Partner Content (Wellington) –

What is happening in private equity markets?

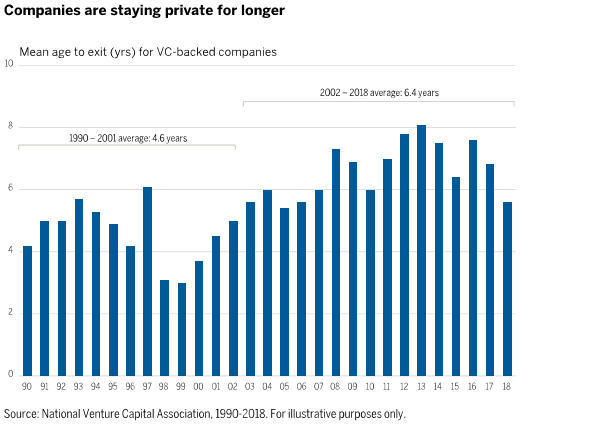

We’ve noticed that young, growing privately held companies are delaying their initial public offerings (IPOs) and staying private longer. We believe this is due to increased regulation, structural changes in public markets and a strategic decision to mature further before going public. For example, the average age at IPO for companies backed by venture capital (VC) funding increased from 4.6 years between 1990 and 2001 to 6.4 years between 2002 and 2018 (see Figure 1). As a result, companies are now often more mature when they go public.

Figure 1

For investors, this has created a significant shift in value creation from public markets to private markets over the last 10 years. For example, let’s compare the value of Google’s IPO in August 2004 with Slack’s IPO in April 2019. Google’s final private market valuation was around US$100 million and it is now trading at a public market valuation of well over US$850 billion. Slack was valued at US$6.8 billion before its IPO and is now trading at around US$13 billion. Google went public at a relatively early stage six years after founding, with most of its value creation captured by public market investors, while Slack stayed private significantly longer (10 years), with much more of its value creation coming while it remained privately held.1

Late-stage private equity, as an asset class, can help capture this missed value creation for investors.

Does this create an investment opportunity?

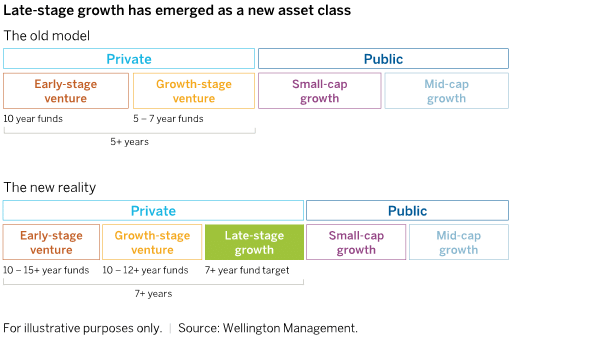

We believe so. In fact, it appears that late-stage growth firms have emerged as a new asset class with several potential advantages (Figure 2). Late-stage companies typically trade at lower valuations than their publicly traded peers, due to their inherent risk. Investors with the appropriate experience and skill may be able to identify companies that are attractively valued, have high return potential and are at the lower end of the risk spectrum.

Additionally, investors may be able to capture a larger portion of companies’ growth potential by investing before an IPO or other liquidity event. Finally, they may be able to provide these companies with the opportunity to accelerate their growth before a liquidity event.

When we add all this up, we see late-stage growth companies as a potential sweet spot in today’s market.

Figure 2

How large is the opportunity?

The late-stage growth opportunity set is bigger than we first expected. The ecosystem continues to grow, with increased investor interest as a greater number of companies choose to stay private for longer.

The entry of new capital providers, such as earlier-stage venture capital firms, has allowed high-potential companies to be more selective in who they work with. We’ve seen that they prefer to partner with value-additive, patient capital partners which give management teams autonomy on business operations. We believe this combination of factors is positive for investing in this emerging asset class.

Are there any downsides?

All investing involves taking some risk. We think investments in late-stage pre-IPO companies could perform well in a market environment where growth companies are recognised and rewarded for their growing businesses, often in the form of a successful IPO or being bought by a competitor. That said, a market retrenchment or a broad risk-off event may cause these companies to experience a delay in liquidity events. A recessionary environment would also be challenging, because there could be a confluence of poor fundamentals and a weak IPO market. Of course, these environments would have a similar or potentially more negative impact on equity markets broadly.

