By Robert Furdak, Man Group – Let’s conduct a thought experiment. There exists a factor which many people contend causes some stocks to outperform.

Most hedge funds would argue that there is a simple way to exploit this. Buy the stocks positively exposed to the factor, short stocks negatively exposed, and construct the portfolio so that it remains neutral to the movement of the index itself. Indeed, betting on both the long and short side is an intrinsic part of being a hedge fund: this is how we ‘hedge’.

If this decision was taken with reference to traditional factors it would be so passé as to be unworthy of comment. But what if the factor in our experiment above is a company’s environmental, social and governance (‘ESG’) ranking?

For some reason, when it comes to responsible investing, very few investors wish to discuss shorting, happy simply to restrict names which don’t match their values and move on. By failing to short companies which rank poorly on ESG criteria, we implicitly take one of two views: 1) that we are prepared to sacrifice performance for moral rectitude; or 2) we believe firms who have good ESG performance will (vastly) outperform peers, so there is no need to focus on the poorly ranked companies.

SHOULD YOU SHORT IT?

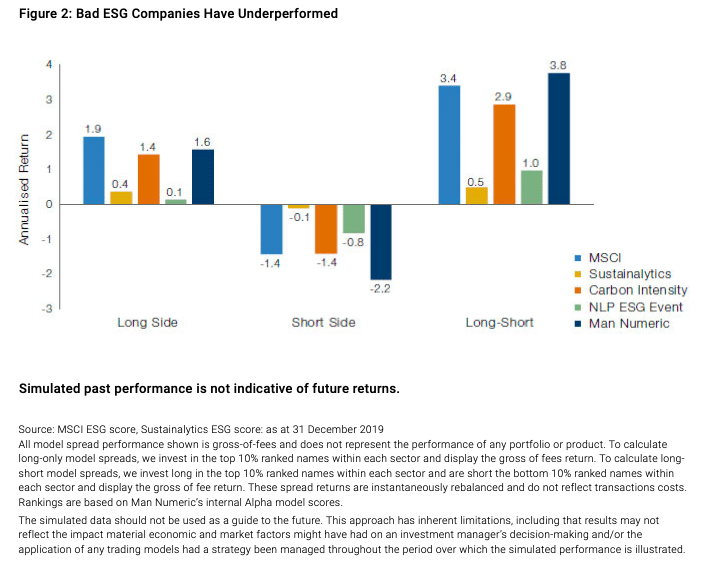

To explore the implications of shorting ‘bad’ ESG companies, we constructed sector-neutral, decile long-short portfolios from a universe of about 4,500 of the most liquid developed market stocks between 1 January, 2013 and 31 December, 2019. Portfolios are formed by longing (shorting) the best (worst) 10% of firms within each sector, selected based on various ESG characteristics. We examined three broad-based strategies, including two commonly used data vendors (MSCI and Sustainalytics ESG rankings) as well as Man Numeric’s proprietary ESG model. Man Numeric’s proprietary ESG model is based on 15 fundamental ESG pillars, which are sector neutral and neutral to common factors. We also evaluate performance from the long (short), high (low) carbon efficiency level data from Trucost and an event-driven strategy built by shorting firms associated with negative ESG news using natural language processing (‘NLP’) techniques – something we have previously covered in our paper “Natural Language Processing: Shakespeare Without the Monkeys”.

