Stockholm (HedgeNordic) – The COVID-19 pandemic, which has led to a near-total shutdown of social and economic activity in many corners of the world, is also creating problems for alternatives fund managers out on the road fundraising. According to a survey by research firm Preqin, more than half of surveyed managers of alternatives such as private equity, real estate and hedge funds report that COVID-19 has negatively impacted their fundraising process.

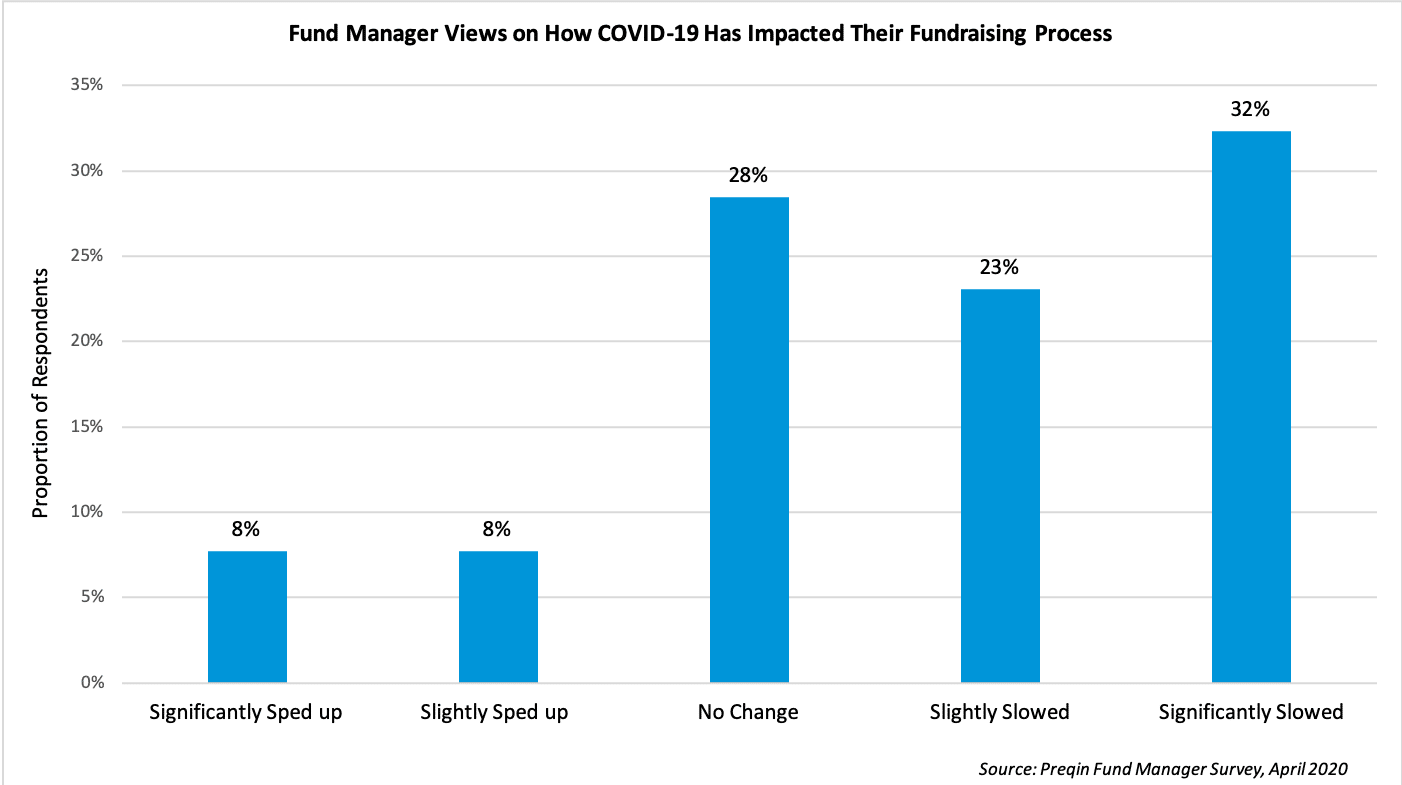

Data provider Preqin surveyed more than 180 fund managers in April to assess the impact of the COVID-19 outbreak on their strategies and operations. According to the survey, 32 percent of respondents report that their fundraising activities significantly slowed down, whereas about eight percent of respondents, on the contrary, say that their fundraising has significantly sped up. About 28 percent of respondents, 20 percent of which are hedge fund managers, report no change in their fundraising activities.

