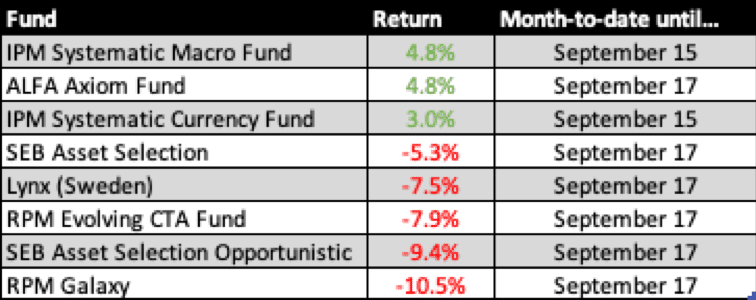

Stockholm (HedgeNordic) – This summer, Nordic CTAs recorded their best summer on record after gaining 6.6 percent on average during the past three months. The industry is in the midst of changing fortunes this month, as some of last month’s strongest performers are struggling in September and some of August’s laggards are performing strongly.

IPM Systematic Macro Fund, which employs a fundamentals-based systematic macro strategy, gained 4.8 percent month-to-date through September 15. The flagship strategy of Stockholm-based systematic asset manager Informed Portfolio Management (IPM) trimmed its year-to-date loss to 4.3 percent. IPM Systematic Currency Fund, meanwhile, gained 8.9 percent year-to-date through September 15 after advancing 3.0 percent in the first half of this month.

Trend-following fund Alfa Axiom gained 4.8 percent month-to-date through the end of Tuesday this week, recouping most of its 5.4 percent loss incurred in the first eight months of 2019. Whereas most Nordic CTAs enjoyed strong performance during the summer, Alfa Axiom was down 3.5 percent during the three summer months.

Most of this year’s strongest performers in the Nordic CTA industry are giving up gains in September. Multi-CTA fund RPM Galaxy, which was up 5.3 percent in the first eight months of 2019, fell 10.5 percent month-to-date through September 17. RPM Galaxy invests in a group of large, established CTA managers. RPM Evolving CTA Fund, which gained 19.2 percent during the three summer months and was up 17.6 percent in the first eight months of the year, is down 7.9 percent month-to-date through September 17.

Swedish-domiciled systematic fund Lynx (Sweden), which was the second best-performing member of the NHX CTA in 2019 at the end of August, fell by 7.5 percent this month through September 17. Lynx (Sweden) was up 29.3 percent year-to-date through the end of August.

SEB Asset Selection, a systematic trend-follower investing across four different asset classes, was down 5.3 percent month-to-date through September 17 after enjoying six consecutive months of positive returns. The fund managed by the SEB Global Quant Team led by Hans-Olov Bornemann was up 9.1 percent in the first eight months of 2019. SEB Asset Selection Opportunistic, a more aggressive version of SEB Asset Selection, fell 9.4 percent month-to-date. This fund gained 14.8 percent in the first eight months of the year.

Photo by Brendan Church on Unsplash