Stockholm (HedgeNordic) – After advancing 6.6 percent during the summer, Nordic CTAs fell by 2.9 percent on average in September and an additional 2.7 percent in October (88 percent reported). Nordic CTAs, as expressed by the NHX CTA, are now up 1.2 percent in 2019 with two months to go the end of the year.

Last month, Nordic CTAs performed broadly in line with the world’s largest CTAs, but underperformed the broader CTA industry. The SG CTA Index, which reflects the performance of a pool of CTAs selected from the larger managers open to new investment, was down 2.4 percent in October. The 20-member SG CTA Index, which includes three members of the Nordic Hedge Index, gained 6 percent in the first ten months of 2019.

The Barclay BTOP50 Index, which tracks a similar group of large investable CTAs, fell by 2.6 percent last month, cutting the group’s year-to-date performance to 6.4 percent. The broader Barclay CTA Index, comprised of over 500 CTAs, fell by only 0.6 percent in October based on reported data from 63 percent of index constituents. The Barclay CTA Index is up 4.9 percent year-to-date through October.

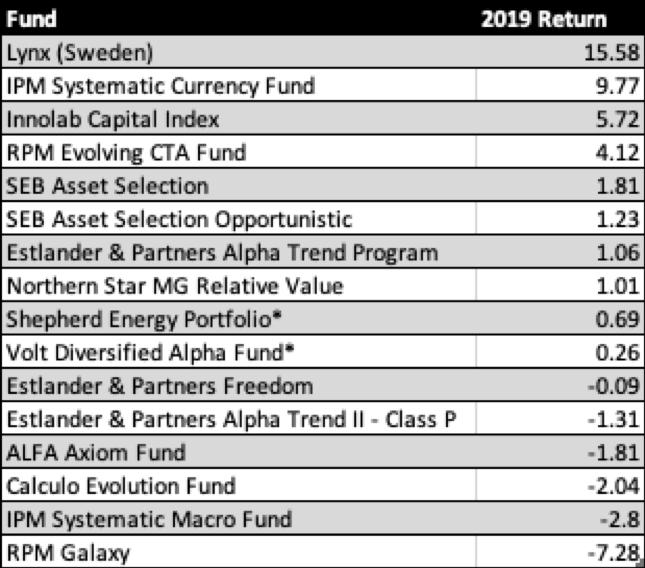

IPM Systematic Macro Fund, which employs a systematic, global macro approach to managed futures investing, was last month’s best-performing member of the NHX CTA with a return of 3.6 percent. The fundamentals-based macro fund gained 6.4 percent since the end of the summer, whereas the NHX CTA lost 5.5 percent during these two months. IPM Systematic Macro Fund’s strategy of serving as a diversifier to the primary source of diversification – trend-following CTAs – has proven effective.

Artificial intelligence-driven Innolab Capital Index gained 2.9 percent last month, which brought the fund’s performance for the year to 5.7 percent. IPM Systematic Currency Fund followed suit with a gain of 0.8 percent. The fund managed by Stockholm-based systematic asset manager Informed Portfolio Management (IPM) ranks as this year’s second-best performing member of the NHX CTA with year-to-date performance of 9.8 percent.

Image by Lorenzo Cafaro from Pixabay