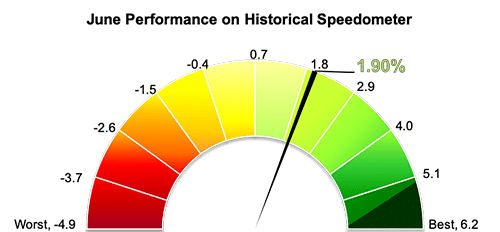

Stockholm (HedgeNordic) – Nordic CTAs gained 1.9 percent on average last month (94 percent reported), booking the group’s best monthly performance since the beginning of 2018. After gaining 2.4 percent in the first six months of 2019, Nordic CTAs registered the second best first half-year performance since 2008.

The NHX CTA, which comprises 18 index constituents, performed broadly in line with the most commonly used indices in the managed futures space. The SG CTA Index, designed to represent the performance of the 20 largest CTA programs, was up 2.4 percent in June. The SG CTA Index, which includes three members of the Nordic Hedge Index, gained 4.7 percent in the first half of 2019. The Barclay BTOP50 Index, which seeks to reflect the performance of a group of CTAs that make up more than 50 percent of all assets in the managed futures space, advanced 2.0 percent in June, bringing the return for the first half of the year to 5.2 percent. The broader Barclay CTA Index, which includes more than 500 CTAs, was up 1.4 percent last month and gained 3.7 percent in the first six months of 2019.

Most members of the NHX CTA delivered a positive return in June. Estlander & Partners Alpha Trend II, a higher leverage version of systematic trend-following fund Estlander & Partners Alpha Trend, was the best performing member of the NHX CTA for a second consecutive month. Following a gain of 12.6 percent in May, the fund returned 9.1 percent in June, which brought its performance for the first half of 2019 to 9.4 percent.

After a weak start to the year, RPM Evolving CTA Fund registered a fourth consecutive month of positive performance. The diversified multi-CTA fund’s 6.9 percent gain in June took the fund’s performance into positive territory for the year at 5.5 percent. Swedish-domiciled systematic fund Lynx (Sweden) closely followed suit with a return of 5.2 percent. With a gain of 13.5 percent in the first six months of 2019, Lynx (Sweden) is currently the best performing member of the NHX CTA in 2019. RPM Galaxy and Innolab Capital Index advanced 5.2 percent and 3.3 percent last month, respectively.

Photo by Daoudi Aissa on Unsplash