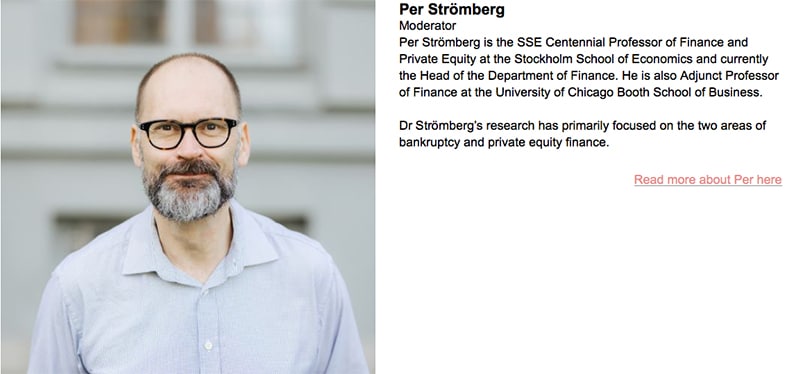

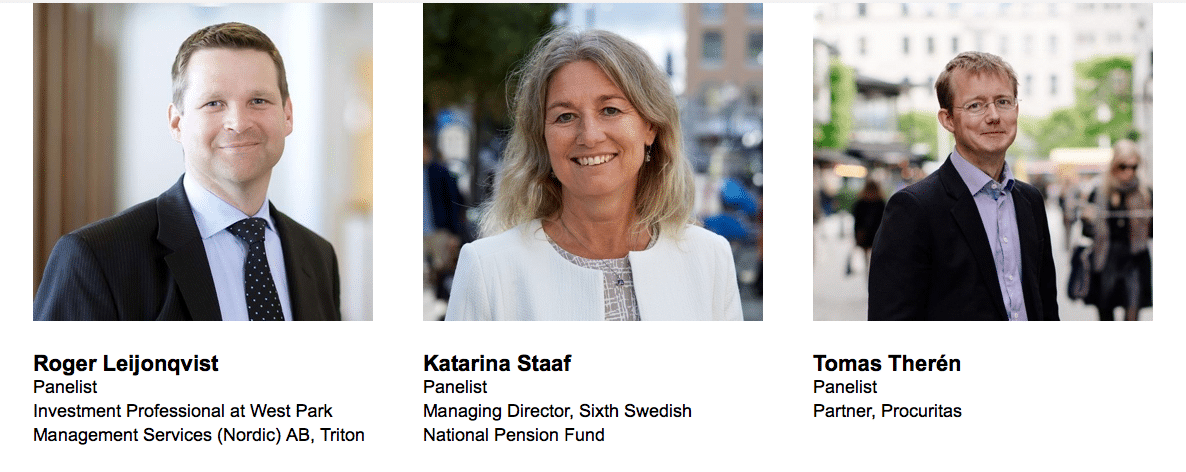

Stockholm (Swedhish Houde of Finance) – Welcome to a”now-casting” webinar from Swedish House of Finance with Professor Per Strömberg, SSE Centennial Professor of Finance and Private Equity, Department of Finance, SSE. He is joined by Roger Leijonqvist, Triton, Katarina Staaf, AP6 and Tomas Therén, Procuritas. Together they will discuss the current state of the private equity market and how the corona crisis poses both difficulties and opportunities for the private equity companies.

Private equity (PE) firms and their portfolio companies come into this crisis riding a long wave of growing transaction volumes, valuations, and fundraising. In the months ahead, this may prove to be especially important when steering trough the crisis compared to other firms. Will PE owned firms manage the crisis better? Are there even good opportunities for PE investors in the short- and medium term?

There are also great risks to consider – deal leverage recently reached a new high, so there may be cause for being worried about PE leverage both in the short term both also in the medium term.

And how are the investors – LP’s – reacting to the crisis? Are they reluctant to make new commitments? Are they unwilling to honor capital calls? Do we see any activity in the secondary market?

The webinar will cover the current state of PE portfolio companies at the moment, and shed some light on what the PE owners are doing to get through the current crisis.

Please be advised that the webinar is held under the Chatham House Rule.

Time: 09:00-10:15

Duration: 75 minutes

Call in details: To be able to attend the webinar you need Zoom. If you need to download it you can use this link Zoom

|

| About us

The Swedish House of Finance at the Stockholm School of Economics is Sweden’s national research center for financial economics. It hosts internationally distinguished researchers, and enables financial research and development of the highest quality. The center serves as an independent platform where academia and both the private and public financial sectors can exchange knowledge, foster new ideas and gain access to a global network of the most prominent researchers in finance. The Swedish House of Finance is an equally private and government funded, nonprofit, nonpartisan organization. It hosts approximately 70 researchers, consisting of resident and affiliated professors as well as PhD students. |