fund employing a high-conviction value investing approach, was up about 14.0 percent last month to take its year-to-date performance in positive territory at 9.3 percent. Formuepleje Penta, a multi-strategy fund maintaining long-only portfolios in equities and bonds, and a market-neutral equity portfolio, gained 13.7 percent in November to bring the fund’s 2020 performance in positive territory at 0.8 percent. Visio Allocator, an absolute return fund focused on Northern European equity and bond markets, returned 12.8 percent last month and 15.4 percent in the first 11 months of 2020.

Biggest Positive Surprises

Hedge funds exhibit different risk-return profiles and hence experience different levels of volatility in their returns. With a gain of 17.3 percent for November, Sissener Canopus experienced the biggest surprise last month relative to its historical level of volatility. Its last month’s gain was 5.2 standard deviations above zero. Multi-strategy hedge fund Crescit, which utilizes derivatives primarily on major equity indices and fixed-income investments to generate a good risk-adjusted return with low correlation to equity markets, gained 8.4 percent last month, which was 4.4 standard deviations above zero.

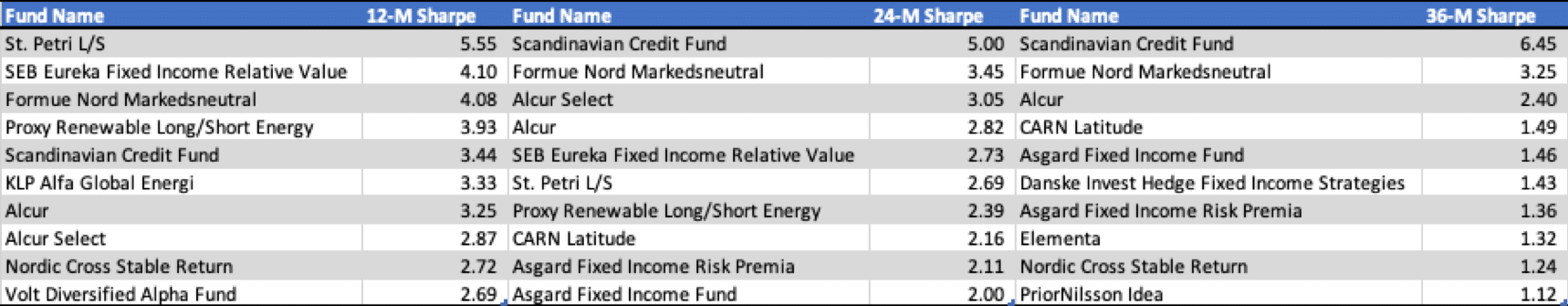

Highest Sharpe Ratios

Given the heterogeneous nature of hedge fund strategies, absolute performance numbers do not always reflect how successful hedge funds are. Risk-adjusted measures such as the Sharpe ratio are a good starting point in the process of identifying the best-performing hedge funds. The three tables below display the Nordic hedge funds with the highest Sharpe ratios over the past 12 months, past 24 months and 36 months.

The Month in Review for November can be downloaded below:

Photo by Kelly Sikkema on Unsplash