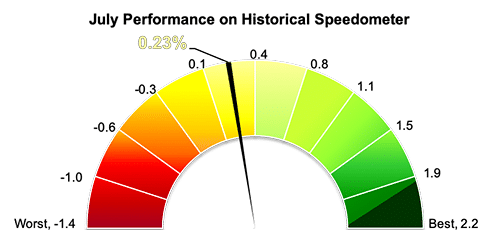

Stockholm (HedgeNordic) – Nordic fixed-income hedge funds edged up 0.2 percent in July (97 percent reported), bringing the group’s year-to-date return above four percent. Last month, Nykredit EVIRA Hedge Fund was the best-performing member of the group for a second consecutive month, strengthening its top position in the performance leaderboard.

Nordic fixed-income hedge funds lagged their global peers both last month and year-to-date. The Eurekahedge Fixed Income Hedge Fund Index, which reflects the performance of more than 300 funds that employ fixed-income strategies, was up 0.5 percent in July and 5.5 percent in the first seven months of 2019. The HFN Fixed Income (non-arbitrage) Index, which tracks the performance of fixed-income funds in eVestment’s hedge fund database, netted a 0.7 percent return last month. The HFN index gained 5.0 percent year-to-date through the end of July.

Two in every three constituents of the NHX Fixed Income, currently comprised of 32 members, posted gains for July. Nykredit EVIRA Hedge Fund, which manages a leveraged portfolio on BBB- and BB-rated European corporate credit, extended its year-to-date performance to 24.0 percent after gaining 2.2 percent in July. Nykredit EVIRA is this year’s best-performing member of the NHX Fixed Income and rounds up the top five list of best performers in the Nordic Hedge Index.

Hamiltonian Global Credit Opportunity Fund, a hedge fund focusing on global credit markets, is enjoying a strong year following a relatively difficult 2018. The fund managed by Sean George gained five percent in the first seven months of 2019 after returning 1.8 percent in July. Danske Invest Fixed Income Global Value, the youngest fund in Danske’s range of fixed-income hedge funds, returned 1.1 percent last month, which brought the fund’s year-to-date return to 8.5 percent. Both Borea Høyrente and Catella Credit Opportunity gained 0.9 percent last month.

Photo by Aaron Burden on Unsplash