Stockholm (HedgeNordic) – When asked to highlight some unique features of the Nordic hedge fund industry, we most often point out that the industry houses several of world’s largest CTA managers and also comprises a strong pool of fixed-income hedge funds (mostly Danish but not only). Judging by the statistics provided by the HedgeNordic database, the group of Nordic fixed-income hedge funds is in a very solid and healthy state, especially when comparing to the broader industry. There are a couple of data points backing this statement.

First, six new fixed-income hedge funds have been launched in the Nordics since the beginning of 2018 and only one fund closed down during the same period. Second, the collective assets managed by Nordic fixed-income hedge funds increased from around €6.4 billion in December 2017 to €7.3 billion in December of last year. This segment of the Nordic hedge fund space continues to manage a little over €7.3 billion as of the end of October. Third, fixed-income hedge funds handily outperformed all four remaining strategy categories in the Nordic Hedge Index in the previous 36 months.

Country of Origination

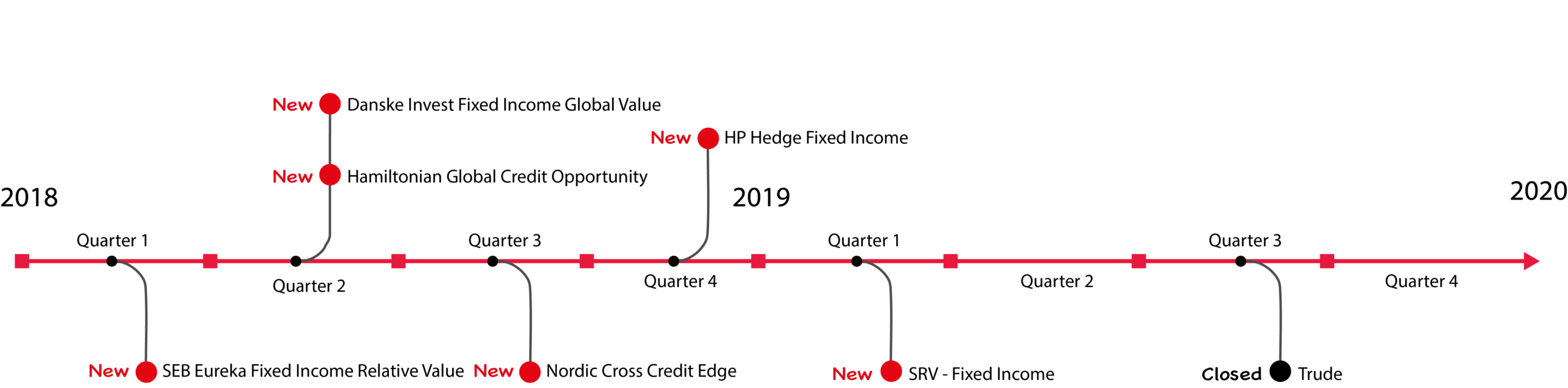

There are 31 fixed-income hedge funds in the Nordics as of the end of October, exactly the same number as at the end of 2018. During 2019, one new fund joined the industry and one vehicle shut its doors. SRV – Fixed Income, a Danish relative value fund focused on Scandinavian and European fixed-income markets, was launched in February of this year, whereas credit hedge fund Trude was closed down in September. Last year was more fruitful in terms of new hedge fund launches in the Nordic fixed-income space. Five new funds were launched and joined the Nordic Hedge Index during 2018. No fixed-income hedge funds closed down last year.

