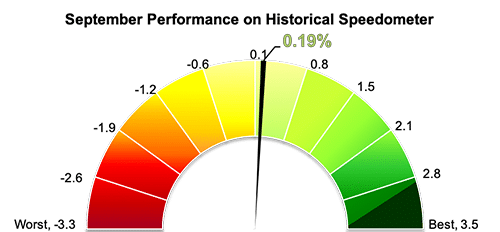

Stockholm (HedgeNordic) – Nordic equity hedge funds posted mixed performance in September, as a rotation out of relatively expensive stocks and into cheaper names had different effects on different managers. Equity hedge funds, as expressed by the NHX Equities, gained 0.2 percent in September (90 percent reported), which brought their performance for the first three quarters of 2019 to three percent.

Equity markets across the globe ended September in positive territory as the rotation swept through markets. Nordic equities, as expressed by the VINX All-Share index, returned 3.1 percent in Euro terms in September. The index includes all firms listed on Nasdaq OMX Nordic Exchanges and Oslo Börs. Global equities, as measured by the FTSE World Index, gained 3.4 percent in Euro terms last month. Eurozone equities were up 3.7 percent, whereas North American equities advanced 2.9 percent in Euro terms.

Based on preliminary estimates, Nordic equity hedge funds performed in line with their global peers but slightly outperformed European long/short equity funds. The Eurekahedge Europe Long Short Equities Hedge Fund Index, which tracks the performance of 266 European equity hedge funds, was flat last month based on reported data from 35 percent of index constituents. The Eurekahedge Long Short Equities Hedge Fund Index, a broader index comprised of 922 funds, gained an estimated 0.3 percent last month based on reported data from 31 percent of index constituents. In the first three quarters of the year, European and global equity hedge funds gained 3.9 percent and 6.1 percent, respectively.

The dispersion between last month’s best- and worst-performing members of the NHX Equities was at 7.2 percent. The top 20 percent of members gained 3.3 percent on average, whereas the bottom 20 percent lost 3.9 percent. Two in every three members of the NHX Equities with reported data for September posted gains last month. DNB ECO Absolute Return, a market-neutral fund focused on renewables, was last month’s best-performing member of the NHX Equities with a return of 6.9 percent. The fund was down 18.6 percent in the first three quarters of the year.

Atlant Sharp, a hedge fund employing equity-related derivatives on the OMX Stockholm 30 in an attempt to outperform the index and protect against sharp declines, was up 3.9 percent last month. The fund gained 16.4 percent year-to-date through the end of September. Value-oriented long/short equity fund Incentive Active Value followed suit with a return of 3.6 percent, which brought the fund’s year-to-date performance to 7.9 percent. Sissener Canapus and Rhenman Global Opportunities L/S were up 3.6 percent and 3.2 percent last month, respectively.