Stockholm (HedgeNordic) – Thirteen Nordic hedge funds launched between October 2018 and September of 2019 that are constituents of the Nordic Hedge Index qualified for the Rookie of the Year award. The 2019 Rookie of the Year award goes to HP Hedge Fixed Income, the second hedge fund of Copenhagen-based HP Fonds.

How the Winner is Decided

Based on the success of all of the previous winners of the Rookie of the Year award presented by HedgeNordic, one can draw two conclusions. First, the winners of this award are, indeed, promising hedge fund launches. Second, the peer group jury, assembled by HedgeNordic to pick the winner of the Rookie of the Year award, has demonstrated exceptional skill over the years in identifying promising hedge fund launches.

The winner of this special award has been selected by a peer jury composed of other Nordic hedge fund managers. For this award category, the usual selection process that relies on both qualitative and quantitative assessments is not applicable. First, the quantitative screening performed to nominate contenders in each category cannot be performed in the Rookie of the Year category, because rookies, by definition, have a limited track record. Second, even if a quantitative screening were to be applied, the approach would not create an equal playing field for funds due to different lengths of their track records and different investment strategies. The winner in this award category, therefore, has been selected based on qualitative assessments from a peer group jury.

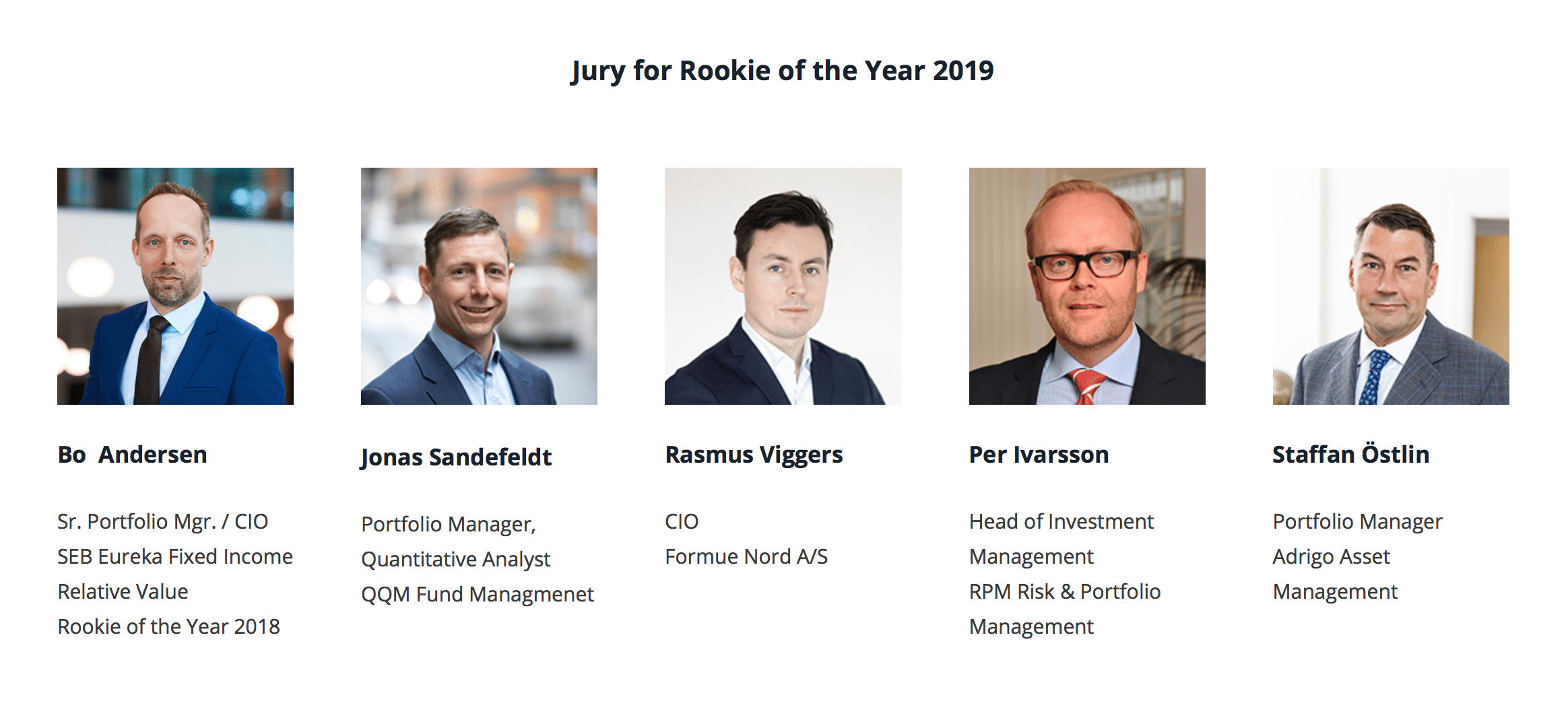

The five-member jury board had the difficult task of selecting the most promising hedge fund launch for 2019. The task involved evaluating which funds they would be most comfortable investing in, which ones would be most likely to reach their target performance, and which ones were better positioned to become prominent funds among their peers in the future. The members of the jury were given full discretion in choosing the criteria they felt most comfortable with, with the final aim being to select the most promising hedge fund launch.

Rookie of the Year: HP Hedge Fixed Income

Crowned as this year’s Rookie of the Year, HP Hedge Fixed Income is one of the most prominent launches in the universe of Danish-originating fixed-income hedge funds focused on the domestic mortgage market. Launched in October 2018, the Copenhagen-based hedge fund seeks to identify and take advantage of market moves exacerbated by the reduced capacity of risk absorption of market-making banks.

In a comment on the distinction, CEO and Chief Portfolio Manager Henrik Fournais tells HedgeNordic that “receiving an award in the fund’s first year is, of course, both an honor but also a testimony to the professionalism of the team behind the fund and the work that has been put into creating a unique fund to the benefit of clients.” Fournais adds that “it is an honor to get recognition especially in a year with many other new hedge funds.”

The primary strategy employed by HP Hedge Fixed Income involves the purchase of Danish callable mortgage bonds below par and non-callable mortgage bonds. As Thomas Loldrup Kjaer, Partner and Senior Portfolio Manager, explained HedgeNordic earlier this year, “the majority, a minimum of 70 percent, of the fund’s long positions will always be in Danish mortgage bonds.”

The team at HP Fonds predominantly seeks to “make a profit on the spreads between Danish mortgage bond yields and the fund’s borrowing rate.” This carry trade approach involves borrowing at low rates and investing in higher-yielding mortgage bonds. Depending on the set of opportunities, the fund can also invest in Swedish Böstader property-backed bullet bonds and floaters, senior non-preferred bonds issued by Danish and other Nordic systematically important financial institutions (SIFIs), as well as European government and corporate bonds.

HP Hedge Fixed Income performed strongly in its first full year of operations but had to give up some of the gains in the turbulent first quarter of 2020. “The fund had a great first year but, as for many others, 2020 is so far both a difficult year,” acknowledges Fournais. However, 2020 is “also a year that will present opportunities for our hedge fund,” he emphasizes.

The “Rookie of the Year” award was supported and presented by HedgeNordic.