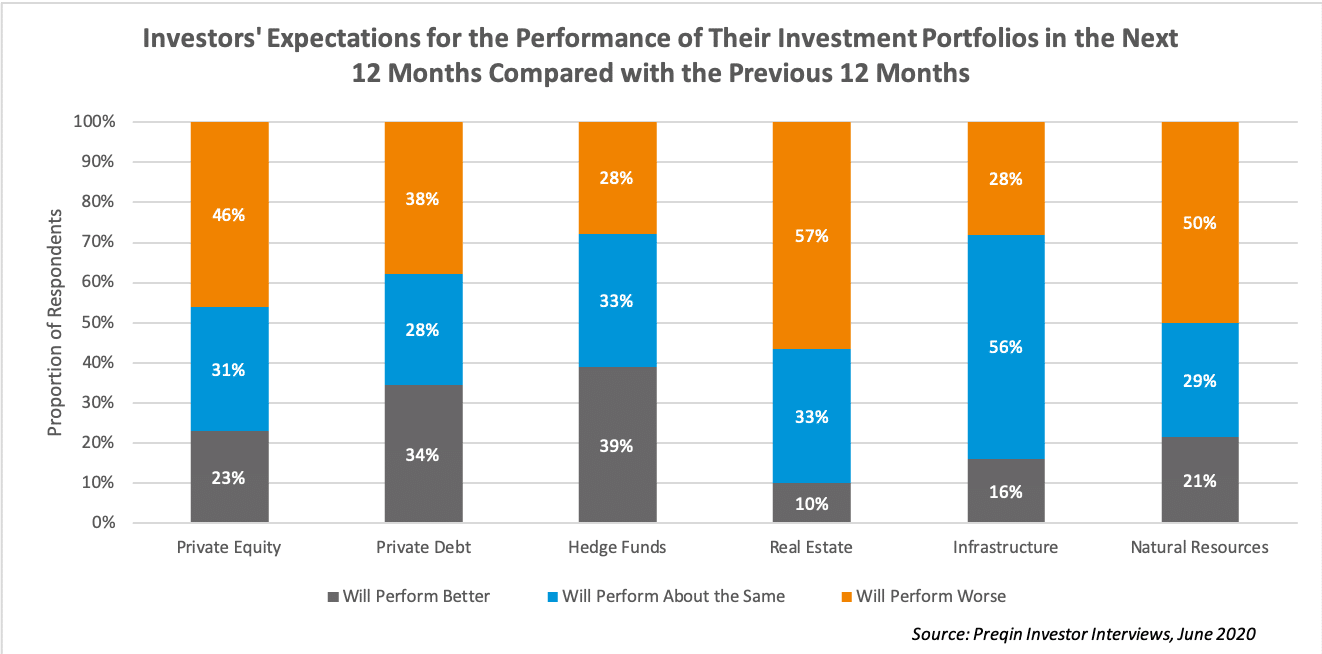

Stockholm (HedgeNordic) – Hedge funds have the most positive prospects among alternative investments, according to Preqin’s June investor survey, “though this should be seen in the context of the industry’s disappointing performance over the past 12 months.” About 39 percent of investors surveyed by Preqin expect their hedge fund portfolios to perform better in the next 12 months compared with the previous 12 months and 44 percent expect to increase commitments to hedge funds over the next year.

“Investors believe the most positive prospects are in hedge funds, where 39% expect performance over the next 12 months to improve, though this should be seen in the context of the industry’s disappointing performance over the past 12 months.”