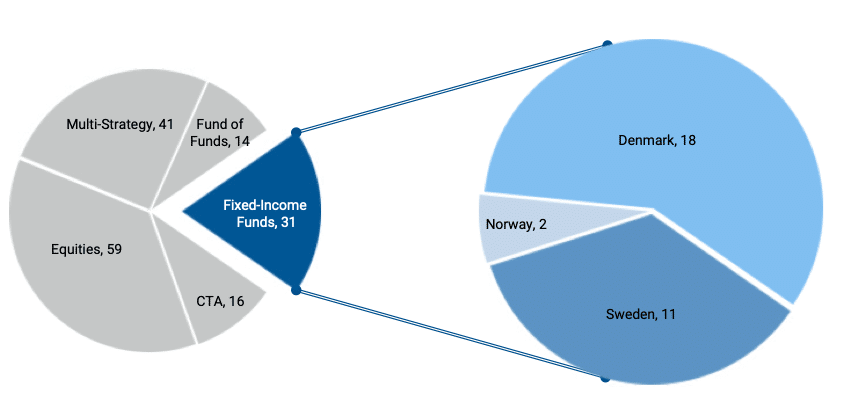

One in every five active members of the Nordic Hedge Index are classified as fixed-income hedge funds, and three in every five fixed-income funds are based in Denmark. The Danish mortgage bond market is one of the largest and most liquid bond markets in the world, which partly explains the high number of Danish fixed-income-focused hedge funds. Of the 40 Danish funds in the Nordic Hedge Index, 18 solely focus on investing in the fixed-income space. The Nordic hedge fund industry also includes 11 Swedish fixed-income funds and two Norwegian funds. There are no Finnish fixed-income hedge funds in the Nordic Hedge Index.

Nordic Fixed-Income Hedge Funds Versus the Rest

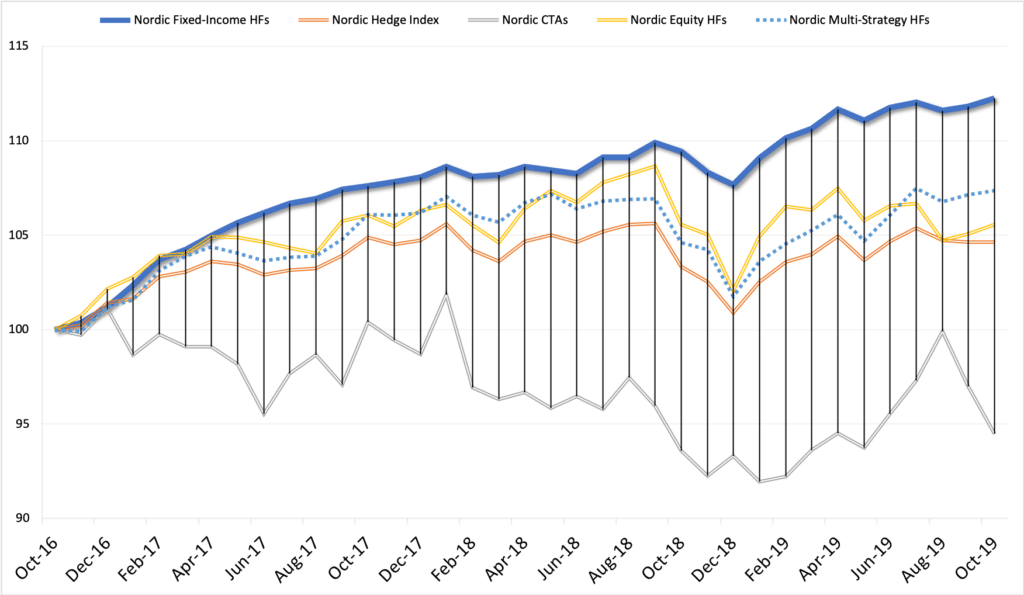

Nordic fixed-income hedge funds outperformed each of the remaining four strategy categories in the Nordic Hedge Index in the previous 36 months and outperformed CTAs, multi-strategy and funds of hedge funds (all but equity hedge funds) over the past 60 months. Furthermore, fixed-income hedge funds outperformed the four other categories in each of the previous full years, with the group trailing only multi-strategy hedge funds year-to-date to the end of October.

