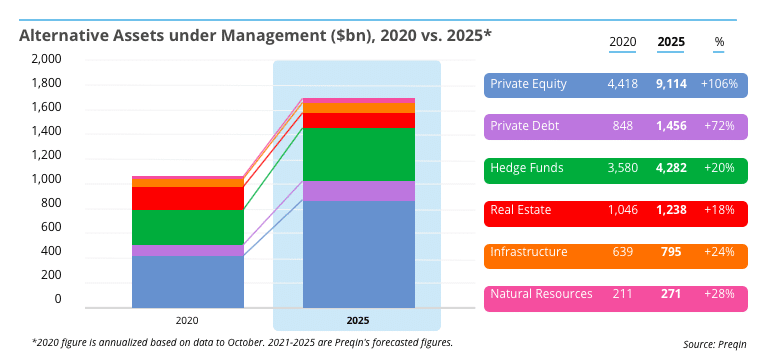

Stockholm (HedgeNordic) – Previously accounting for only a small portion of institutional investors’ portfolios, alternative investments have evolved into a core allocation choice for most, if not all, institutional investors. Preqin anticipates the alternatives space to manage a larger pool of assets in five years, with capital flowing to almost all alternative asset classes. Preqin also expects hedge funds to hold onto their position as the second-largest alternative asset class in 2025, even if the industry is expected to experience the slowest growth in assets under management of all asset classes.

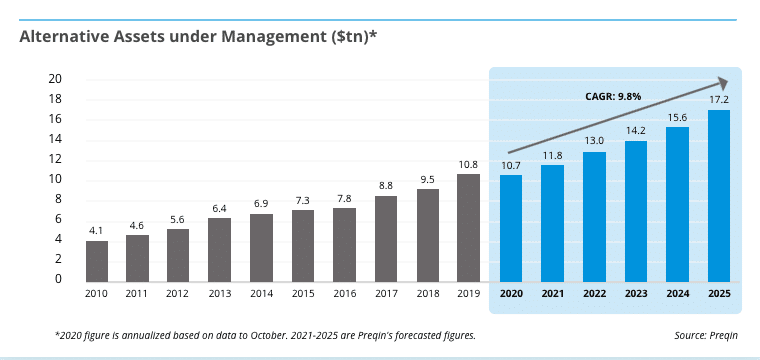

“By virtually any measure, the alternative investment industry is well into its growth phase but, with less than 20% of the global assets under management (AUM) pie, there is still a lot of runway before maturity sets in,” says Bill Kelly (pictured), the CEO of the CAIA Association, in connection with Preqin’s Future of Alternatives 2025 survey. Preqin anticipates alternative assets under management to top $17 trillion in 2025 from just under $11 trillion at the end of 2019, translating into an average growth rate of 9.8 percent per year to 2025. “Persistently low interest rates will attract investors of all types drawn to the promise of outperformance, diversification, and lower correlation with public markets,” writes Preqin.

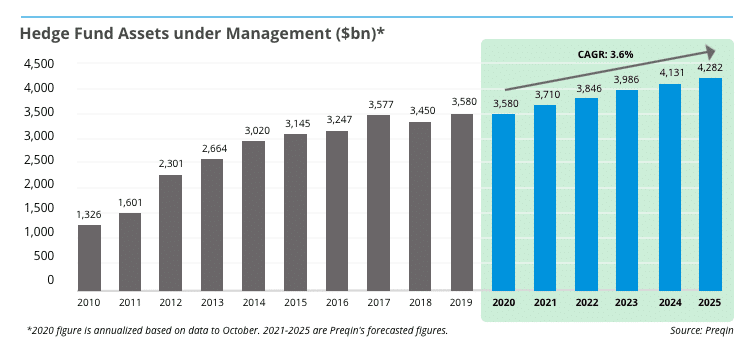

The growth in the hedge fund industry’s assets under management will be the lowest of all asset classes, according to Preqin. Preqin expects the industry’s asset base to reach $4.28 trillion in 2025 from $3.58 trillion at the end of 2019, which translates into an annualized growth rate of 3.6 percent. Nonetheless, “we expect hedge funds to hold onto their position as the second-largest alternative asset class in 2025,” writes Julian Falcioni, a senior research associate at Preqin. “We predict that hedge funds will lose out to passive exchange-traded funds (ETFs), smart beta, and other liquid alternatives that offer risk-adjusted returns at a lower cost,” says Falcioni. “We expect AUM to be boosted by performance, with hedge fund returns beating the AUM growth rate over the next five years.”

Preqin also expects hedge funds to continue to perform well in a more volatile environment over the next five years. “Hedge funds have the potential to shine in a period with higher-than-average volatility, which has so far defined 2020,” writes Julian Falcioni. “The next five years look likely to pose more economic and financial market risks than the past decade. The COVID-19 crisis has necessitated changes that will increase market volatility for years, such as increased debt loads of companies, central banks, and countries, while political risks also lie ahead as countries rethink trade policy and secularization.” According to Falcioni, “hedge funds can exploit the resulting volatility for gain.”

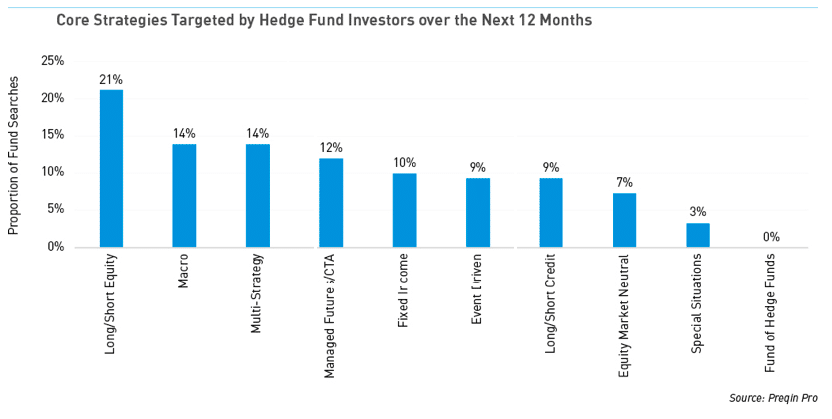

Equity and macro strategies are likely to remain the largest strategies in terms of assets under management within the hedge fund space, according to Preqin. Long/short equity and macro funds collectively make up over a third of core strategies targeted by investors in the next 12 months, according to a survey by Preqin. Funds of hedge funds, on the other hand, are receiving little interest from investors.