Stockholm (HedgeNordic) – Launched amid last week’s turbulent markets, DNB Fund Multi Asset is a multi-strategy, multi-asset absolute return fund designed to withstand the largest stock market falls. “The stock market decline at the end of February shows the benefit of having this type of fund in a portfolio,” argues portfolio manager Anette Hjertø.

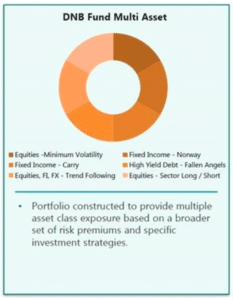

As the name suggests, DNB Fund Multi Asset invests across many asset classes such as equities, fixed income and foreign exchange instruments and employs a total of six sub-strategies. Whereas DNB Fund Multi Asset does not aim to achieve and maintain market neutrality, the fund seeks to limit beta exposure to traditional asset classes.

“Some of the strategies are market neutral, while others move with equity and fixed-income markets to some extent,” explains Hjertø. At the overall level, however, the exposure to broader markets is limited. “Through the use of this range of sub-strategies, the goal is to create a more stable return than one can get in equity funds,” says Hjertø, who adds that “at the same time, the fund is expected to generate higher returns over time than in the fixed-income market.”

DNB Asset Management’s dedicated teams focusing on equities, fixed income and currencies are responsible for managing each of the sub-strategies employed by DNB Fund Multi Asset. “The special thing about investing in DNB Fund Multi Asset is that one gets access to the essence of our best management in one single product,” explains Hjertø. “Several of the return sources are unique to this fund.” The fund also follows DNB’s standards for responsible investments. A team of three consisting of Lena Öberg, Kim Stefan Anderson and Anette Hjertø will be responsible for portfolio construction and decide on the allocation to each individual sub-strategy.

Hjertø argues that DNB Fund Multi Asset represents a suitable alternative to traditional equity funds and fixed-income funds for both professional and retail investors, as many investors are struggling to find good investment alternatives in today’s market. “With the great uncertainty stemming from the coronavirus, many investors find that all investments in their portfolios fall in value at the same time,” points out Hjertø. “With the low level of interest rates, the bond market will no longer provide the risk-mitigation effect desired by many,” she says, adding that “an investor looking for risk-mitigation securities must, therefore, look for alternatives.” The retail share class of DNB Fund Multi Asset was launched on February 25, and the fund will soon open for subscriptions.