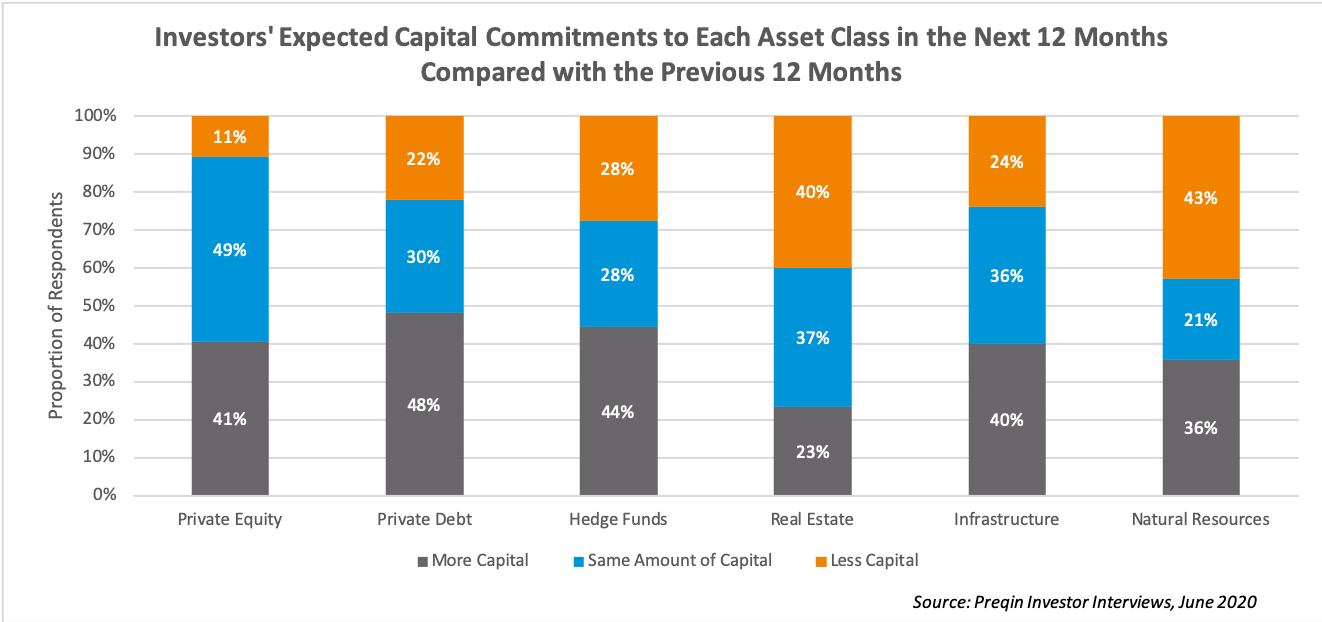

“Volatile markets have increased appetite for hedge funds,” writes Preqin in its mid-year investor update on alternative assets. A substantial portion (44 percent) of surveyed investors expect to increase their commitments to hedge funds in the next 12 months and a further 28 percent plan to commit the same amount of capital, outweighing the 28 percent of investors intending to trim their hedge fund allocations. Among other alternative asset classes, only private debt is enjoying higher investor appetite, with 48 percent of surveyed investors intending to raise their commitments to this asset class.

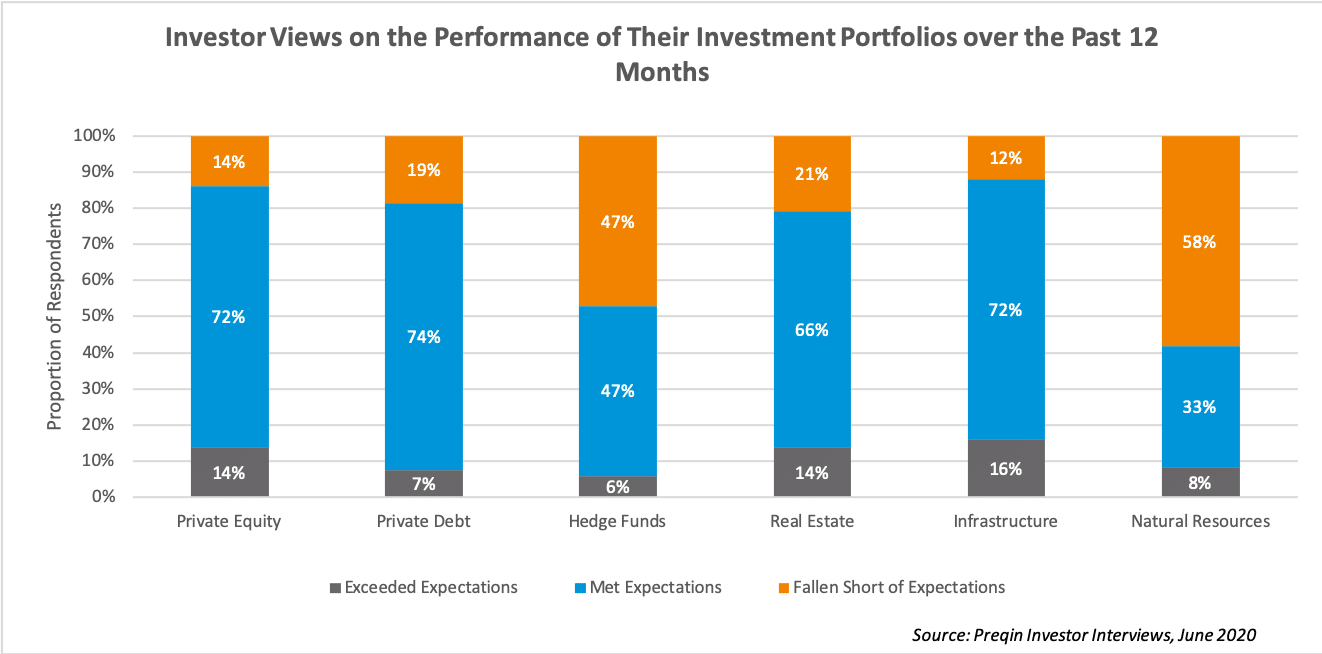

While a significant majority of investors in private equity (86 percent), private debt (81 percent), real estate (80 percent) and infrastructure (88 percent) indicated that returns had either met or exceeded expectations in the past 12 months, the proportion of hedge fund investors saying returns had met expectations was equal to those describing performance as below expectations. About 47 percent of surveyed investors reported that their hedge fund portfolios had performed worse than expected and just six percent indicated that returns exceeded expectations.

Despite being disappointed with hedge fund returns, investors were more optimistic about the hedge fund industry than any other alternative asset class. According to Preqin, 39 percent of surveyed investors predicted that hedge funds would perform better over the next 12 months, compared to 28 percent who expect hedge funds to perform worse over the next year. In contrast, about 47 percent of surveyed investors expect private equity funds to perform worse over the next 12 months and 57 percent expect real estate to underperform over the next year compared to the previous 12 months.

Photo by Marco Bianchetti on Unsplash