Stockholm (HedgeNordic) – A little more than four years ago, HedgeNordic introduced a new award category at the Nordic Hedge Award: the Rookie of the Year.

Before delving into how the winners of the Rookie of the Year award fared over time, let’s share a little bit of information about the selection process for this award category. The best Rookies are determined by the combined scoring of a jury board of fellow Nordic hedge fund managers. The jury selects the most promising hedge fund debut of the passing year by considering a host of qualitative assessments at the discretion of jury members. The jury is asked to consider things such as:

- Which of the qualifying funds would I, personally or for the fund portfolio/selection I am responsible for, be most comfortable investing in, despite its short track record and likely small size?

- Which of the funds is likely and positioned to build a respectable and outstanding, long-lasting and robust track record?

- Which of the funds is likely to have a meaningful impact on the Nordic hedge fund universe (potential to be “star manager”, sizeable assets)?

- Which of the funds is positioned to be a “billion Dollar Fund” (if that is even desired or the intention, within the capacity of the strategy)?

The previous winners of this category to the Nordic Hedge Award were:

| Year | Fund | Management Company | Portfolio Manager |

|---|---|---|---|

| 2023 | Norselab Meaningful Impact High Yield | Norselab Credit Management | Tom Hestnes and Ole Einar Stokstad |

| 2022 | Protean Select | Protean Funds Scandinavia | Pontus Dackmo and Carl Gustafsson |

| 2021 | Borea Utbytte | Borea Asset Management | Magnus Vie Sundal |

| 2020 | Frost | Frost Asset Management | Martin Larsén and Anders Augusén |

| 2019 | HP Hedge Fixed Income | HP Fondsmæglerselskab | Henrik Fournais |

| 2018 | SEB Eureka Fixed Income Relative Value | SEB | Bo Michael Andersen |

| 2017 | Asgard Credit Fund | Momas Advisors | Daniel Vesterbaek Pedersen |

| 2016 | Scandinavian Credit Fund I | Skandinaviska Kreditfonden AB | Fredrik Sjöstrand |

| 2015 | Elementa | Elementa Management AB | Marcus Wahlberg |

More info and background on the “Nordic Hedge Fund Rookie of the Year” can be found here: Rookie

In April 2020, at this year’s edition of the Nordic Hedge Award, HedgeNordic announced the fifth winner of this award. Time to look at how the Rookies fared over time and whether the Rookie of the Year award serves as an indicator of future success.

