Stockholm (HedgeNordic) – This year’s race for the best-performing hedge fund in the Nordics has been intense, with no clear winner at any point throughout the year. At different points in time, HCP Focus, Proxy Renewable Long/Short Energy and Alcur Select held the position of the best-performing Nordic hedge fund of 2019. As of the end of September, long-biased small-cap-focused equity hedge fund Alcur Select is leading the way with a year-to-date return of 36.9 percent.

Managed by portfolio manager Wilhelm Gruvberg (pictured), Alcur Select recorded only positive months so far in 2019 and generated a cumulative return of 43.5 percent since launching in May of last year. Alcur Select is a long-biased small-cap-focused equity hedge funds focused on the Nordic region, particularly Sweden. Over a full economic cycle, the fund aims to maintain a net market exposure between 50 percent and 100 percent, with the exposure at any given time mostly dependent on the available pool of risk-reward opportunities. Dubbed as a “hedge fund on steroids” by the Alcur Fonder team, the fund has lived up to its name so far.

Discussing Alcur Select’s strong performance since inception, portfolio manager Wilhelm Gruvberg highlights one interesting piece of data. During all the months with negative returns for the Carnegie Small Cap Index, Alcur Select earned a positive cumulative return of over one percent, whereas the Carnegie Small Cap Index returned a negative 16 percent over the same months. In all the months the Carnegie Small Cap Index delivered gains, Alcur Select still managed to beat the index with a cumulative return of about 43 percent. “We achieved our returns with below-market volatility,” says Gruvberg, who adds that the fund achieved a Sharpe ratio of 3.4 since inception.

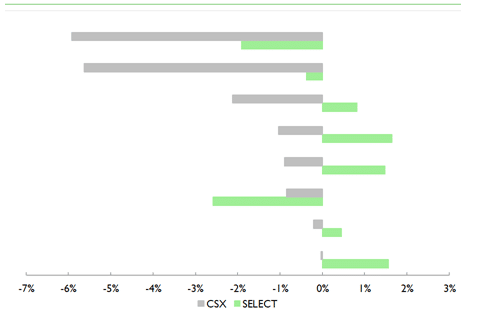

Commenting on the main drivers of this year’s performance, Gruvberg says that “in the long book, we had a good contribution from software companies like Admicom, Vitec and Addnode.” The Alcur Fonder team is “even more proud of the contribution from value cases in Lindab, Skanska and Holmen, which delivered good risk-adjusted returns.” Alcur Select also enjoyed good returns from short positions in banks, sporting goods retailer XXL and digital entertainment company Modern Times Group (MTG).