(Partner Content from SSGA) –

• Significant developments in 2018 are moving investors to take greater action to address the impacts of climate change in their investment portfolios.

• Commitments by investors to the Task Force on Climate-related Financial Disclosure (TCFD), as well as existing and pending regulation in Europe, are quickly advancing the financial industry’s response to climate change.

• Due to evolving climate science and regulation, investors are on a journey when it comes to understanding and responding to climate change.

• State Street Global Advisors has developed a suite of capabilities to help clients meet their investment goals specific to climate challenges. These include a spectrum of climate-related investment solutions, from exclusionary and mitigation solutions to those that also incorporate adaptation.

A Growing Need For Climate Action

For decades, experts have warned that the physical, economic, and regulatory risks posed by climate change could mean significant losses for investors. Consequently, investors have been debating how to interpret and measure climate risk in their portfolios and what actions can help safeguard investment from a risk and return perspective.

In 2018, three key developments helped shift the climate conversation from debate to action and have created a new sense of urgency among investors. They include:

• Clear manifestation of the physical impacts of climate change. As extreme weather events have become more frequent, the physical impacts of climate change have become more visible and obvious. In Australia, for example, it is predicted that the impacts of prolonged drought on the agriculture sector caused by changing climate patterns over the last few years may reduce Australia’s GDP by a full percentage point over a two-year period.1

• Quantification of economic risk. In November 2018, a report published by 13 United States government agencies drew widespread attention. It warned that without significant steps to address global warming, annual losses in some economic sectors could reach hundreds of billions of dollars by 2100.2

• Climate regulation. An overhaul of the European legislative framework that will directly impact investors made significant advances in 2018,3 as Europe begins to operationalize the Paris Climate Agreement. In the UK, the regulators are also exploring means to implement the recommendations set out by the TCFD.

Together, these developments have crystalized for investors the urgent need for taking action to limit the impact of climate change on their portfolios. In this paper, we aim to support that action by:

• Highlighting climate-related regulatory developments that are influencing investors’ portfolio needs;

• Outlining a range of approaches available to address climate change within an investmentportfolio; and

• Providing an overview of State Street Global Advisors’ climate capabilities.

Aligning Action With Climate Commitment

Against the backdrop of the macro developments outlined above, at State Street Global Advisors, clients seek our guidance based on two key drivers of action:

The Evolving Regulatory Landscape: Clients are working to meet evolving regulatory and voluntary climate-related obligations (e.g. disclosures).

A Desire to Align Investors’ Actions with Organizational Objectives: Clients are expanding their investment objectives to include climate-related goals, prompted by the physical and economic impacts of climate change.

Below, we describe these drivers in detail.

The Evolving Regulatory Landscape

Investors are striving to stay abreast of the evolving regulatory landscape with respect to climate change. In recent years, governments — especially in Europe — have increased efforts to operationalize their commitments made through the Paris Accord. This complements the work of the Financial Stability Board’s TCFD that produced voluntary guidelines.

To meet the commitments articulated in the Paris Accord, European policymakers aim to “mainstream” sustainability into the existing legislative framework, most notably embedding explicit requirements to assess, disclose, and mitigate long-term climate-related risks. This is because policymakers view the financial services sector as having an important role in achieving those commitments. The European Climate Legislation Initiatives located on page 3 provides an overview of the existing and incoming legislation that is driving investors to seek out climate solutions to help meet their regulatory obligations.

Additionally, both governments and investors are increasingly looking for ways to comply with the TCFD’s framework, which focuses on assessing, responding to, and disclosing climate risks in investment portfolios. At present, two thirds of G20 countries, including Australia, Hong Kong, Japan, South Africa, and the United Kingdom, have engaged with the TCFD4 and have either conducted private sector consultations on sustainable finance and disclosure, or issued disclosure guidelines and frameworks. At the same time, investors have committed to comply with the Task Force’s recommendations, and are working to find investment solutions that help them demonstrate alignment.

