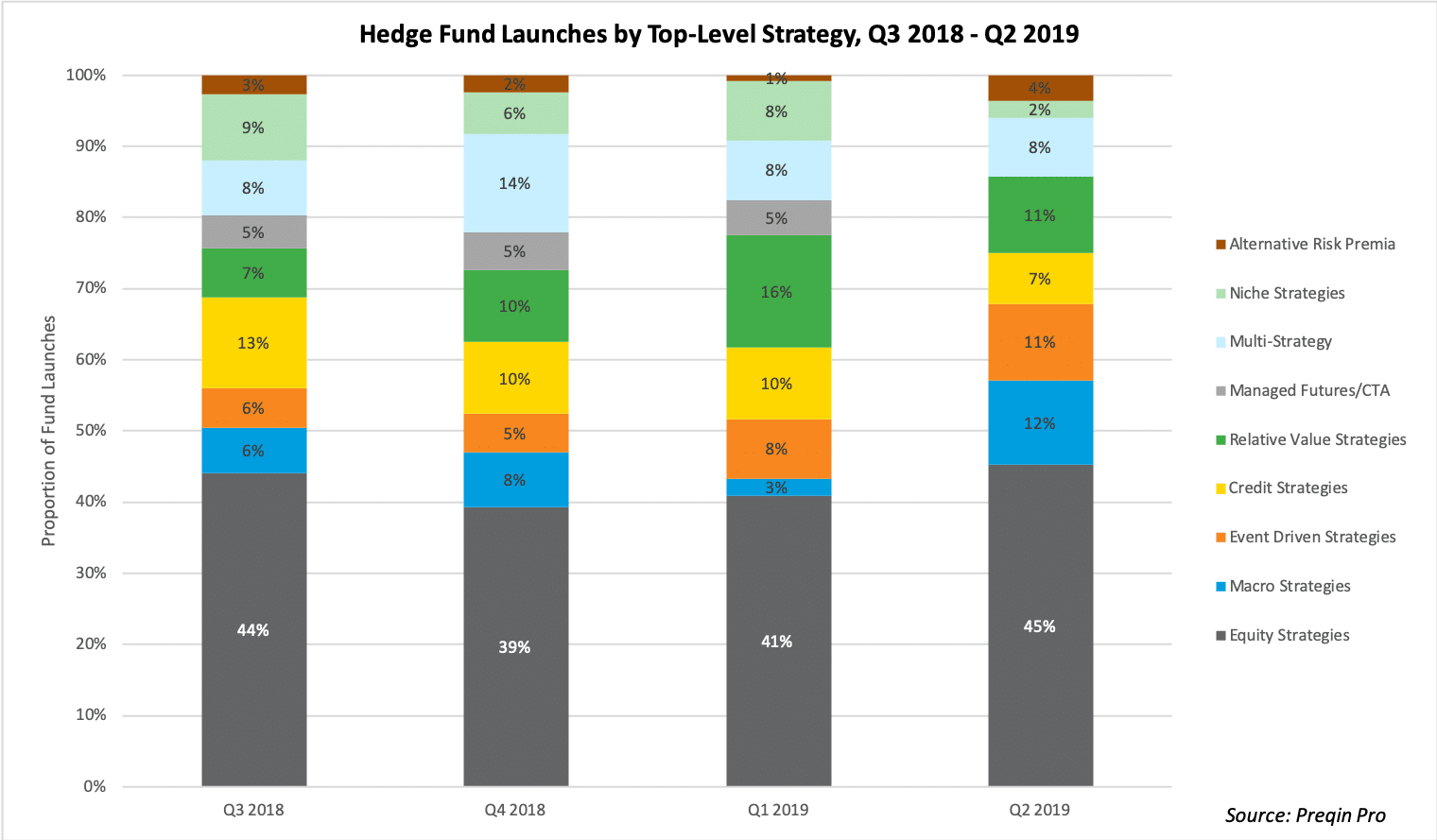

Stockholm (HedgeNordic) – During the second quarter, 86 new hedge funds opened their doors, up from 69 launches in the first quarter. No CTAs were launched during the previous quarter, which “could be a knock-on effect of underperformance in 2018,” according to Preqin’s latest quarterly update on the hedge fund industry.