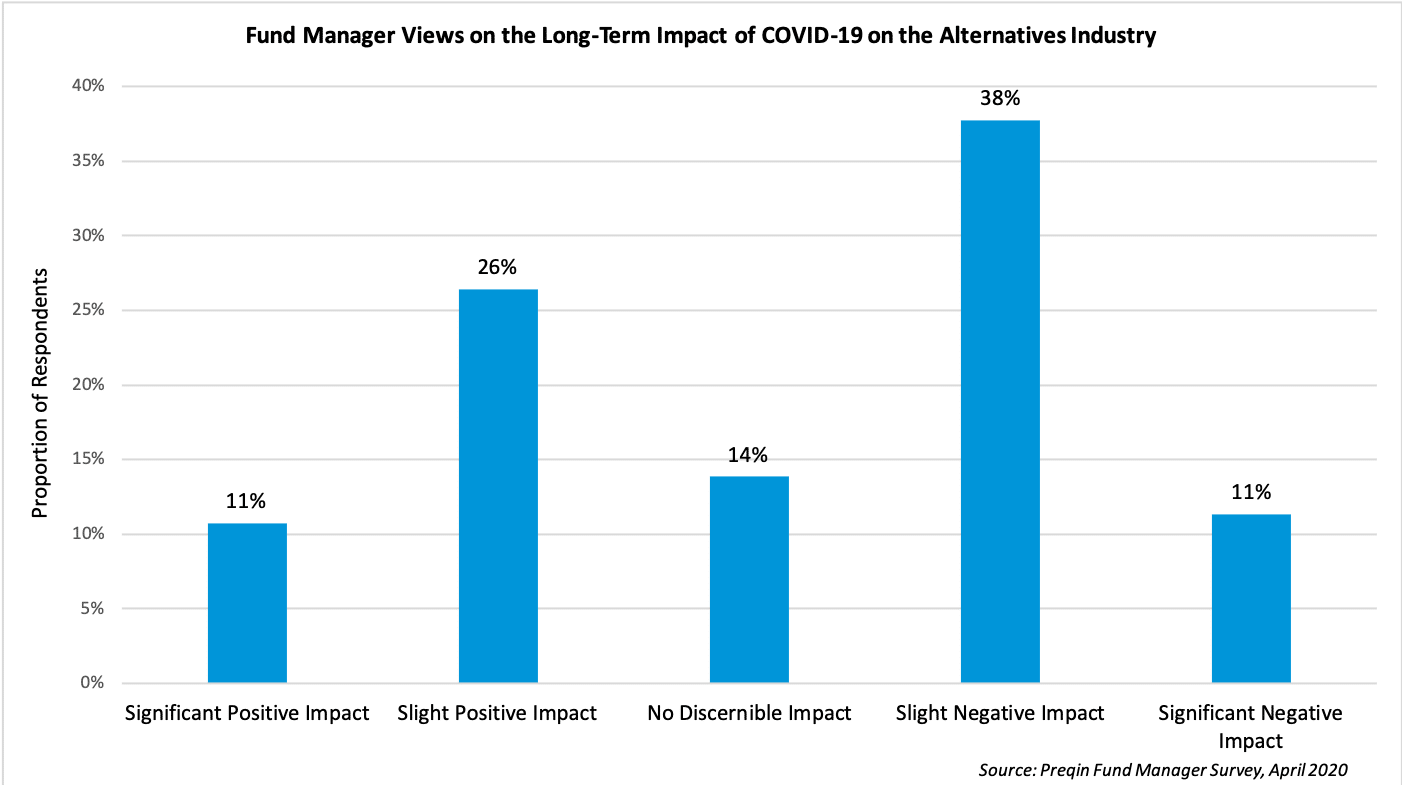

According to the April survey by Preqin, about 38 percent of surveyed fund managers believe that the COVID-19 pandemic will only have a slight negative impact on the alternatives industry. However, an equal share (11 percent) of respondents believe that the coronavirus crisis will have either a significant positive impact or a significant negative impact on the industry. The survey results, therefore, suggest that there is no consensus yet on the long-term impact of the coronavirus on the alternatives industry.