Aligning Investors’ Actions with Organizational Objectives

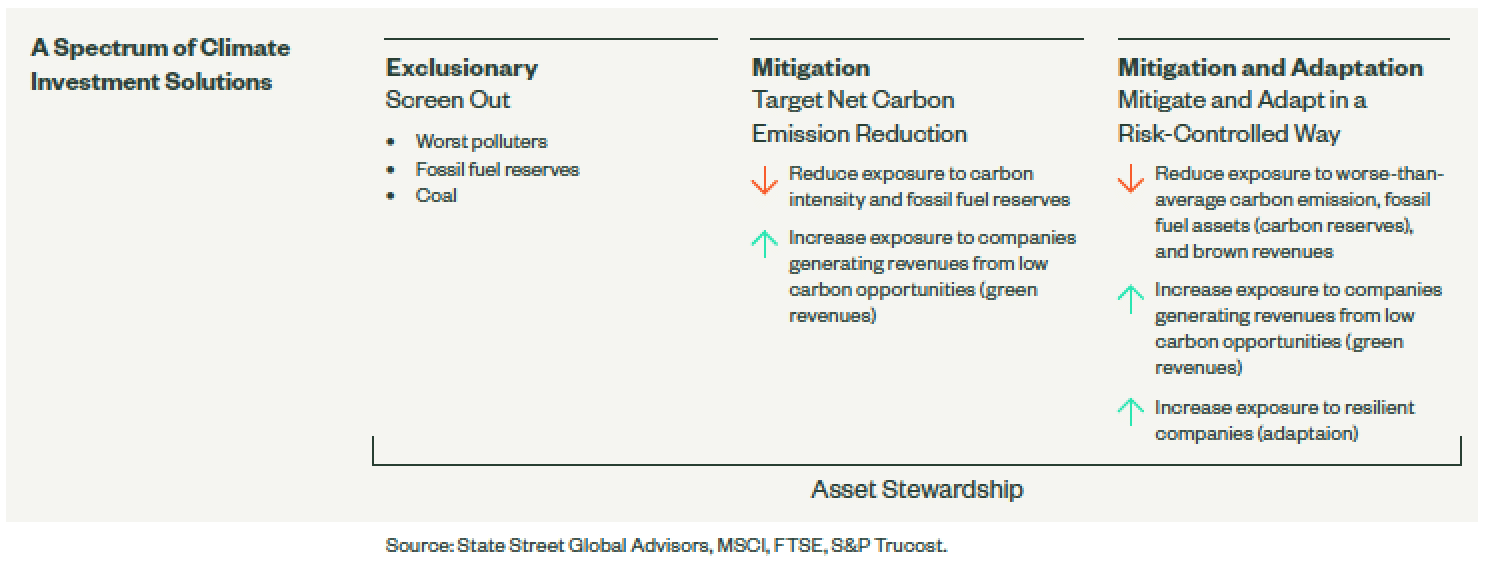

There are many ways to address climate change within a portfolio. As climate science and data availability improve, approaches to climate solutions evolve, offering investors a broader range of options to help meet their organization’s investment objectives. Below, we have identified the common ways in which investors can express their climate commitment in their portfolios:

Exclusionary Screening. Targets meaningful carbon reduction across asset classes by:

• Screening out the companies with high emissions and fossil fuel reserves, and/or companies in key industries with significant climate-related risk exposure, such as coal. This is implemented as a standalone screen or in combination with other investment approaches.

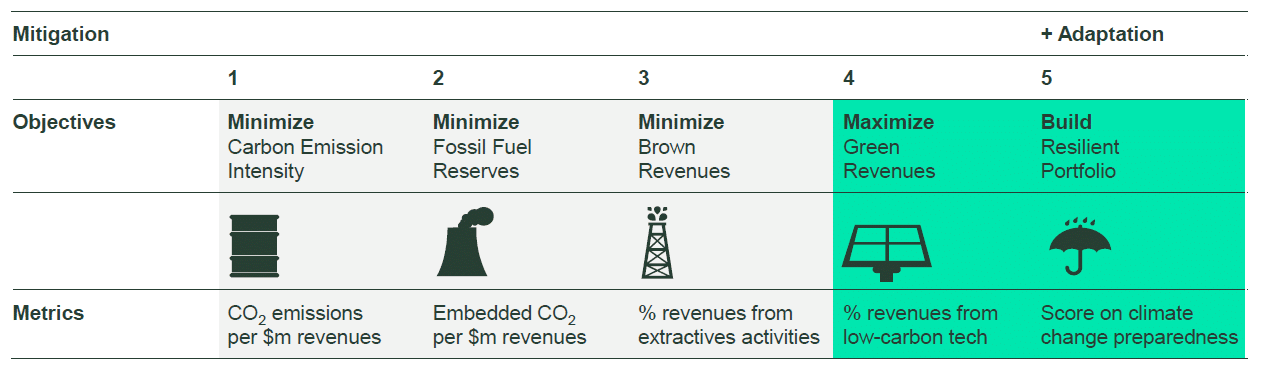

Mitigation. Targets specific net carbon reduction goals by:

• Reducing the carbon intensity of a portfolio by a desired percentage while staying within a specified tracking error range against a specific benchmark.

• Increasing exposure to companies generating ‘green’ revenues from low carbon opportunities.

Mitigation and Adaptation. Targets carbon reduction and provides exposure to businesses that are adapting to the impacts of climate change by:

• Reducing exposure to below-average carbon emitters, fossil fuel assets, and ‘brown’ revenues derived from extraction or power generation of fossil fuels.

• Increasing exposure to ‘green’ revenues and to companies that are adapting their business models to climate risks and opportunities.

This represents a new frontier in climate investing and is one of 5 Trends in ESG Investing in 2018.

Asset Stewardship.

• Regardless of portfolio approach, asset stewardship is an inextricable part of any climate

investment approach.

• Climate stewardship allows for ongoing engagement with companies about the risks and opportunities presented by climate change.

• For some investors, this represents their primary climate-focused tool, regardless of whether they also invest in portfolios with specific climate objectives.

The appropriate approach for a particular investor depends on a variety of considerations, including investment objectives, climate-related objectives, and risk tolerance, among others.

The full paper, including SSGA´s solutions can be accessed here: Climate Investing Moving From Conversation To Action

Belgium: State Street Global Advisors Ireland Limited, Brussels Branch, Chaussée de La Hulpe 120, 1000 Brussels, Belgium, T: 32 2 663 2036. F: 32 2 672 2077 is a branch of State Street Global Advisors Ireland Limited, registered in Ireland with company number 145221, authorised and regulated by the Central Bank of Ireland, and whose registered office is at 78 Sir John Rogerson’s Quay, Dublin 2.

The information provided does not constitute investment advice and it should not be relied on as such. It should not be considered a solicitation to buy or an offer to sell a security. It does not take into account any investor’s particular investment objectives, strategies, tax status or investment horizon. You should consult your tax and financial advisor.

All information has been obtained from sources believed to be reliable, but its accuracy is not guaranteed. There is no representation or warranty as to the current accuracy, reliability or completeness of, nor liability for, decisions based on such information.

© 2019 State Street Corporation.

All Rights Reserved.

2600408.1.1.EMEA.INST

Exp. Date: 2/29/2020