Nordic fixed-income hedge funds, as expressed by the NHX Fixed Income, generated a cumulative return of 12.2 percent in the previous 36 months through the end October, surpassing the 4.6 percent cumulative return delivered by the Nordic Hedge Index. Multi-strategy hedge funds, the second best-performing category in the past 36 months, delivered a cumulative return of 7.4 percent during the period. International fixed-income hedge funds, as measured by the Eurekahedge Fixed Income Hedge Fund Index, generated a cumulative return of 14.5 percent in the previous 36 months. The Eurekahedge index currently includes over 300 constituent funds.

Who’s the Biggest?

The universe of Nordic fixed-income hedge funds oversees €7.33 billion in assets under management as of the end of October based on data from 28 of the 31 members of the NHX Fixed Income. 29 of the 31 fixed- income-focused members of the Nordic Hedge Index that were up and running in December of last year (including the now-closed Trude) had €7.30 billion in asset under management at the end of 2018. The 25 fixed-income hedge funds at the end of 2017 with reported assets data (out of the 27) collectively managed €6.44 billion at the end of that year.

At the end of October, Danish-based fixed-income hedge funds collectively managed two-thirds of the €7.33 billion, whereas Swedish funds represented around 30 percent of all assets. The two Norwegian fixed-income funds collectively managed a little over €300 million in assets at the end of October.

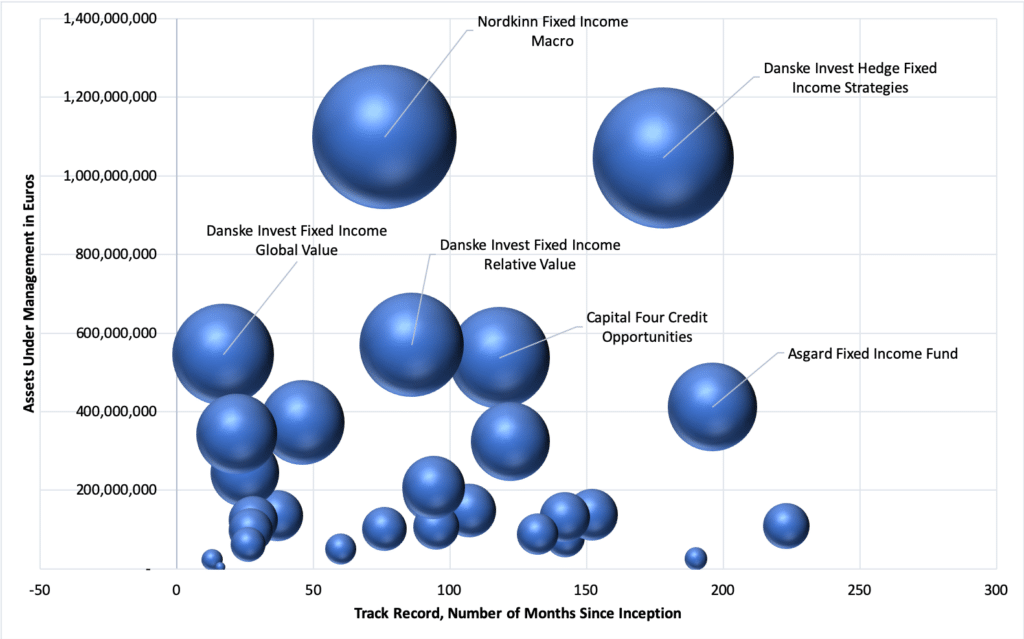

Danske Bank Asset Management’s suite of four fixed-income hedge funds oversees about €2.2 billion in assets as of the end of October, accounting for 30 percent of the “fixed-income” category’s combined assets. Stockholm-based Nordkinn Fixed Income Macro Fund is the Nordic industry’s largest fixed-income hedge fund with assets under management of €1.1 billion at the end of October. Danske Invest Hedge Fixed Income Strategies closely follows suit with assets under management of €1.0 billion. These are the only fixed-income hedge funds in the HedgeNordic database with assets above €1 billion.

