Stockholm (HedgeNordic) – Warren Buffett once said that “it’s only when the tide goes out that you discover who’s been swimming naked.” Stefan Åsbrink (pictured), who partnered with Coeli Asset Management to launch Coeli Multi Asset, has no intention of “swimming naked.” Launched at the end of 2019, the long/short equity fund that can hedge out risk with a wide range of hedging tools and techniques across various asset classes.

“Coeli Multi Asset is a global long/short equity fund with an extra feature of global tactical asset allocation,” explains Åsbrink. This feature represents “a top-down approach to hedge out risk when required and also exploit short-term mispricing in various asset classes.” A long/short equity strategy is an effective way to build wealth over time, reckons Åsbrink. “If you add some hedging capabilities and other strategies that can generate uncorrelated alpha, then you get an excellent combination.”

“Coeli Multi Asset is a global long/short equity fund with an extra feature of global tactical asset allocation.”

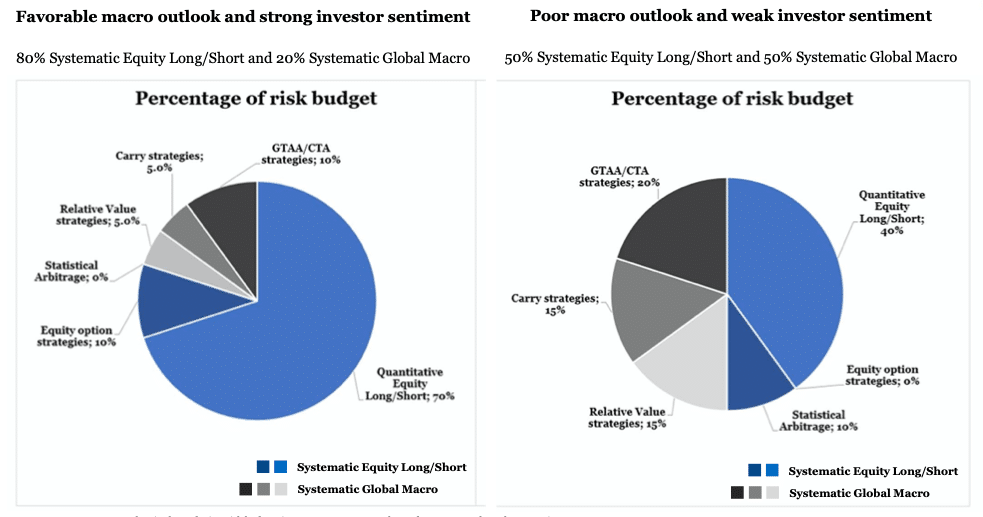

Coeli Multi Asset is designed to represent this “excellent combination” by running a dynamic systematic equity long/short strategy with an overlay of uncorrelated systematic global macro strategies. “The main strategy is equity long/short,” Åsbrink points out, and the “main reason for the extra layer is to have less correlation to equity markets.” To assess the optimal mix between the primary strategy and the extra layer, the fund manager closely examines the macro outlook and investor sentiment.

“The assessment of the market outlook and investor sentiment is based on a lot of data,” says Åsbrink, who holds a PhD in Econometrics from Stockholm School of Economics and has more than 20 years of experience as a hedge fund manager. “Yet there is a lot of common sense,” he emphasizes. The assessment relies on a “combination of top-down fundamental macro analysis and statistical analysis of global markets.” All the fundamental and statistical data goes into proprietary models that estimate the global investor sentiment. “I measure the investor sentiment to assess when to take down risk and when to increase risk.”

“I measure the investor sentiment to assess when to take down risk and when to increase risk.”

“If the markets are extremely overbought according to this indicator, I take down risk,” explains Åsbrink. “If markets go into oversold territory, I start increasing the exposure and taking on more risk.” When the investor sentiment model is flashing buy signals, “the net exposure of the long/short equity portfolio can be fairly high,” says the Coeli manager. When the model suggests the market has entered overbought territories, “I decrease the net market exposure using futures.”