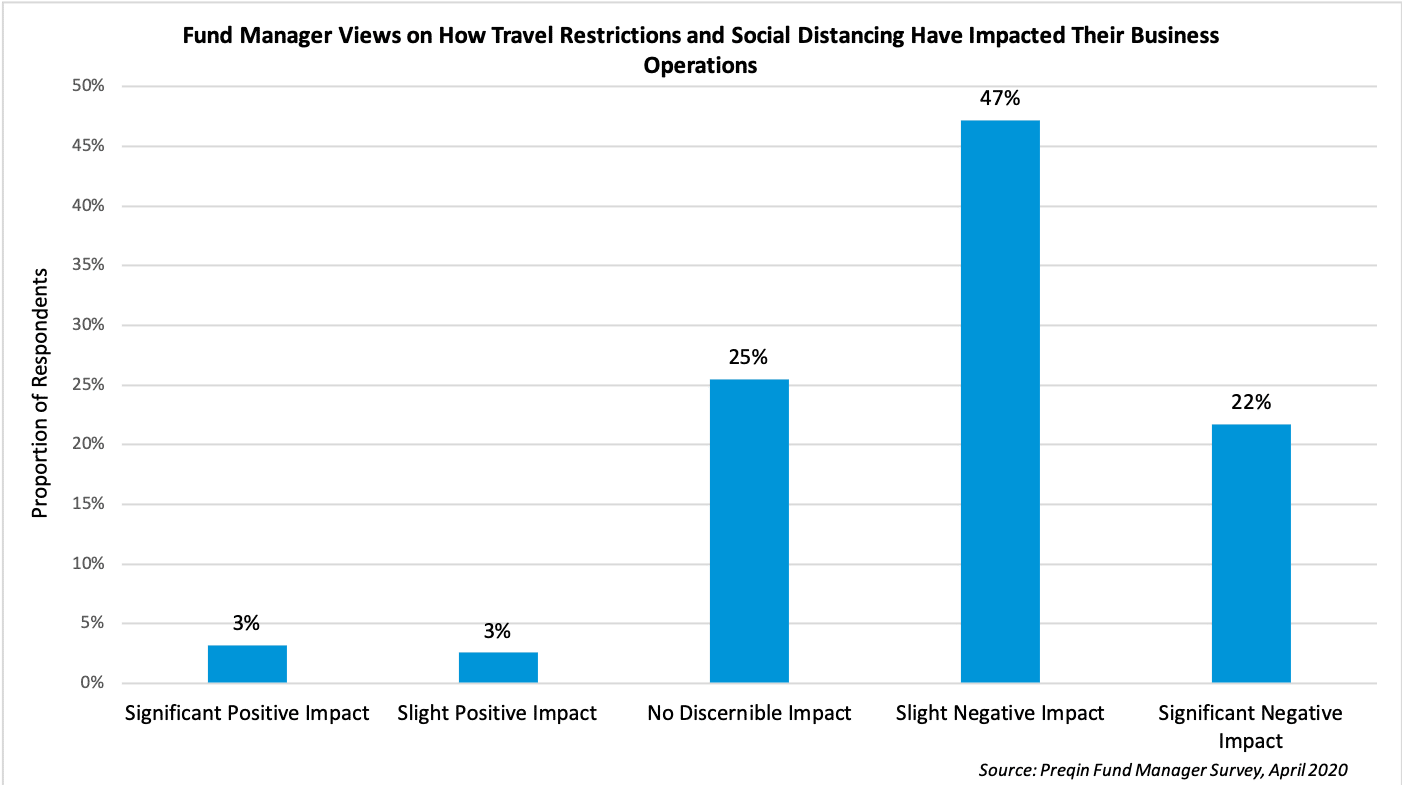

The travel restrictions and social distancing measures imposed by many governments across the world have impacted the business operations of most fund managers in the alternatives industry. According to the Preqin survey, about 47 percent of respondents report that travel restrictions and social distancing have had a slight negative impact on business operations, whereas 22 percent report that these measures have had a significant negative impact on business operations.

Approximately 74 percent of surveyed managers anticipate that business operations will return to their pre-COVID-19 state within 12 months, with only six percent predicting business operations to return to normal in less than three months. About 23 percent of respondents anticipate operations to return to the pre-crisis state between 12 months and 24 months, and only three percent believe the impact on operations will last beyond two years.

Photo by engin akyurt on Unsplash