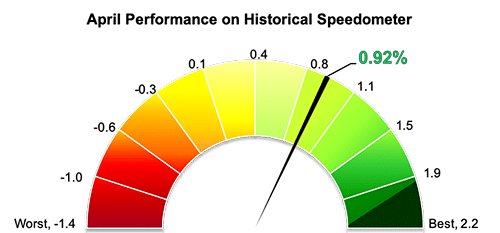

Stockholm (HedgeNordic) – Nordic fixed-income hedge funds gained 0.9 percent on average last month (100 percent reported), the fourth consecutive month of positive returns following a three-month string of losses. The group of fixed-income funds, as expressed by the NHX Fixed Income, gained 3.7 percent in the first four months of the year.

Nordic fixed-income hedge funds performed broadly in line with their global peers last month and year-to-date. The Eurekahedge Fixed Income Hedge Fund Index, which reflects the performance of 326 global fixed-income hedge funds, was up 0.8 percent in April and gained 3.9 percent in the first four months of 2019. The HFN Fixed Income (non-arbitrage) Index, which tracks the performance of fixed-income funds in eVestment’s database of hedge funds, gained 0.7 percent last month and 3.6 percent in the first four months of the year.

Most members of the NHX Fixed Income posted gains for April, with Nykredit EVIRA Hedge Fund topping last month’s performance chart. Nykredit EVIRA, which harvests credit risk premia in European corporate bonds, was up 6.6 percent in April, extending this year’s gains to 18.7 percent. The young Nykredit fund more than recouped its 16.7 percent decline last year, which reflected a sharp expansion in credit spreads.

Midgard Fixed Income Fund, meanwhile, advanced 3.4 percent last month, taking the fund’s year-to-date performance to 10.6 percent. Asgard Credit Fund, which harvests credit risk premia in the lower end of the investment grade spectrum and the higher end of the high-yield spectrum, closely followed suit with a gain of 2.7 percent. The Asgard fund is up 17.4 percent in the first four months of 2019. Nordic Cross Credit Edge and Nykredit KOBRA Hedge Fund were up 1.5 percent and 1.3 percent last month, respectively.

Picture © shutterstock