Standard Long/Short Equity Strategy with Extra Layers

To build the long/short equity portfolio, Coeli Multi Asset “combines systematic bottom-up fundamental analysis, top-down macro analysis and statistical analysis of each stock’s price behaviour.” Coeli Multi Asset usually maintains a long portfolio of 50-60 cheap, high-quality stocks with favourable expected risk-return properties and a short portfolio of about 20-30 lower-quality companies.

“Coeli Multi Asset combines systematic bottom-up fundamental analysis, top-down macro analysis and statistical analysis of each stock’s price behaviour.”

The long names “fall in the high-quality bucket and include stocks with good growth prospects and solid cash flows that I will probably hold for many years,” explains Åsbrink. The short portfolio, meanwhile, “includes stocks with obsolete business models, obsolete products or weakening profitability” due to external developments. Åsbrink also prefers to “avoid selling short highly volatile stocks and heavily shorted stocks prone to short squeezes.”

Coeli Multi Asset makes extensive use of options on single stocks to capitalize on the “built-in risk management property of options” and Åsbrink’s experience in running option strategies. “When the market approaches overbought territory, I buy out-of-the-money calls on stocks that I like to gain some extra exposure,” explains the fund manager. “If stock prices come down, I only lose the premium,” he says. “That is an in-built risk control feature, which is perfect when markets are strong because options are usually very cheap then due to very low implied volatility.”

“When the market approaches overbought territory, I buy out-of-the-money calls on stocks that I like to gain some extra exposure. If stock prices come down, I only lose the premium. That is an in-built risk control feature.”

Coeli Multi Asset can also employ a statistical arbitrage strategy to capitalize on short-term opportunities that may arise during periods of market turmoil. “There are some stocks that have tight relationships over time because they are similar in nature,” explains Åsbrink. As the price discrepancy between these pairs of stocks may increase in volatile markets, this strategy seeks to capitalize on mean-reverting spreads. “This strategy is an extra way of making money when markets are panicking,” says Åsbrink. Coeli Multi Asset “has unfortunately not been able to employ this strategy to any large extent recently “as the short-selling of stocks has been banned in European markets due to the Corona crisis.

Additional Layers

In addition to the long/short equity strategy, Coeli Multi Asset uses an overlay of uncorrelated systematic global macro strategies. The purpose of this overlay is to “contribute to returns in bad times or at least help the fund avoid losing money,” explains Åsbrink. Usually receiving a risk-adjusted allocation of about 20 percent, “the global macro side helps diversify the fund further and decrease its correlation to equity and bond markets.”

“The global macro side helps diversify the fund further and decrease its correlation to equity and bond markets.”

Åsbrink’s approach of using futures to “neutralize market exposure” falls in the bucket of systematic global macro strategies. The bucket also includes strategies that represent additional sources of uncorrelated returns, including carry strategies and value or relative-value strategies across equity, fixed income, credit and foreign exchange markets. “These strategies are sources of extra returns that are not correlated with traditional markets,” says Åsbrink. “With these uncorrelated strategies, the risk-return characteristics of the fund get even better.”

The Journey so Far

“At the beginning of the year, the fund was mainly invested in single stocks and owned some call options,” says Åsbrink. When the market started to be more volatile towards the end of February, “my investor sentiment model warned about an extremely overvalued market and I neutralized the exposure by shorting futures on the S&P 500, Eurostoxx 50 and OMX.” Coeli Multi Asset is up about one percent year-to-date through the end of March. On average, the fund has maintained a market-neutral exposure since its inception, mainly because Åsbrink took down the net exposure before markets started crashing. “Coeli Multi Asset can be market-neutral when the indicators tell me to take away risk.”

“My investor sentiment model warned about an extremely overvalued market and I neutralized the exposure by shorting futures on the S&P 500, Eurostoxx 50 and OMX.”

“Since I reduced the market exposure, I have been waiting for the volatility to come down to take on more fundamental-based trades,” says Åsbrink. “When the volatility is very high with the VIX above 60, investing is more like a lottery than anything else.”