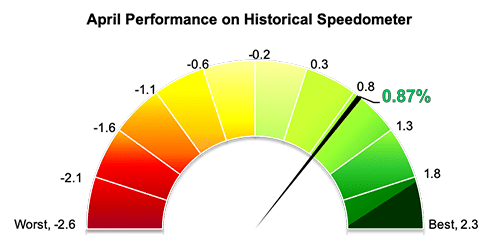

Stockholm (HedgeNordic) – Nordic multi-strategy hedge funds gained 4.4 percent in the first four months of 2019, representing the group’s best first four months in more than a decade. The NHX Multi-Strategy, which is the most diverse and inclusive strategy category in the Nordic Hedge Index, gained 0.9 percent in April (93 percent reported).

The NHX Multi-Strategy includes Nordic hedge funds that cannot be easily assigned to any of the four strategy categories in the Nordic Hedge Index: equities, fixed income, CTAs, or funds of funds. Most members of this group, however, are hedge funds that invest across a range of asset classes and strategies to achieve their objectives.

Nordic multi-strategy hedge funds have performed broadly in line with their international peers so far this year. The Eurekahedge Multi-Strategy Index, which includes 276 multi-strategy hedge funds, was up 0.7 percent in April and gained 4.3 percent in the first four months of 2019. The Barclay Multi-Strategy Index, meanwhile, gained 0.8 percent last month based on reported data from 116 funds. The Barclay index advanced 4.1 percent in the first four months of the year.

Three in every four members of NHX Multi-Strategy posted gains for April. Carve 2, an equity and credit hedge fund backed by Brummer & Partners, was last month’s best-performing member of the group with a gain of 5.3 percent. The absolute return fund is up 1.8 percent in the first four months of 2019.

Formuepleje Penta, an asset allocation hedge fund allocating between bonds and equities, gained 4.4 percent in April, extending its year-to-date performance to 25.1 percent. Othania Invest, which uses a systematic model to allocate capital either into equity or bond exchange-traded funds, followed suit with a 3.8 percent return in April. The Othania fund is up 8.3 percent year-to-date. Formuepleje Epikur and SEB Diversified were both up 3.6 percent last month.

Picture © PsychoShadow—shutterstock