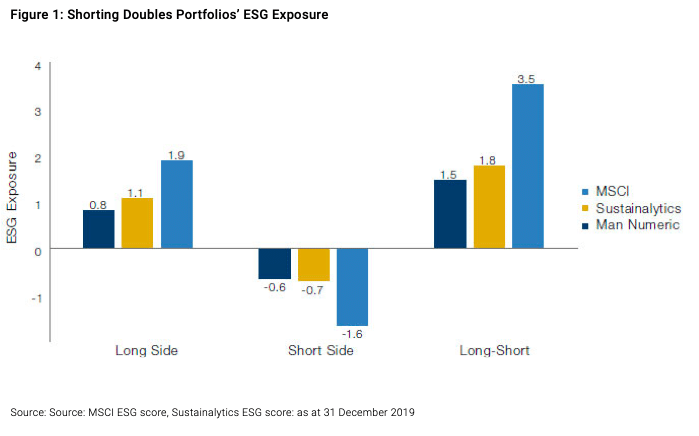

By shorting, one can almost double a portfolio’s overall exposures to ESG factors (Figure 1). The sector-neutral decile return (Figure 2) shows that firms with poor ESG performance underperform in the market. Moreover, our analysis indicates that returns were about equal from both the long side and short side of all broad-based ESG strategies, including MSCI, Sustainalytics and Numeric models, as well as the carbon-efficient strategy. NLP news-driven strategies have a stronger return form the short side than the long side.

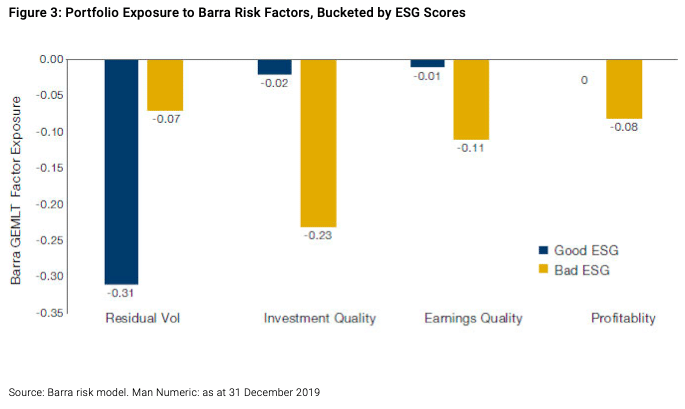

Shorting poor ESG firms can offer other added benefits. Analysing the Barra factor exposures of the long and short sides of the portfolios (ranked on Man Numeric proprietary ESG scores) illustrated that betting against bad companies greatly reduces portfolios’ risk and lowers the drawdown. As shown in Figure 3, we found that while both groups had lower residual volatility than the overall universe, the stocks with good ESG scores had much less residual volatility exposure. Moreover, poorly ranked ESG firms had much lower investment quality, lower earnings quality, and lower profitability.

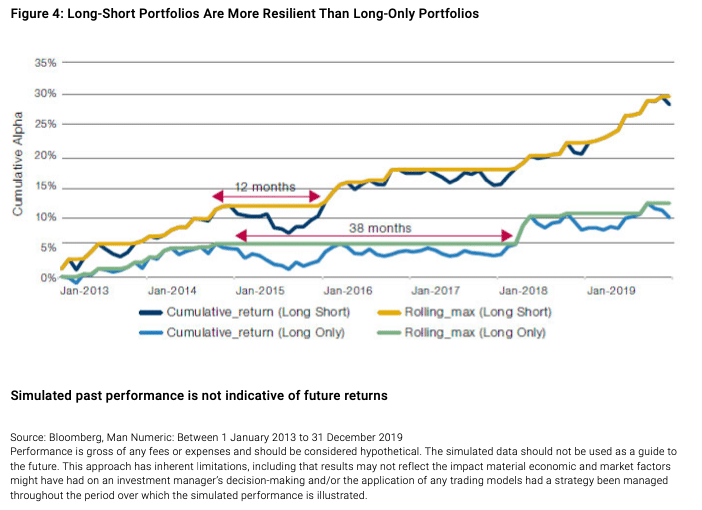

We further compared the drawdown patterns of the long-short portfolio and long-only portfolio. Figure 4 shows the cumulative returns from 2013 to 2019 for both portfolios. First, we found that the long-short portfolio realised more than double the cumulative return compared with the long-only portfolio at the end of 2019. From 2015 to 2016, both portfolios experienced drawdowns, with the maximum peak-to-trough decline of 4.3% for the long-short portfolio, while the long-only portfolio had a 4.1% drawdown. Though the long-only portfolio had a slightly lower absolute drawdown, it took more than three years to exceed the prior peak level, while it only took a long-short portfolio 12 months to recover the loss.