Such an environment could, however, be perfect for deploying capital, as investment opportunities in late-stage private equity would be accessed at more attractive valuations.

How should we respond?

We believe the emergence of these trends can offer opportunities for private equity investors to invest in late-stage companies at attractive valuations.

- Consider public and private allocations holistically, to be sure that value creation within markets is being fully accessed. For example, late-stage growth is now infringing on the space occupied by publicly listed small-cap companies, which is starting to blur the lines from an asset return perspective between public and private markets.

- Take a fresh look at how and where you are accessing growth across your portfolio. The corporate landscape has changed significantly from five or 10 years ago, so it is important to consider whether you may be missing out on the fastest-growth phase of companies’ life cycle.

- Evaluate your liquidity and cash-flow needs. How far will the realisation of any existing private investments line up with your future spending needs? For example, traditional venture capital funds may require extended time frames to pay off. In our view, late-stage growth can typically return capital faster (less than seven years) than traditional venture capital or private equity (more than 10 years). For many investors, this may create a painful liability mismatch.

For more information visit: www.wellingtonfunds.com/alternatives

1 Last private market valuation as defined by the company’s pre-money valuation at IPO | For illustrative purposes only. Companies were selected as an example of some of the largest and best-known consumer and technology companies. Other companies may have different results. This is not intended to be an investment recommendation and is intended only to highlight a historical trend in the industry.| PAST RESULTS ARE NOT NECESSARILY INDICATIVE OF FUTURE RESULTS | Source: PitchBook | As of 30 September 2019

Investment Risks

Capital risk — Investment markets are subject to economic, regulatory, market sentiment, and political risks. All investors should consider the risks that may impact their capital, before investing. The value of your investment may become worth more or less than at the time of the original investment. Manager risk — Investment performance depends on the portfolio management team and the team’s investment strategies. If the investment strategies do not perform as expected, if opportunities to implement those strategies do not arise, or if the team does not implement its investment strategies successfully, an investment portfolio may underperform or suffer significant losses.

Important Information

Wellington Management Company LLP (WMC) is an independently owned investment adviser registered with the US Securities and Exchange Commission (SEC). WMC is also registered with the US Commodity Futures Trading Commission (CFTC) as a commodity trading advisor (CTA) and serves as a CTA to certain clients including registered commodity pools and their operators. WMC provides commodity trading advice to all other clients in reliance on exemptions from CTA registration. WMC, along with its affiliates (collectively, Wellington Management), provides investment management and investment advisory services to institutions around the world. Located in Boston, Massachusetts, Wellington Management also has offices in Chicago, Illinois; Radnor, Pennsylvania; San Francisco, California; Beijing; Frankfurt; Hong Kong; London; Luxembourg; Singapore; Sydney; Tokyo; Toronto; and Zurich.

This material is prepared for, and authorized for internal use by, designated institutional and professional investors and their consultants or for such other use as may be authorized by Wellington Management. This material and/or its contents are current at the time of writing and may not be reproduced or distributed in whole or in part, for any purpose, without the express written consent of Wellington Management. This material is not intended to constitute investment advice or an offer to sell, or the solicitation of an offer to purchase shares or other securities. Investors should always obtain and read an up-to-date investment services description or prospectus before deciding whether to appoint an investment manager or to invest in a fund. Any views expressed herein are those of the author(s), are based on available information, and are subject to change without notice. Individual portfolio management teams may hold different views and may make different investment decisions for different clients.

In Europe (ex. Austria, Germany and Switzerland), this material is provided by Wellington Management International Limited (WMIL), a firm authorized and regulated by the Financial Conduct Authority in the UK. This material is directed only at persons (Relevant Persons) who are classified as eligible counterparties or professional clients under the rules of the FCA. This material must not be acted on or relied on by persons who are not Relevant Persons. Any investment or investment service to which this material relates is available only to Relevant Persons and will be engaged in only with Relevant Persons.

WMIL, WM Hong Kong, WM Japan, and WM Singapore are also registered as investment advisers with the SEC; however, they will comply with the substantive provisions of the US Investment Advisers Act only with respect to their US clients.

©2020 Wellington Management Company LLP. All rights reserved.