Stockholm (HedgeNordic) – A once-unthinkable environment of ultra-low and negative interest rates and historically expensive equity markets has been forcing pension funds to search for other opportunities to earn decent returns to meet future obligations. As Henrik Olejasz Larsen (pictured), Chief Investment Officer at Danish pension provider Sampension, explains, “the low interest rates challenges both the pension product design, the prudent level of risks taken and the asset allocation.”

How does Sampension, Denmark’s largest labour-market pension fund, respond to the low-return environment? According to Larsen, “an optimal exploitation of the risk budget today means a higher allocation to assets that are very capital intensive for a bank to hold, and a smaller allocation to assets purchased by central banks in their QE-programmes.” Because of the low-return environment, “the traditional asset allocation is no longer optimal,” according to Larsen. “Both relative expected returns and correlations have changed.”

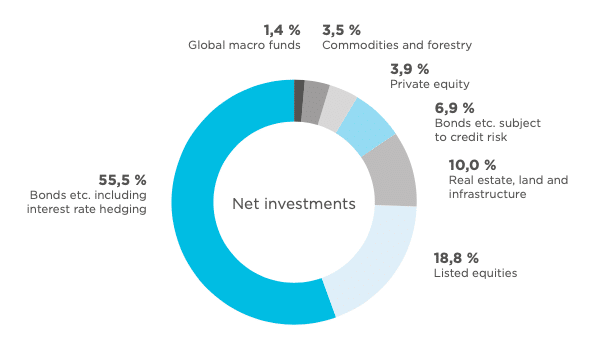

Sampension’s Largest Exposures: Bonds and Stocks

More than half of Sampension’s net investment assets are allocated to low-risk bonds, whereas equities account for under 20 percent of the portfolio. As most fixed-income investments pose the risk of leaving savers with low pensions, Sampension “are increasing the exposure to less liquid and more complicated credit, especially in segments with low credit risks,” explains Larsen. These investments include AAA-rated collateralized loan obligations (CLOs) debt tranches, co-lending with senior real estate loan funds, other senior loan funds or fund finance. The re-allocation from low-risk bonds to less liquid and more complicated credit investments represents “a resource-intensive effort, and thus the change in the portfolio is very gradual.”

As equity markets across the globe appear expensive on many measures, the return outlook from equities over the next decade might be sobering investors and prompting them to look outside of traditional asset classes. “We do find equity markets expensive from both a long-term perspective and in light of the mature stage of the business cycle,” agrees Larsen. Yet, “equities are likely to be supported by low interest rates for some time yet,” he argues. “We are not underweight.” Instead, Sampension “will strategically increase the benchmark allocation to equities as we are gradually adapting to a later retirement age for our members.”

The Alternatives Bucket

With an expected bleak decade ahead for both stock and bond returns, many pension funds and other institutional investors are shifting out traditional equity and bond investments into alternative asset classes such as real estate, infrastructure, private equity, hedge funds, among others. “Alternatives will play a larger role in our portfolio,” reckons Larsen, who adds that “this is a result of many structural tendencies.” First, Sampension’s “internal ability to source, evaluate, monitor and develop alternative investments has increased.” Second, the supply of alternative assets has increased, whereas the number of listed companies has declined and banks have been pulling back on lending. Third, efficiency and quality have increased in the alternatives space, according to Larsen.

“Alternative assets represent a very diverse set of instruments that can serve many purposes in a portfolio,” argues the CIO of Sampension. “This set of assets gives access to risk premia that are not perfectly correlated to returns on traditional assets, and thus offer a diversification benefit.” Some alternative investments also provide better protection against inflation than listed equities, for example, argues Larsen. The exposure to alternatives, however, “comes at a price of higher complexity, higher costs and lower liquidity,” he acknowledges. “But in this respect, a large investor like Sampension will have a comparative advantage.”

However, Larsen argues that “plain vanilla alternatives are also currently very expensive.” For that reason, Sampension is increasingly looking to engage in early development projects in real estate or renewables, for instance. “The risks here are higher compared with assets that are in place, but so are the rewards,” argues Larsen. “We are a good owner of this type of risk, as we can choose to hold onto the asset when it is fully developed.”

Internal Versus External Investment Management

As alternative investments are more complex than traditional ones and are thereby associated with higher costs, Sampension is expanding their internal resources to make more investments internally in an attempt to reduce total investment costs. Sampension relies on both internal and external management of alternatives, as well as some models with mixed elements. Sampension can make a direct real estate investment “that is concentrated in our home market where we internally can source, monitor and manage the assets and take advantage of the lower costs of internal management,” according to the CIO. As for assets outside Denmark, Sampension “will use external management to take advantage of the supply of skills, sourcing, among others,” explains Larsen.

When externalizing investment management, Sampension “will go for higher risks to justify the higher investment costs, but we will put emphasis on diversification.” As Larsen explains, “for low-risk alternatives, diversification is not as important as with assets with high risk.” For external management, Sampension is increasingly making use of segregated mandates or “fund-of-one” structures, where Sampension “plays a role in the design and strategy of the structure, but leaves day-to-date investment decisions to the external manager.”

Within alternative investments, in-house management is not as widespread as in the traditional investment space. As Larsen explains, “it is a time-consuming process to build both the necessary internal team and the portfolio itself, which limits the growth rate of the alternatives portfolio.” Another challenge associated with investing in alternatives is the possible risk of overcrowding. “Currently the interest in alternative assets, especially in low-risk real estate and renewable energy, is very substantial relative to the supply of relevant projects,” acknowledges Larsen. This represents “a reason to move ahead with some caution.”

With an increasing share of pension money moving to unguaranteed products with more risk capacity over the last decade and the very low interest rates, “we expect the share of equities and alternatives at the aggregate portfolio level to increase for many years to come,” concludes Larsen.

The article was originally published on Ekonamik.com