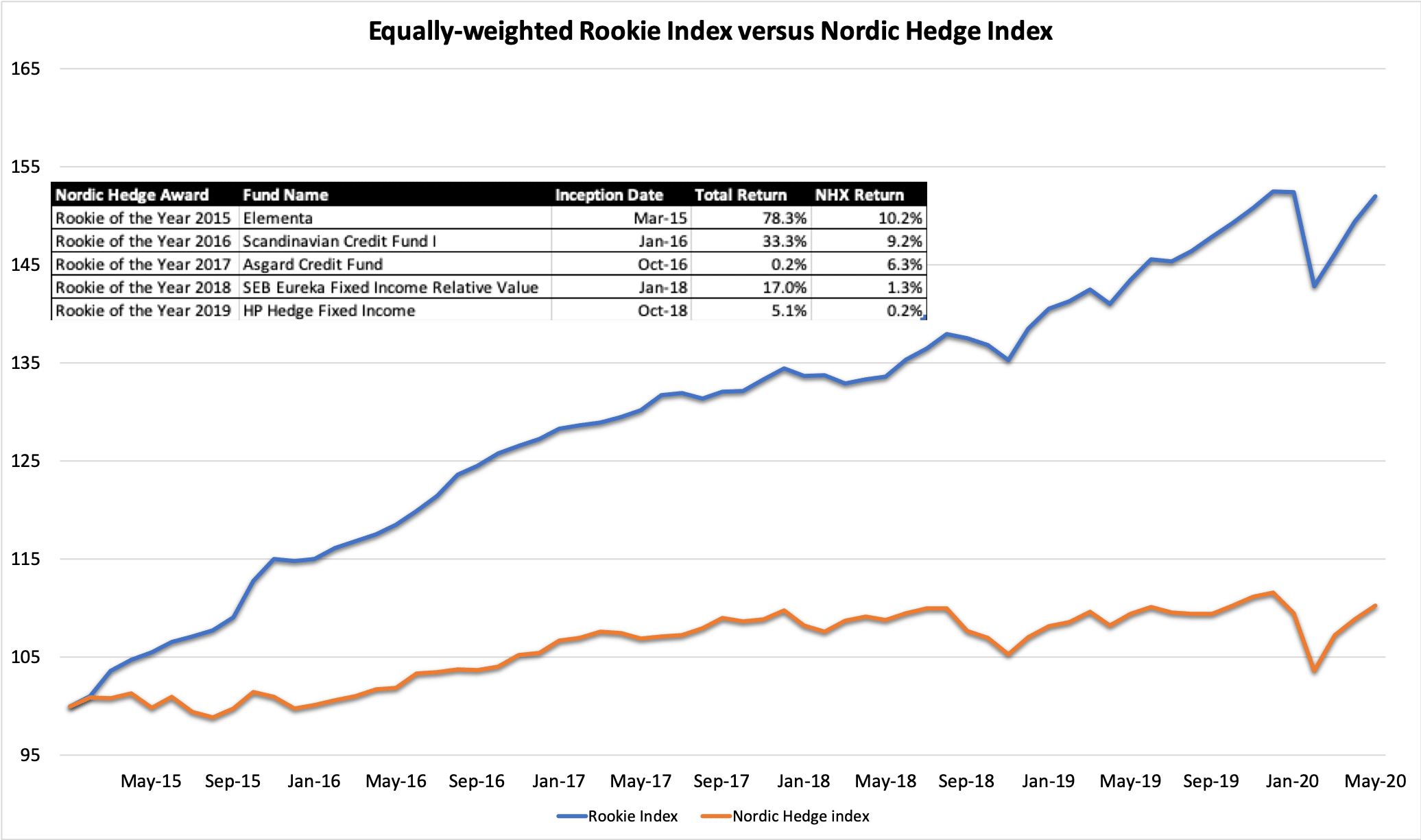

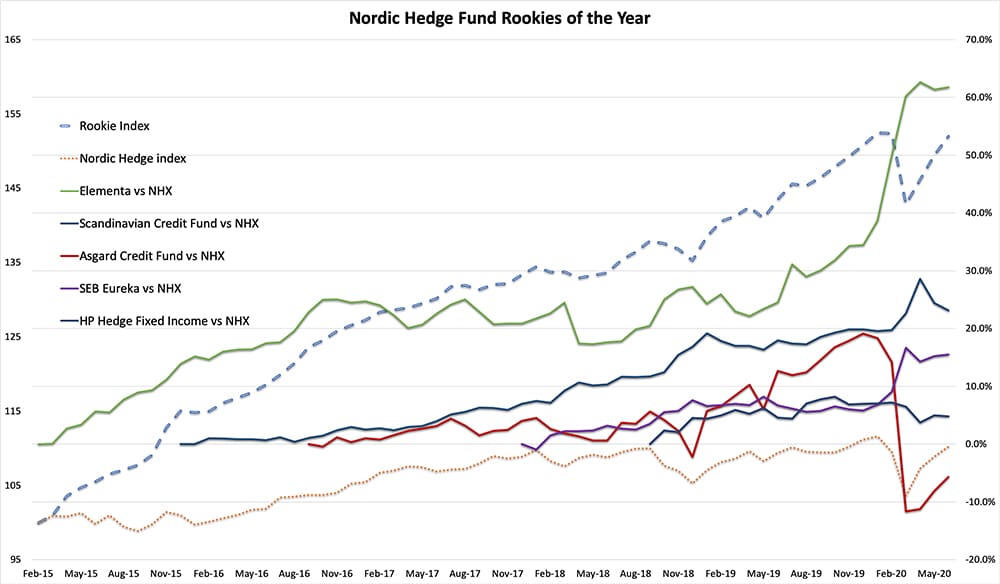

The chart below compares an equally-weighted index comprised of the five winners of the Rookie of the Year award with the broader Nordic Hedge Index (NHX). The inception date of the Rookie Index is the inception date of Elementa, the first winner of the Rookie of the Year award. The table in the chart displays the total cumulative returns generated by all the Rookies since their respective inception dates through the end of June 2020.

What is evident on first sight is the outperformance the Rookie Index displays versus the entire Nordic hedge fund universe, averaging around 170 funds over the last years. All funds indeed performed very well, certainly until Asgard Credit Fund was adversely impacted by the COVID-19-related sell-off and liquidity scares in March earlier this year. Scandinavian Credit Fund I, too was impacted during this period. With redemption requests amounting to about one-fifth of its portfolio, the fund imposed redemption “gates” to deal with the mismatch between the illiquidity of its investments and the sudden liquidity preference of investors.

Based on the reported performance of previous winners of the Rookie of the Year award, there are two immediate observations. First, the winners of the Rookie of the Year award are, indeed, promising hedge fund launches. Second, the peer group jury assembled to select the the Rookie of the Year has demonstrated a good hand over the years in identifying promising hedge fund launches.

Stockholm-based long/short equity fund Elementa, the first winner of the Rookie of the Year award, is a case in point. Of the ten candidates for the first Rookie of the Year award, only two are still up and running: Elementa and Incentive Active Value Fund. Launched and managed by Marcus Wahlberg, Elementa generated a cumulative return of 90.5 percent net of fees since its inception in March 2015 and achieved an inception-to-date Sharpe ratio of 1.9. This cumulative return figure corresponds to an annualized return of 12.6 percent since inception.

The second winner of the Rookie of the Year award, Scandinavian Credit Fund I generated an annualized return of 6.6 percent since its launch at the beginning of 2016, enjoying a Sharpe ratio of 6.9 since inception. Asgard Credit Fund, the winner of the 2017 Rookie of the Year award, performed exceptionally well until the COVID-19-induced sell-off triggered a 27 percent-loss in March 2020 from which it is gradually recovering.

SEB Eureka Fixed Income Relative Value, the winner of the fourth Rookie of the Year award, has been meeting or exceeding its return target – in the range of four to eight percent per year – each year since inception. After two years of rubbing elbows with the lower-end of the target, the fund managed by a team of three out of SEB’s Copenhagen office is up 10.6 percent year-to-date through the end of July. SEB Eureka Fixed Income Relative Value delivered an annualized return of 7.1 percent since inception and achieved an inception-to-date Sharpe ratio of 2.7.

HP Hedge Fixed Income, the latest winner of the Rookie of the Year award, is keeping up the standards. Launched in October 2018, the Copenhagen-based hedge fund delivered a cumulative return of 6.3 percent since inception, so far faring much better than the historically strong-performing flagship hedge fund managed by the team at HP Fonds.

The 2019 Nordic Hedge Award was held with the kind support of these fine companies: