Stockholm (HedgeNordic) – The coronavirus crisis has made life increasingly more difficult for managers seeking to launch hedge funds. “The second quarter of 2020 proved a challenging time to launch new hedge funds,” writes Preqin. Only 59 new hedge funds were launched in the second quarter, down from 182 in the first quarter of the year and 228 in the second quarter of last year.

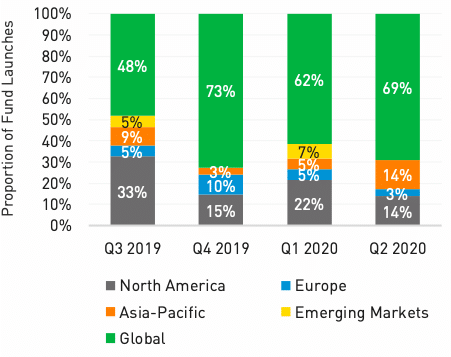

“In this uncertain economic climate, managers look to be diversifying their investment focus,” Preqin writes in its quarterly update on the hedge fund industry for the second quarter. Over two-thirds of all hedge funds launched in the second quarter were global-focused vehicles, one of the largest proportions over the past four quarters. Funds focused on North America accounted for 14 percent of all launches, down from 22 percent in the first quarter of the year. The proportion of Asia-Pacific-focused fund launches increased from five percent in the first quarter to 14 percent in the second quarter.

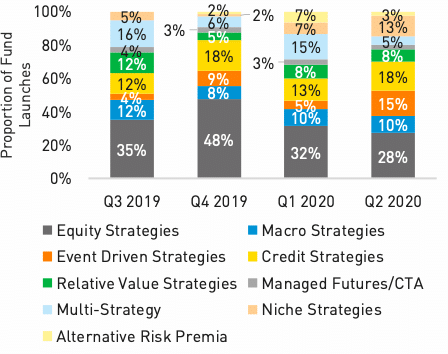

The challenges stemming from the coronavirus pandemic have also affected the universe of strategies employed by new launches. The proportion of new funds employing equity strategies decreased over the first two quarters of 2020, accounting for just 28 percent of all launches in the second quarter, down from 32 percent in the first quarter and 48 percent in the last quarter of 2019.

In contrast, the proportion of launches that focus on opportunities arising from distressed and recapitalizations has increased “as more companies face difficulties.” In the second quarter, new launches employing event-driven strategies accounted for 15 percent of all new launches, up from five percent in the previous quarter. The share of launches using credit strategies, meanwhile, increased from 13 percent of all launches in the first quarter to 18 percent in the second quarter.

More cryptocurrency-focused funds are entering the global hedge fund industry, according to Preqin. “While the overall number of launches declined significantly, the steady stream of cryptocurrency funds entering the market drove up niche strategies to 13 percent of all funds launched in Q2 2020,” writes Preqin.

Photo by Mark Williams on Unsplash