Partner Content by CME Group: There are many factors that can influence FX exchange rates, including event risk and fundamental economic data. To manage such risk, traders have often turned to futures and options. Recent events around the world have caused dramatic moves in exchange rates, particularly for currencies impacted by the chaos of Brexit. Additionally, uneven U.S. economic data, along with the Fed pausing further rate hikes, have created new momentum for CME Group’s U.S. Dollar-based foreign exchange contracts. The Euro FX futures, in particular, have seen increased demand as the uncertainty of a Brexit outcome and concerns over a decelerating U.S. economy, among others, create new risks and opportunities for traders.

On March 12, 2019, British Prime Minister Theresa May presented her deal for Brexit to Parliament for the second time, resulting in another resounding defeat. This temporarily increased the odds of a so-called ‘no deal’ Brexit, an outcome that could threaten the value of the Euro. The next day, March 13, Parliament voted to reject a ‘no deal’ Brexit under any circumstances, buoying the Euro against the dollar as the instability of a ‘no deal’ Brexit may be avoided. That same period saw lower-than-expected inflation figures out of the U.S., as reported in the CPI release on March 12. The 1.5% annual gain in the broad CPI reported for February was below expectations.1 This drove the dollar down against other major currencies and seemed to confirm market expectations that the Federal Reserve would pause its rate increases in 2019.

These two geo-political factors in the UK and the US, combined with the roll date for the Euro FX contract, appear to be the contributing factors for the significant volumes on the Euro FX futures, as traders positioned themselves for the potential changes brought by the on-going Brexit votes and uncertainty over the U.S. economic outlook.

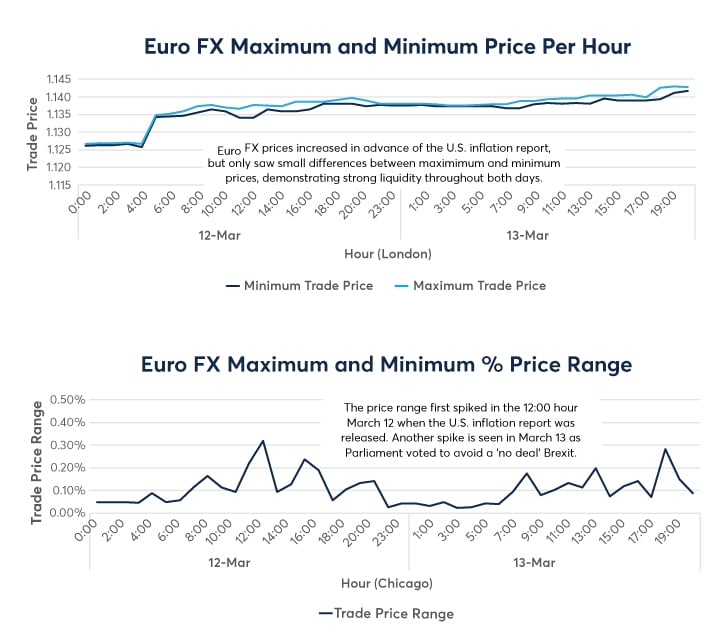

News for the dollar and Euro came throughout the day on March 12 and 13, resulting in elevated trading volumes for London and U.S. trading days. At the end of this two-day period, Euro FX futures were trading at an average price more than 1.5% higher than the open on March 12.2

March 12 and 13 had the highest volumes of 2019 to date, but the pattern of trading on these days also differed significantly from a typical day. Looking at the average hourly volume for March 2019, the bulk of the volume is traded during the London trading day, but the U.S. and Brexit related news later in the London trading day clearly impacted the hourly trading patterns.

Sometimes when volumes spike or prices increase dramatically, there’s a large distinction between the maximum and minimum prices. The Euro FX future contract, even while managing large volumes and uncertainty from different sources, maintained a very tight price range, increasing moderately on news of the U.S. inflation report on March 12 and the Brexit vote on March 13. It could be argued that this price stability demonstrates the reliable liquidity in this contract during these events.

As shown above, markets increased trading and price of the Euro FX in response to the U.S. inflation data on March 12 and Brexit-related votes on March 12th and 13th. This can create concerns regarding liquidity, questions about whether traders will be able to execute as necessary to manage the risk of the changing environment. Looking at the bid / spread and implementation costs (both measured in ticks), in Figure 3, both metrics stayed near their minimum of 0.5 tick throughout both days.

This means that the market remained sufficiently liquid for traders around the world, in every time zone. Even as news was breaking in response to the new economic data and political confusion with regards to Brexit, traders could execute core FX contracts on CME Group’s markets to manage their risks in this uncertain environment.

Traders rely on news from a variety of sources and time zones to inform their trading and risk management needs. In international markets and products, there are several macro-economic and political influences that can impact exchange rates. Traders using futures markets to manage their exposures to these rates could find sufficient liquidity of the Euro FX futures contract, even as price and volume move in response to breaking news.

- CME Group FX futures can help traders manage their risk and exposure to exchange rates.

- As multiple news items break, the impact on exchange rates and corresponding futures can result in significant volumes in the exchange-traded futures markets.

- Even as volumes and prices moved in response to domestic and international news such as Brexit, liquidity at CME remained stable enough to help trades be executed as necessary to manage exposures.

All examples in this report are hypothetical interpretations of situations and are used for explanation purposes only. The views in this report reflect solely those of the author(s) and not necessarily those of CME Group or its affiliated institutions. This report and the information herein should not be considered investment advice or the results of actual market experience.

- https://www.bls.gov/news.release/cpi.htm

- Source: CME Group