Stockholm (HedgeNordic) – Sovereign wealth funds currently allocate 24 percent of their assets to alternative investments, with allocations continuing “a five-year-long upward march,” according to Invesco’s Global Sovereign Asset Management Study. Private equity and real estate continue to be the most significant allocations in the alternatives space, but the allocations to infrastructure and hedge funds registered the largest year-over-year increases.

Invesco’s eighth annual study of sovereign investors covers 139 institutions, including interviews with chief investment officers, portfolio strategists and heads of asset classes at 83 sovereign funds and 56 central banks. This pool of investors oversees a combined $19 trillion in assets under management as of March this year.

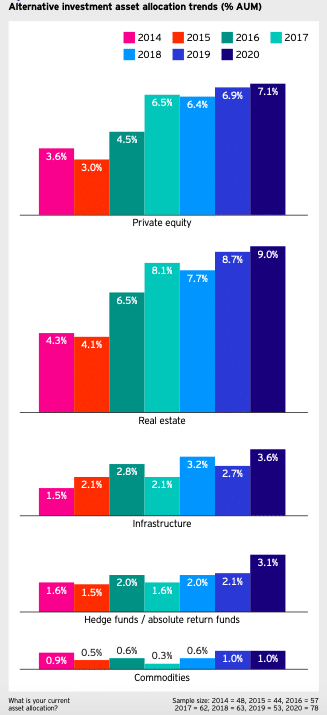

Within alternative allocations, real estate and private equity were the largest allocations among sovereign investors at the end of 2019, accounting for 9.0 percent and 7.1 percent of assets under management, respectively. The asset allocation to hedge funds and absolute return funds increased to 3.1 percent from 2.1 percent last year and 2.0 percent in 2018. The allocation to infrastructure, meanwhile, rose to 3.6 percent at the end of 2019 from 2.7 percent a year earlier.

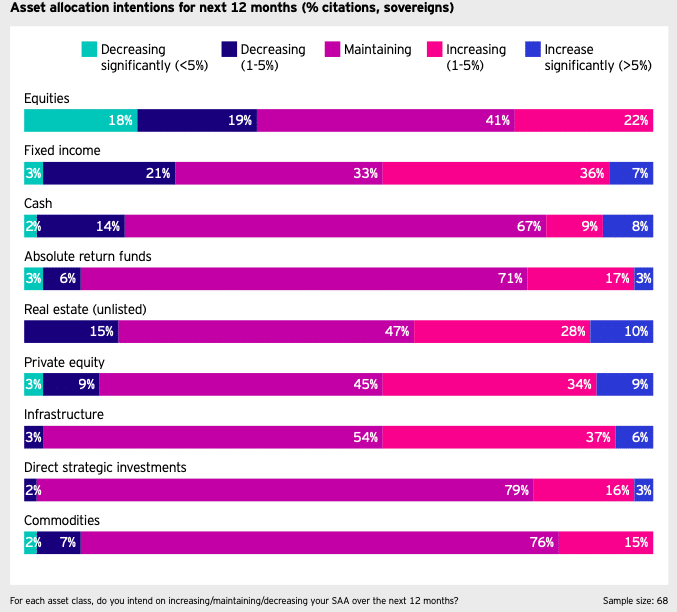

According to Invesco, sovereigns cited plans to increase allocations to illiquid alternatives over the next 12 months, with about 43 percent planning to increase allocations to both private equity and infrastructure, and 38 percent planning to increase allocations to real estate. About 20 percent of sovereign investors indicated plans to raise allocations to absolute return funds, with approximately 71 percent of investors indicating plans to maintain their allocations to this asset class over the subsequent 12 months.

The coronavirus pandemic has affected assets across the investment spectrum, with the infrastructure sector being tested as never before. According to Invesco, “valuations in infrastructure have long been considered ‘full’ due to the supply of capital chasing relatively few deals. However, sovereigns saw the current situation as an opportunity to take advantage of selling in sub-sectors that have exposure to economic growth and could be available at attractive valuations for the first time in years.”

The socio-economic consequences of the pandemic, therefore, can provide institutional investors with more attractive opportunities to increase their allocations to infrastructure. “Many investors have considered infrastructure investments expensive because there is a lot of competition for good assets,” Rod Ringrow, head of official institutions at Invesco, told IPE. “But some see the current situation as creating potential distressed assets,” he added. “For example, airports are looking for capital injections on favourable terms to investors taking a long-term view,” Ringrow told IPE.

According to Invesco’s Global Sovereign Asset Management Study, “a similar sense of opportunism was evident in discussions related to real estate, with sovereigns expecting significant opportunities to emerge over the next year in areas such as travel and leisure.” The Invesco report goes on to say that “these sectors, at the epicentre of the current crisis, were seen as eventually returning to their previously strong upwards trajectory in line with the expansion of the middle classes in emerging economies and the rising discretionary spending on ‘experiences’ in developed economies.”