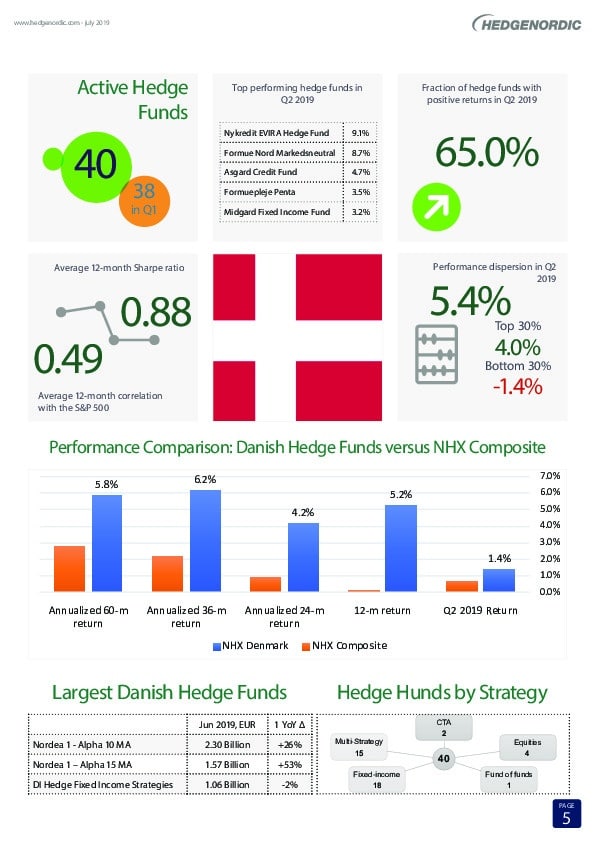

Stockholm (HedgeNordic) – Danish hedge funds were up 6.5 percent on average in the first half of 2019, better than funds from other Nordic countries. The Danish hedge fund industry, as measured by the NHX Denmark, produced an annualized return of 5.8 percent in the past five years through the end of June, more than twice the 2.7 percent-return delivered by the Nordic Hedge Index.

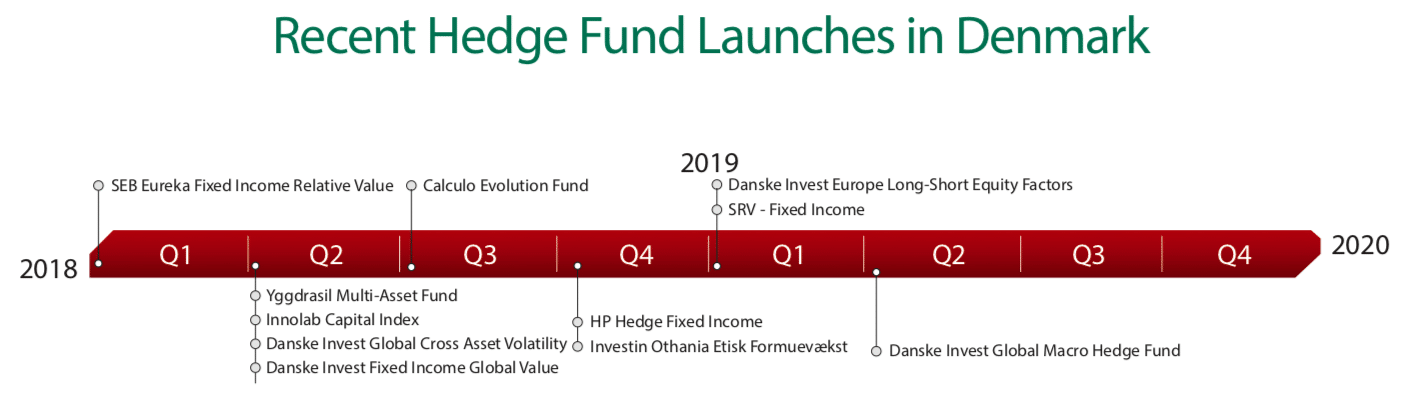

As displayed in the “Nordic hedge fund space: country-by-country report” for the second quarter of 2019, the Danish hedge fund industry outperformed the other three Nordic industries on most quantitative measures. The NHX Denmark currently comprises 40 constituents, three of which were launched in 2019. Danske Invest Europe Long-Short Equity Factors and SRV – Fixed Income were launched in the first quarter, while Danske Invest Global Macro Hedge Fund was launched in the second quarter.

In the second quarter, Nykredit EVIRA Hedge Fund was the best performing Danish hedge fund in the Nordic Hedge Index with a quarterly gain of 9.1 percent. Nykredit EVIRA, which runs a leveraged portfolio on BBB- and BB-rated European corporate credit, returned 21.4 percent during the first six months of 2019 (read more). Formue Nord Markedsneutral, a market-neutral fund focusing on special situations, closely followed suit with a quarterly return of 8.7 percent. Asgard Credit Fund, Formuepleje Penta, and Midgard Fixed Income Fund completed the list of top five best performing Danish hedge funds in the second quarter.

The 33 of the 40 Danish hedge funds with reported assets under management data in the HedgeNordic database held €12.3 billion in assets at the end of June. Two of the three members of Nordea’s Alpha family were the largest hedge funds in Denmark. Nordea 1 – Alpha 10 MA and Nordea 1 – Alpha 15 MA, both of which employ a similar multi-asset approach to harvest risk premia but exhibit different risk-return profiles, had €2.30 billion and €1.57 billion in assets under management at the end of June, respectively. Danske Invest Hedge Fixed Income Strategies, which enjoyed double-digit gains in seven of the ten years since the financial crisis, held €1.06 billion in assets at the end of June.

The 33 of the 40 Danish hedge funds with reported assets under management data in the HedgeNordic database held €12.3 billion in assets at the end of June. Two of the three members of Nordea’s Alpha family were the largest hedge funds in Denmark. Nordea 1 – Alpha 10 MA and Nordea 1 – Alpha 15 MA, both of which employ a similar multi-asset approach to harvest risk premia but exhibit different risk-return profiles, had €2.30 billion and €1.57 billion in assets under management at the end of June, respectively. Danske Invest Hedge Fixed Income Strategies, which enjoyed double-digit gains in seven of the ten years since the financial crisis, held €1.06 billion in assets at the end of June.

Photo by Laura Cleffmann on Unsplash