In our simulations, shorting poor ESG companies allowed portfolios to achieve a higher exposure to ESG signals and realise higher returns, lowering overall risk exposure and drawdown. Thus, it is natural to ask: why not profit from both good and bad companies, especially if those companies are unfriendly to the environment, employees or shareholders?

Furthermore, it allows portfolios to properly capture the value of a growing risk: the risk that companies fail to deal with the transition to more responsible models of operating, overstating the value of potentially stranded assets and failing to account correctly for the ESG risks to which their businesses are exposed.

More importantly, however, going short marks the evolution of responsible investment from a more passive approach (that just excludes stocks based on a categorical restriction list) to a more active approach that uses all available information to fully reflect their views in their positioning.

CONCLUSION

We recognise that some investors operate under constraints which could make shorting or even holding poorly ranked ESG stocks inappropriate. However, for those who are not constrained, it seems illogical not to harvest the full spectrum of available ESG information. Indeed, maximising performance is a fiduciary duty for investors. If that can be done while taking responsible investment one (short) step further, why not do it?

Man Group is a proud signatory to the United Nations-supported Principles for Responsible Investment (‘PRI’) and we have long recognized how responsible investing is fundamental to the firm’s fiduciary duty. Follow the link for more information on Man Group’s Responsible Investment (‘RI’) fund framework, policies, stewardship and latest responsible investment insights:

https://www.man.com/responsible-investment

Important Information

This information is communicated and/or distributed by the relevant Man entity identified below (collectively the “Company”) subject to the following conditions and restriction in their respective jurisdictions.

Opinions expressed are those of the author and may not be shared by all personnel of Man Group plc (‘Man’). These opinions are subject to change without notice, are for information purposes only and do not constitute an offer or invitation to make an investment in any financial instrument or in any product to which the Company and/or its affiliates provides investment advisory or any other financial services. Any organisations, financial instrument or products described in this material are mentioned for reference purposes only which should not be considered a recommendation for their purchase or sale. Neither the Company nor the authors shall be liable to any person for any action taken on the basis of the information provided. Some statements contained in this material concerning goals, strategies, outlook or other non-historical matters may be forward-looking statements and are based on current indicators and expectations. These forward-looking statements speak only as of the date on which they are made, and the Company undertakes no obligation to update or revise any forward-looking statements. These forward-looking statements are subject to risks and uncertainties that may cause actual results to differ materially from those contained in the statements. The Company and/or its affiliates may or may not have a position in any financial instrument mentioned and may or may not be actively trading in any such securities. This material is proprietary information of the Company and its affiliates and may not be reproduced or otherwise disseminated in whole or in part without prior written consent from the Company. The Company believes the content to be accurate. However, accuracy is not warranted or guaranteed. The Company does not assume any liability in the case of incorrectly reported or incomplete information. Unless stated otherwise all information is provided by the Company. Past performance is not indicative of future results.

Unless stated otherwise this information is communicated by Man Solutions Limited which is authorised and regulated in the UK by the Financial Conduct Authority. [In the United States this material is presented by Man Investments Inc. (‘Man Investments’). Man Investments is registered as a broker-dealer with the US Securities and Exchange Commission (‘SEC’) and is a member of the Financial Industry Regulatory Authority (‘FINRA’). Man Investments is also a member of Securities Investor Protection Corporation (‘SIPC’). Man Investments is a wholly owned subsidiary of Man Group plc. (‘Man Group’). The registrations and memberships in no way imply that the SEC, FINRA or SIPC have endorsed Man Investments. In the US, Man Investments can be contacted at 452 Fifth Avenue, 27th floor, New York, NY 10018, Telephone: (212) 649-6600.] Ref: 20/1613/D/GL/R/W