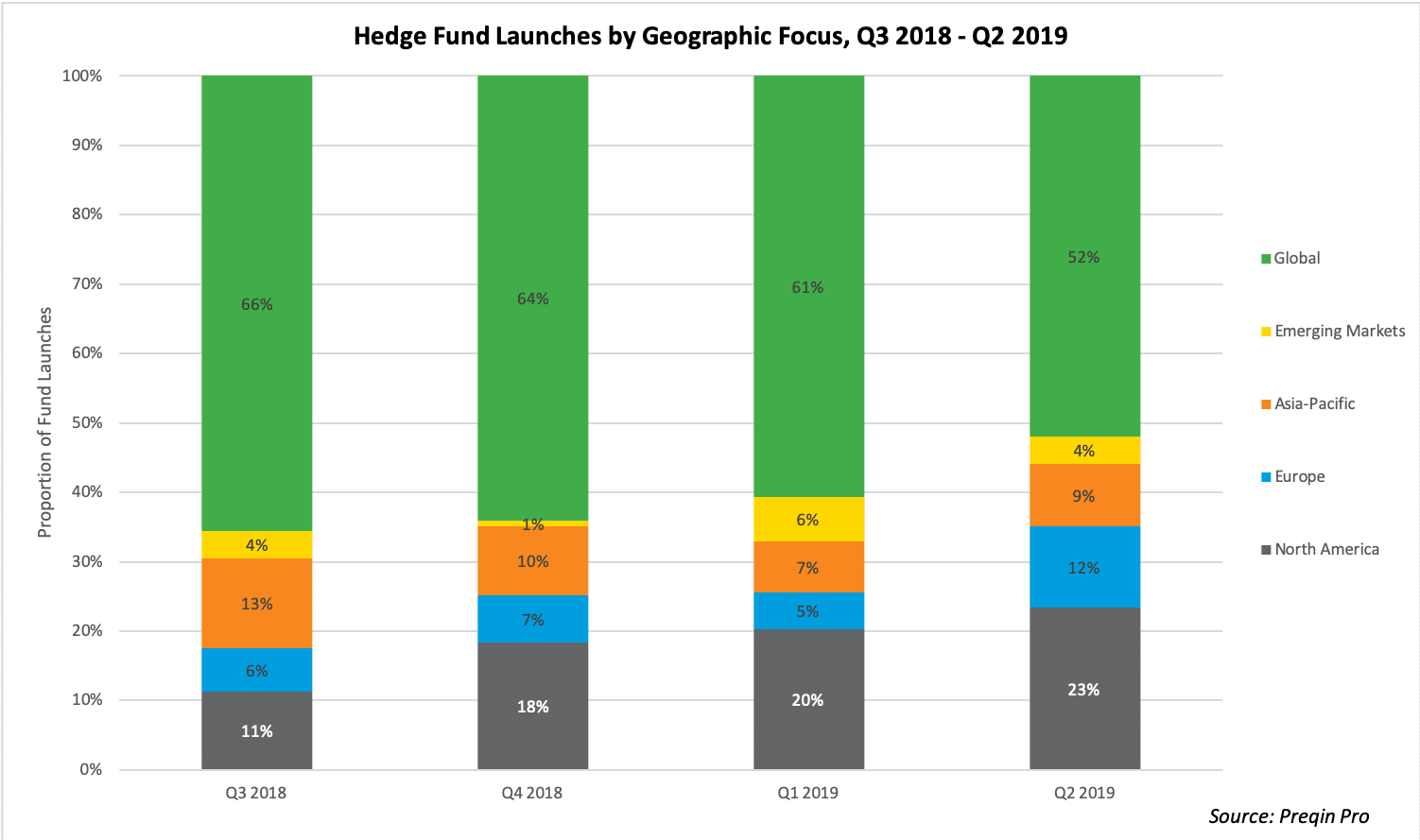

Europe-based funds accounted for 36 percent of hedge fund launches in the second quarter, up from 23 percent in the first quarter. Over the previous four quarters, new hedge funds have steadily shifted their focus towards more region-specific opportunities in developed markets, away from having a broader global emphasis. Europe-focused funds accounted for 12 percent of all launches in the second quarter, up from five percent in the prior quarter. Funds focused on North America, meanwhile, made up 23 percent of all launches last quarter, compared to 11 percent and 18 percent in the third and fourth quarter of last year, and 20 percent in the first quarter of 2019.

Following the strong performance of global equity markets in the first quarter, equity-focused hedge funds accounted for the highest share of all hedge fund launches in the second quarter. During the quarter, equity funds constituted 45 percent of all launches, up from 41 percent in the first quarter and 39 percent in the final quarter of last year. Macro strategies represented 12 percent of all launches in the second quarter, up from three percent in the first quarter. “With more volatility potentially looming from Brexit and an escalating US-China trade war,” writes Preqin, macro strategies “could be better positioned to navigate volatile market events.”

This year’s Q2 edition of the Preqin Quarterly Update: Hedge Funds can be found below:

Photo by Jungwoo Hong on Unsplash