(Partner Content from SSGA) – Since introducing our Sustainable Climate Strategy last year, we’ve received a remarkable level of interest from pension funds, corporations, sovereign wealth funds and asset owners around the world who are committed to addressing climate risk through their portfolio management.

Our Strategy has been developed to align with the key aims of the Paris Agreement, including limiting the effects of climate change to less than 2° Celsius above pre-industrial levels, and it does so with a focus on investment performance. The strategy can help prepare portfolios for the regulatory initiatives that could accompany the transition to a low-carbon economy, such as the possible introduction of a carbon tax.

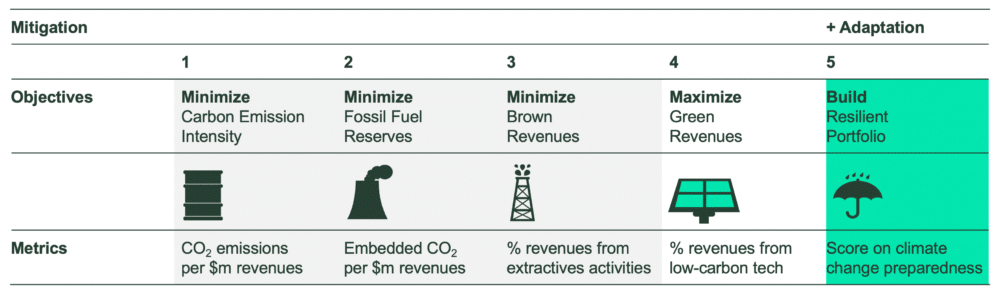

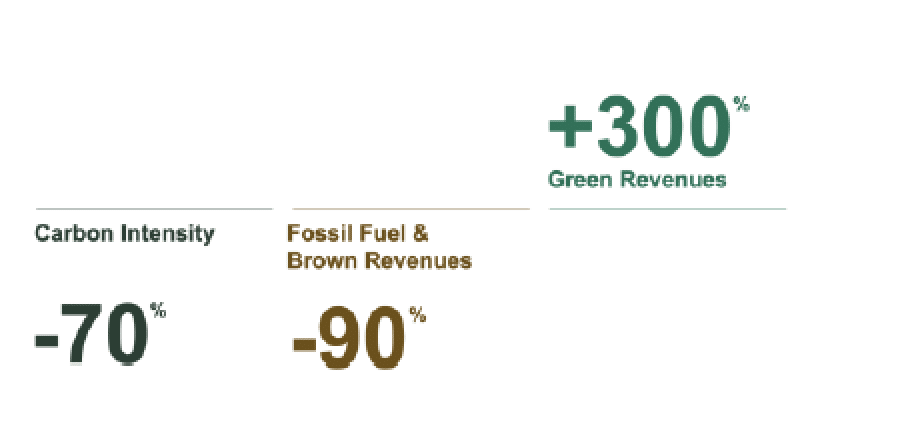

We use an effective blend of mitigation and adaption to target the best results. To target net carbon emission reductions, the strategy reduces exposure to companies with worse-than-average carbon emissions, fossil fuel reserves and brown revenues from extraction activities, while also increasing exposure to companies that generate green revenues from low-carbon technology.

In addition to this focus on mitigating the drivers of climate change, the strategy also targets Adaption — by increasing exposure to companies that are actively adapting to, and effectively reporting on, the actual or expected effects of global warming and other environmental changes.

Targets Climate Risk and Opportunity on Multiple Fronts

Flexible and Effective

The State Street Sustainable Climate Strategy is a long-only investment approach, using a Mitigation + Adaptation methodology to build climate change thematically into equity portfolios.

It’s designed from the ground up to be flexible: a customizable framework allows us to create client portfolios that target reductions in current and future carbon emissions, increase exposure to green revenues and increase resiliency to the physical risks posed by climate change.

Designed for investors who wish to prepare their portfolios for the transition to a low-carbon economy, in a scalable and risk-aware way, it’s available now to meet those needs.

Delivers on Climate and Carbon Objectives

Real-Life Delivery

We know that investors of all kinds are facing increasing pressure on climate issues. We’re hearing from companies in many different sectors, each looking to build climate-change resiliency into all aspects of their business practices. Some already have a strong vision of how to proceed, others require more assistance to meet their aims.

Here are a couple of examples of how we’re helping investors apply the Sustainable Climate Strategy framework to transform their portfolio into one that delivers high impact on the carbon profile of their investments .

Case Study 1 The Sovereign Wealth Fund

Spurred by government policy directives, a leading sovereign wealth fund sought to improve the environmental sustainability of its portfolio — and prepare it for the transition to a low-carbon economy.

Our client asked us to analyse the climate risk in their strategies. We started our analysis by looking at exposure only to carbon emissions. We backtested our model for all of the fund’s equity universes and provided an analysis showing the amount of carbon exposure that could be removed from the portfolio across a tracking error range of 50 to 250 basis points. We identified the companies that would be removed at various levels of tracking error and diagnosed how excluding these specific stocks would affect the fund’s current asset allocation. Next, we expanded our analysis to include exposure to both carbon emissions and fossil fuel reserves. With these new parameters set, we spent four more weeks conducting additional backtesting.

Mapping the Future Path

Throughout our analysis, we also considered opportunities to future-proof the fund’s portfolio and prepare it for the possibility of a carbon tax, more frequent extreme weather events and other elements of the transition to a low-carbon economy. This includes increasing exposure to green revenues and making the portfolio more resilient by tilting toward companies that are actively responding to the threat of global warming and accounting for the likelihood of heightened regulatory standards.

The results of these two rounds of analysis provided the fund with an essential starting point for mapping a path to gradually increasing the scope of their climate-focused investing and identifying the key role our Sustainable Climate Strategy could play in those efforts.

Case Study 2 The Consumer Goods Conglomerate

Consumer goods companies face heightened exposure to climate risk on both the supply and the demand sides. Droughts, hurricanes and other severe weather events can disrupt supply chains and drive extreme volatility in commodities markets.

With consumers becoming increasingly aware of the environmental impact of production, sustainability, transportation and processing methods are becoming an important driver of purchasing decisions.

Building Climate-Change Resiliency

We worked with this particular consumer goods company to help them assess the benefits of the Strategy. The adaptation component of the Sustainable Climate Strategy was very appealing to the company.

The company was already focused on improving climate-change resiliency throughout its supply chain, operations and new product development, and the strategy’s adaptation component takes this same approach and applies it to the investment portfolio making it a valuable avenue for further improvement.

Learn how our ESG strategies could help you meet the climate change challenge and more.

Please visit ssga.com/climate for further information.

Important Risk Discussion

The information provided does not constitute investment advice and it should not be relied on as such. It should not be considered a solicitation to buy or an offer to sell a security. It does not take into account any investor’s particular investment objectives, strategies, tax status or investment horizon. You should consult your tax and financial advisor.

All information has been obtained from sources believed to be reliable, but its accuracy is not guaranteed. There is no representation or warranty as to the current accuracy, reliability or completeness of, nor liability for, decisions based on such information.

The whole or any part of this work may not be reproduced, copied or transmitted or any of its contents disclosed to third parties without State Street Global Advisors’ express written consent.

© 2019 State Street Corporation – All Rights Reserved

2693899.1.1.EMEA.INST 31/08/2020

—

Picture: (C) By-Sergey-Nivens—shutterstock