Stockholm (HedgeNordic) – Allocations to alternative asset classes remain robust and little changed in the past several years. Still, preferences for specific types of alternatives have been changing, according to EY’s latest Global Alternative Fund Survey. Whereas hedge funds continue to account for the largest share of investors’ allocations to alternatives, more investors are increasing allocations to private equity and other alternative asset classes mainly at the expense of hedge funds.

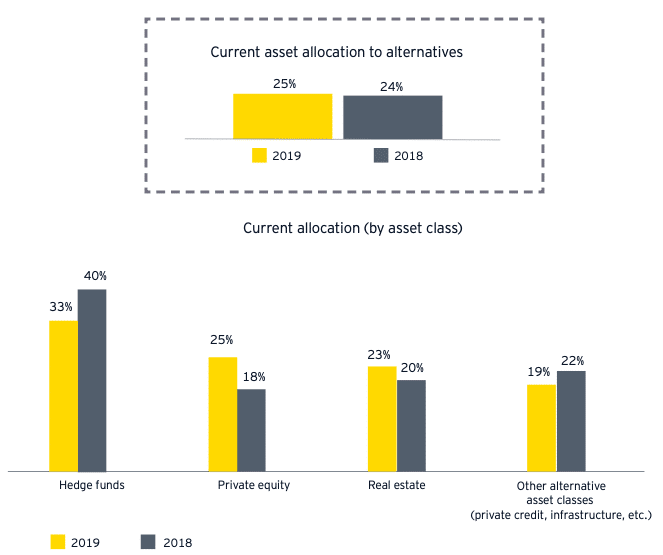

According to EY’s 2019 Global Alternative Fund Survey, surveyed institutional investors, on average, have a quarter of their assets allocated to alternatives. Their allocations to hedge funds, however, decreased from 40 percent in 2018 to 33 percent in 2019. “Muted performance, continued scrutiny of costs and competition from other products have resulted in lackluster demand,” writes EY’s paper that accompanies the survey. With the overall volume of assets allocated to alternatives remaining mostly unchanged, investors are distributing capital away from hedge funds to other alternative asset classes such as private equity, real estate, private credit and infrastructure.

The exposure to private equity and real estate increased to 25 percent and 23 percent in 2019 from last year’s 18 percent and 20 percent, respectively. The allocations to other alternative asset classes such as private credit and infrastructure edged down to 19 percent in 2019 from 22 percent last year. “Whereas minimal volatility, consistently rising equity markets and low interest rates have challenged hedge managers’ returns, these market conditions have served as rocket fuel for private equity portfolios,” writes the paper. The survey results also indicate that institutional investors plan to increase their allocations to private equity and real estate products over the next two to three years.

The survey results indicate that hedge funds are using the challenging asset raising environment to look for ways to improve operations and optimize costs. According to the paper accompanying the survey, “as fewer hedge funds in the current year prioritize asset growth in this fundraising-challenged environment, more are focused on reining in costs than their private equity peers.” Nonetheless, asset growth continues to represent the top strategic priority for both private equity and hedge fund managers. “This is consistent with prior years and unsurprising as asset growth contributes to working capital for managers to invest in the people and infrastructure of the business to ensure longevity,” writes the paper.

The 2019 EY Global Alternative Fund Survey can be downloaded below:

Image by Iwona Olczyk from Pixabay