Stockholm (HedgeNordic) – Agenta Alternativa Investeringar, one of the lowest-cost hedge funds in the Nordics, has got off to a great start since launching at the beginning of 2019. The fund managed by Stefan Engström (pictured), who co-founded Stockholm-based asset manager Agenta with Peter Agardh almost 15 years ago, returned 6.6 percent in the first ten months of operations (posting nine positive months out of ten). A year-to-date return that exceeds the fund’s return target of five percent combined with low volatility leads to the happy result of a Sharpe ratio of 2.3.

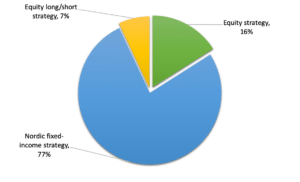

While holding a far-reaching mandate, Agenta Alternativa Investeringar mainly operates as a “Nordic-focused multi-strategy fund that slightly falls back on our absolute return alternative fixed-income fund, Agenta Alternativa Räntor,” according to Engström. Given Agenta’s extensive experience in fixed-income investing, the young multi-strategy fund allocates around two-thirds of its portfolio to the Nordic fixed-income market. The remaining capital is allocated to Swedish equity market and a select group of long/short equity funds. “To create a more uncorrelated product when setting up the new fund, we got rid of the other fund’s restriction that allowed us to only invest in the fixed-income market,” says Engström.

The Young Fund’s Main Pillar

With about 77 percent of the portfolio allocated to Swedish corporate bonds, fixed-income securities form the foundation of Agenta Alternativa Investeringar. “We started building the fund and its portfolio from the fixed-income side as we already had extensive experience in this space with the other product,” explains Engström. “We have a lot of know-how in the space, and we find numerous opportunities in this market partly because of our network in the market.”

Describing the composition of the fixed-income portion of the portfolio, Engström says that “we invest across the broad spectrum of corporate bonds in the Nordic market.” Investments can involve both short- and long-term plays, as well as arbitrage opportunities. “The Swedish fixed-income space is very immature,” argues Engström, “as a lot of investors cannot assess the ‘accurate’ market price.” The Agenta team can also take a more active ownership approach in the bond portfolio on some occasions, mainly when issuers are not performing as expected. “This active approach helps us reduce risk and achieve higher returns at the same time.”

Since the sizeable real estate segment in Swedish economy dominates the corporate bond market, real estate-linked securities account for around one-third of Agenta Alternativa Investeringar’s entire portfolio. Engström reckons that the relatively high exposure to the Swedish real estate market does not pose significant risks in the foreseeable future. “The outlook on the Swedish real estate market depends on where interest rates are heading, and we do not expect significantly higher interest rates in the short- to medium-term,” argues Engström. “There are some players in the Swedish real estate market who will struggle,” he acknowledges. “For that reason, careful security selection is very important.”

Building the “Equity” Pillar

After using fixed-income securities as the central pillar to build the fund’s portfolio, “we then started allocating to equities, and we expect the exposure to equities to increase over time from the current portion of around 16 percent,” says Engström. Corporate bonds are usually highly correlated with stocks, which is why the Agenta team seeks to “make sure that the equities we invest in are uncorrelated to our bond portfolio.” Agenta Alternativa Investeringar mainly relies on fundamentals-based analysis to select a concentrated portfolio of Swedish liquid stocks.

Small Exposure to External Managers

Because Agenta Alternativa Investeringar has grown at a rapid pace since launching at the beginning of 2019, the fund had to rely on a few external long/short equity managers to generate uncorrelated returns. “As we have grown the fund from zero to over SEK 1 billion, we encountered a lot of challenges in this rapidly-growing phase that typically lower returns quite significantly,” highlights Engström. The allocation to external managers helped tackle some of the challenges.

Partly because of relatively limited experience in equity investing and shorting stocks in particular, “we need to have exposure to these external managers to some extent.” Yet, the co-founder of Agenta reckons that the allocation to external managers, which currently accounts for around seven percent of net assets, will not remain forever. “We will probably reduce that exposure over time as we might do the shorting in-house,” says Engström, who further adds that “we have not set a firm date for that transition just yet.”

Lowest-Cost Nordic Hedge Fund?

Before launching Agenta Alternativa Investeringar in early 2019, Agenta had managed a fund of hedge funds that was closed down “mainly because fees and costs were too high.” As Engström explains, “the management fees and performance fees were relatively high, but we also had two layers of fees due to the fees charged by the underlying managers.” Agenta Alternativa Investeringar represents a comparable version of that fund but with some of the industry’s lowest fees.

The fund charges investors an annual management fee of 0.24, the second-lowest among single-strategy hedge funds in the Nordic Hedge Index, and a yearly performance fee of 15 percent. “When launching the new fund, we thought we could implement ourselves a number of the strategies that existed in the now-closed fund of hedge funds and create an uncorrelated product with tiny fees compared to other vehicles in the market,” says Engström.

“We differentiate ourselves by charging low fees and incurring low operating costs,” he argues. “Investors appreciate that.” Explaining the Agenta team’s plans for the new fund, Engström says that “we are not aiming to become the biggest fund in this segment, we are striving to have the best performance instead.” Whereas the fund has yet to reach a size that might affect performance, the co-founder of Agenda reckons that a very large asset base can impact his fund’s performance. “When we start noticing that size is affecting performance, we will close the fund to new investment.”