The majority of the Nordic fixed-income hedge funds manage over €100 million in assets (20 of the 28 vehicles with reported assets under management figures). Eleven of these 28 funds manage more than €200 million, and eights vehicles oversee less than €100 million. Three Nordic fixed-income hedge funds manage between €500 million and €1 billion in capital as of the end of October. As mentioned above, two fixed-income funds from the Nordic Hedge Index manage over €1 billion.

It is worth pointing out that younger fixed-income hedge funds in the Nordics have been relatively successful in attracting capital from investors. The ten Nordic fixed-income funds launched during 2017 or later (with an operating life of less than three years) collectively manage €1.5 billion or €144.7 million on average as of the end of October. The eleven hedge funds started before 2011 (with an operating life of more than ten years) oversee a combined €3.0 billion or €276.5 million on average. The remaining ten mid-age hedge funds started from the beginning of 2011 to the end of 2016, meanwhile, manage €2.8 billion or €284.1 million on average.

The Best Performers

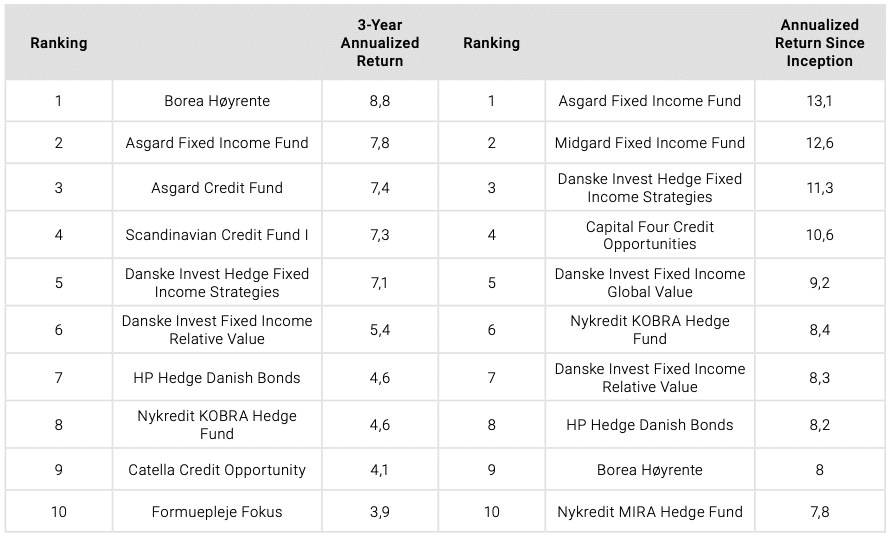

Norwegian fixed-income fund Borea Høyrente achieved the highest annualized return in the past 36 months to the end of October among the funds with a track record of more than three years. Two funds managed by Copenhagen-based fixed-income manager Moma Advisors followed suit, with Asgard Fixed Income Fund generating an annualized return of 7.8 percent in the past 36 months and Asgard Credit Fund delivering 7.4 percent per year.

Stockholm-based direct lending fund Scandinavian Credit Fund, meanwhile, achieved a net-of-fees annualized return of 7.3 percent in the past three years to the end of October. Danske Bank Asset Management’s flagship fixed-income fund, Danske Invest Hedge Fixed Income Strategies, delivered an annualized return of 7.1 percent.

Looking at inception-to-date returns, Asgard Fixed Income Fund generated an annualized return of 13.1 percent since launching in mid-2003, the highest annualized rate of return among fixed-income funds in the Nordic Hedge Index.

Midgard Fixed Income Fund, managed by the asset management arm of Danish commercial pension fund PFA, generated an annualized return of 12.6 percent since its inception in September of 2009. Danske Invest Hedge Fixed Income Strategies, meanwhile, returned 11.3 percent per annum since launching at the beginning of 2005. Up and running Nordic fixed-income hedge funds have performed relatively well over time. After all, 20 of the current 31 funds achieved inception-to-date Sharpe ratios above one.

Image by ejaugsburg from Pixabay