Stockholm (HedgeNordic) – A Danish alternative asset manager specializing in artificial intelligence, Innolab Capital, is planning the launch of a fully autonomous AI market-neutral fund in the second half of this year. From the Virum region a few kilometers north of central Copenhagen, Peter Smedegaard (pictured) designed beta-neutral Innolab Capital Alpha to act as a diversifying “shock absorber” to smooth out an investor’s ride.

Using past price data for over 100 global liquid instruments across three legs or asset classes – equities, bonds and commodities, a deep learning algorithm developed by Smedegaard and his Innolab Capital team makes daily one-month-ahead predictions for all instruments. “Predictions for any instrument are purely based on price data from that same instrument,” explains the founder and CEO of Innolab, emphasizing that “price data are good for deep learning because there is so much of it.”

Looking Under the Hood

To briefly venture into the world of complex finance, Innolab Capital Alpha aims to deliver exposure to untapped non-linear risk premia – non-traditional risk premia that are not attributable to long-only exposure. Since factors such as “price momentum and low volatility show that price-based risk premia exist, we decided to look for information inside price data that cannot be extracted by linear methods,” explains Smedegaard.

To capture non-traditional price-based risk premia, Innolab Capital Alpha builds a diversified portfolio that includes instruments with the highest likelihood of experiencing prices changes on the upside and downside 20 days ahead. To be more exact, the portfolio is built up by initiating two long positions and two short positions in each asset class every day. “We balance the long and short side of the daily trades via risk parity, which basically means that we try to take an equal risk on both sides,” clarifies Smedegaard.

Since the same instrument (cocoa, for instance) can be predicted to outperform the rest over and over again (which results in its addition to the portfolio over and over again), “the portfolio typically has four long positions and four short positions in each asset class.” In a hypothetic world with thousands of liquid instruments available, the portfolio could theoretically include up to 40 positions on the long side and 40 positions on the short side, but “in practice, the portfolio contains between three to six positions on each side for each asset class.”

On average, therefore, the portfolio consists of around 25 distinct instruments with a holding period of approximately 20 days. “The portfolio is turned over approximately every 20 days,” says Smedegaard,” explaining that “our daily trades are not rebalanced, so the turnover is purely from placing trades.”

Shock-Absorber Characteristics

As Smedegaard explains, Innolab Capital Alpha is an alternative fund that “provides the best value for our investors during market turmoil.” Clarifying what investors should expect from an investment in his AI-driven fund, Smedegaard says “investors can expect returns that do not correlate with other assets,” adding that Innolab Capital Alpha “helps protect them against the unexpected.” The fund aims to generate an annual return of 7% while targeting a constant volatility of 10% per annum.

The Innolab Capital team’s tests indicate that allocating a portion of a traditional portfolio consisting of equities and bonds can improve risk-adjusted returns, reduce drawdowns and lower volatility. “Our tests show that when you allocate 30% of a traditional 50/50 portfolio to Innolab Capital Alpha, you increase the annualized return by 1% while reducing the volatility by 1.6%,” says Smedegaard. “That raises the Sharpe ratio by almost 0.3.”

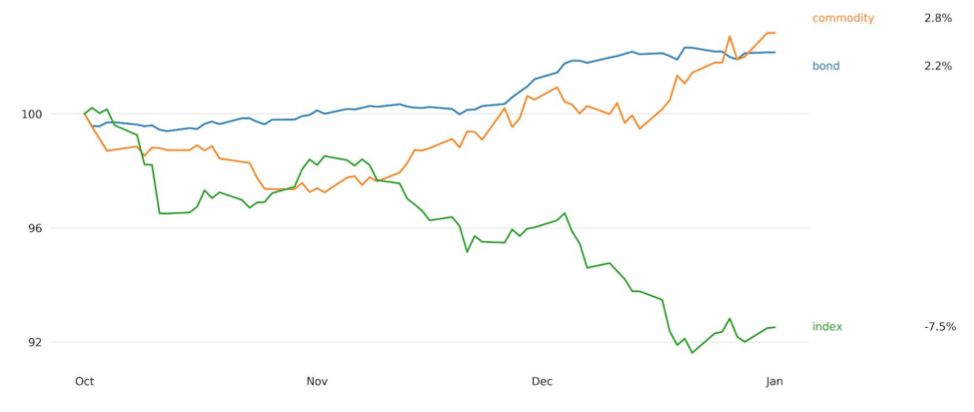

The investment strategy behind Innolab Capital Alpha has been tested live since 2017 and held up relatively well during the tumultuous fourth quarter of last year. “The fund had a net loss in the fourth quarter of 2018,” says Smedegaard, but “the commodity and bond legs both delivered positive returns.” The leg consisting of equity indices, however, “bled through the entire quarter but was balanced enough in December to avoid the huge drop which hit the stock market.” As a result, Innolab Capital Alpha managed to preserve capital in the fourth quarter and booked a gain of 6.7% for 2018. Looking ahead, Smedegaard and his team “expect the fund to keep performing, but we do not know if it will be mostly because of the index-, bond- or commodity-leg the next few years.”

Target Audience

Catered mainly to family offices and institutional investors, Innolab Capital Alpha seeks to produce returns that are independent of broader market behavior. “Professional investors can find cheap beta products to get market exposure,” acknowledges Smedegaard, but he emphasizes that investors should “search for managers that deliver true uncorrelated alpha returns” to diversify their portfolio. “Innolab Capital Alpha delivers on that and, on top of that, the fund is liquid and easy to get in and out of,” he concludes.

The article was originally published on Ekonamik.com.