Stockholm (HedgeNordic) – The Nordic hedge fund industry enjoyed its fifth consecutive positive month with an advance of 1.6 percent in August (95 percent reported). Last month’s gain brings the industry’s year-to-date performance further into positive territory at 2.5 percent.

Four of the five strategy categories in the Nordic Hedge Index enjoyed gains for the month of August. Nordic equity hedge funds, which enjoyed their best summer on record, led the gains last month with an average return of 2.5 percent. Following a three-month advance of 6.2 percent, equity hedge funds are now up 5.1 percent for the year. Fixed-income and multi-strategy hedge funds were up 1.5 percent last month, while funds of hedge funds gained 0.7 percent on average. Following a three percent gain in July, the pool of Nordic CTAs edged down by 0.2 percent in August.

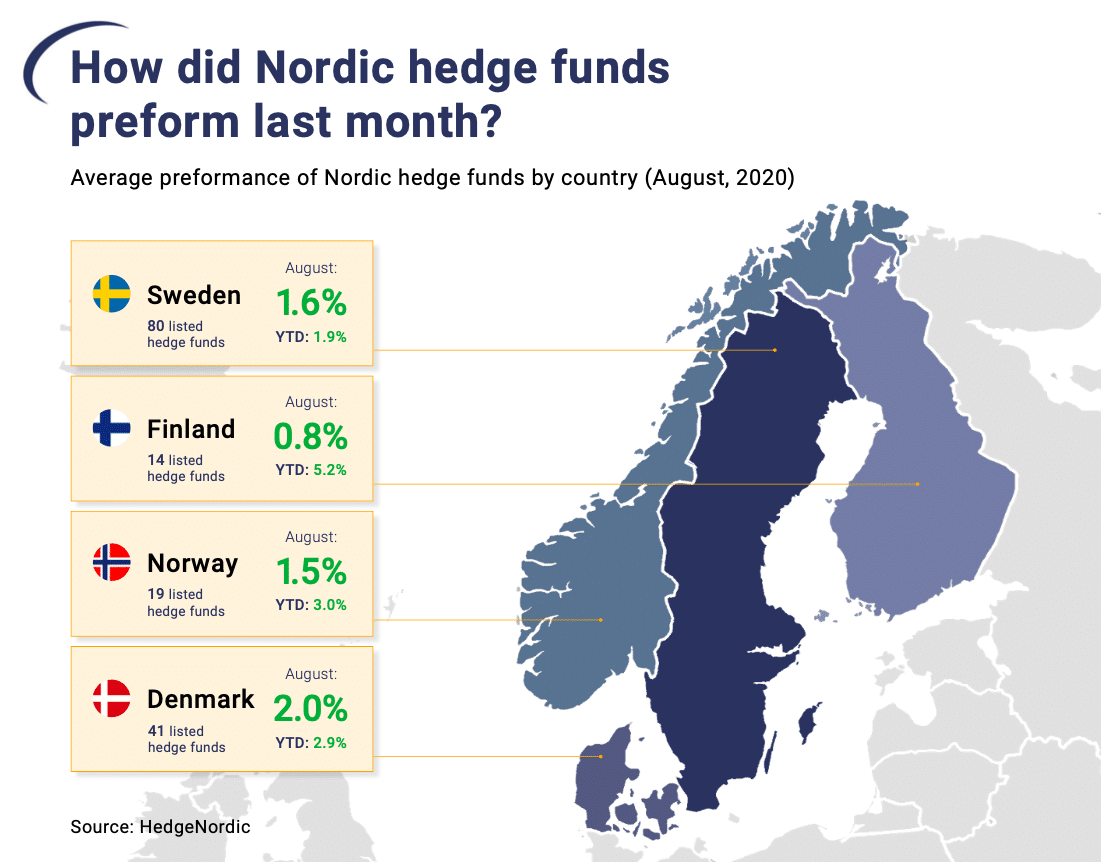

At a country level, the Danish hedge fund industry gained 2.0 percent last month, with 38 of the 41 Danish hedge funds posting gains for the month. Swedish hedge funds, which account for the largest portion of the Nordic hedge fund industry with 80 listed funds, advanced 1.6 percent on average in August to bring their year-to-date performance to 1.9 percent. The Finnish hedge fund industry’s August advance of 0.8 percent brought the industry’s year-to-date performance to 5.2 percent. Norwegian hedge funds, meanwhile, were up 1.5 percent last month, taking their 2020 performance to 3.0 percent.

The dispersion between last month’s best- and worst-performing members of the Nordic Hedge Index decreased slightly month-over-month. In August, the top 20 percent of Nordic hedge funds advanced 5.3 percent on average, while the bottom 20 percent lost 0.9 percent on average. In July, the top 20 percent were up 5.5 percent on average and the bottom 20 percent lost 1.2 percent on average. About 85 percent of the members of the Nordic Hedge Index with reported August figures posted gains last month.

Top Performers

Equity hedge funds dominated last month’s list of top performers in the Nordic Hedge Index. Activist investor Accendo led the way among the members of the Nordic Hedge Index with a monthly gain of 12.6 percent. Accendo is now up 43.5 percent for the year through the end of August, being one of the four Nordic hedge funds with year-to-date returns above 40 percent. Danish long/short equity fund Symmetry Invest gained 9.0 percent in August, bringing the fund’s year-to-date performance back into positive territory at 4.6 percent.

Small-cap-focused long/short equity fund Alcur Select, one of the four funds with year-to-date gains above 40 percent, advanced 8.0 percent last month. Thematic-focused long/short equity fund St. Petri L/S returned 7.5 percent last month to take its year-to-date advance to 47.1 percent. Finnish multi-asset vehicle Visio Allocator rounded up the top five list of best performers with a monthly gain of 7.1 percent, which brought the fund’s 2020 performance further into positive territory at 8.6 percent.

Biggest Positive Surprises

Hedge funds exhibit different risk-return profiles and hence experience different levels of volatility in their returns. Low-risk, low-volatility strategies tend to deliver relatively lower returns than more volatile strategies over time, so HedgeNordic computed a ranking displaying the funds with the highest August return per unit of volatility. Paradigm-focused long/short equity fund Adaptive Paradigm Alpha, for instance, gained 2.2 percent in August, which is 3.6 standard deviations above zero. Crescit’s 5.3 percent-gain for August, meanwhile, was 3.1 standard deviations above zero.

The Month in Review for August can be downloaded below:

Photo by Debby Hudson on Unsplash